The last few weeks have been relatively quiet in the cryptocurrency market. Because there were not many macroeconomic developments that would affect the markets. Their lack has allowed some assets to recover and rally in the short term. However, according to experts, the next week will not be so calm. Investors should be prepared for the upcoming volatility in the SHIB, BTC and altcoin market in general.

BTC and altcoins will be affected by these developments

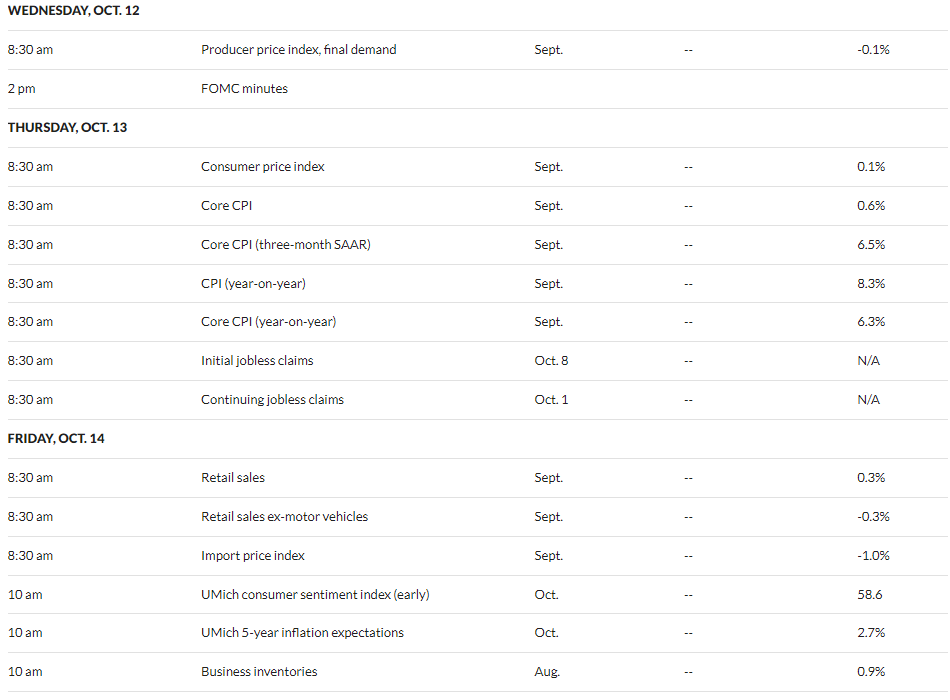

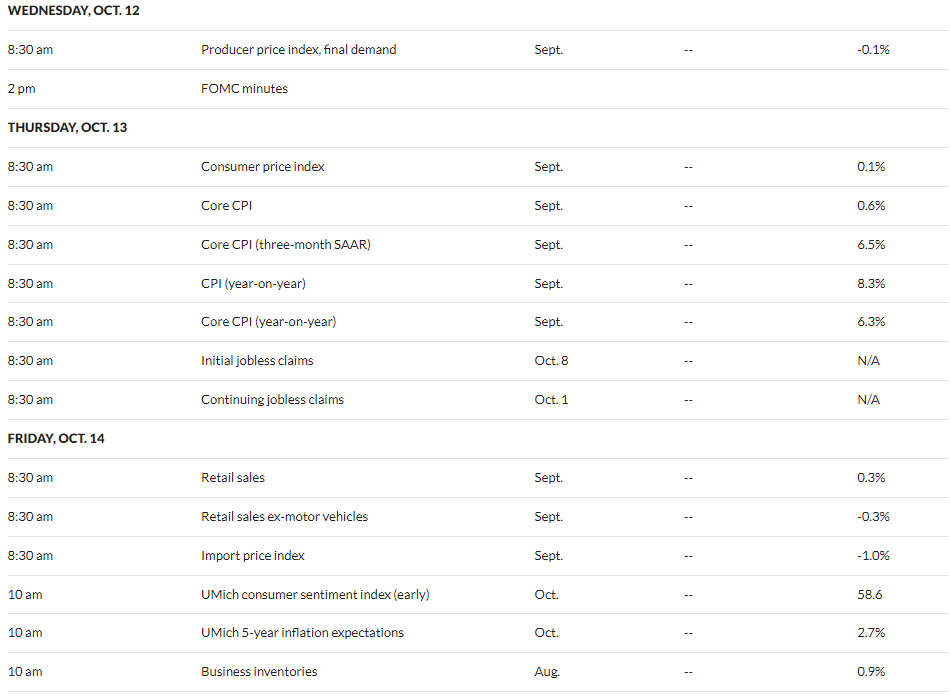

In just one week, big moves are expected in both traditional and crypto markets. A few macro-economic data reports will be made public, which will cause a stir. CPI data in the US will once again show investors how financial regulators are dealing with inflation in the country. It will also show whether further tightening in monetary policy is needed.

Despite the importance of upcoming events, the price performance of the largest cryptocurrency is rather lackluster. Bitcoin has been moving in a low price range for the past few weeks. It has been bouncing between the $18,000 and $22,000 price levels for the past 15 days. This price action shows that neither bulls nor bears dominate the market. He also points out that the outcome of the aforementioned event should give us more clarity.

FOMC minutes matter

In line with the consensus expectation, the FOMC increased interest rates by 75 basis points to 3.00-3.25 percent in September. Minutes of this week’s FOMC meeting will provide more clarity on the key rate hike in the US. With more details, investors will be able to form a specific view on how regulators will react. Depending on the narrative of financial regulators, the cryptocurrency market may experience an increase in volatility either up or down. For now, most investors have different views on the continuation of tight monetary policy. Because, according to the latest CPI report, the tightening in monetary policy did not have much effect on inflation.

In general, the effect of these developments on prices will be determined by the market sentiment after the announcements. In parallel, cryptocurrencies such as SHIB, Ethereum, XRP; It will tend to be affected by the change in Bitcoin price. In the light of the data and reports to be announced in the USA, changes are expected in the price of commodities, stock markets and BTC; There is also the possibility that we will not observe any change. Assets can continue to trade sideways.

At the time of writing, Bitcoin is changing hands at $19,513, up 0.2 percent. cryptocoin.com As we have also reported, it is on its way to close the week out of the $20,000 level. On the other hand, Ethereum (ETH) is up 0.1% at $1,324. BNB is $279, XRP is changing hands at $0.52. ADA is 0.42, SOL is worth $33.07.