At least four wallets have become active again from the early days of Bitcoin (BTC). These investors have not taken any trades for years and a possible sale could put pressure on Bitcoin.

Bitcoin whales scare crypto investors with sudden wallet moves

Whales with large amounts of Bitcoin are showing signs of life again. These investors are known as “whales” because they hold large amounts of coins in their crypto wallets. They have a direct influence on the price because of the size of their balance.

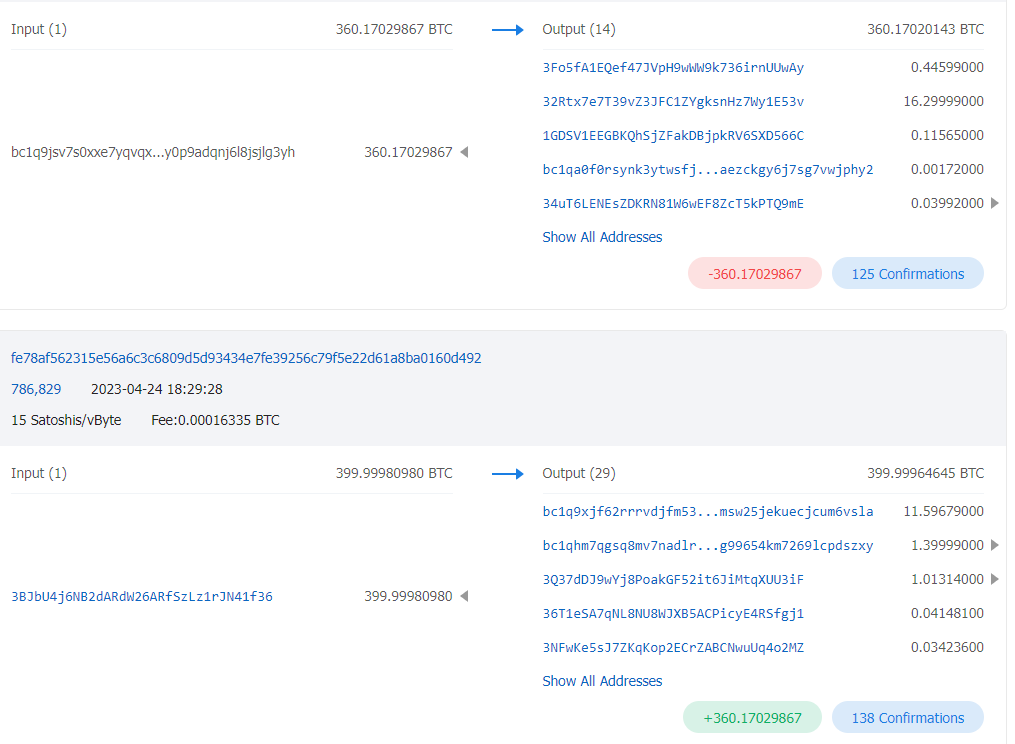

According to the data, one such wallet, last active in 2012, carried over 400 BTC over the weekend. This means that approximately $11 million is under the control of a single person. The Bitcoin whale then moved 360 Bitcoins to one wallet and 40 Bitcoins to other wallets. Whale purchased 900 Bitcoins in 2012 and has since held the asset, earning around 40,000% on the initial investment.

The whale activity has come after several other whales have been carrying large amounts of BTC and ETH over the past few weeks.

Another whale carried 279 BTC in early April after 10 years of inactivity. The whale collected 1,128 Bitcoins between 2012 and 2013, when the price hovered between $12-195. His investment is now worth $31 million.

Ethereum whales are also getting active again

Last week, an investor who participated in Ethereum’s ICO moved 1 ETH to another wallet after eight years of inactivity. The wallet was holding more than 2,356 ETH, which were bought at $0.31 each at the ICO. Now his investment is over $4 million.

What’s next for Bitcoin?

After last week where BTC fell 10%, sentiment is resetting and investors are watching for key supports at $25,000. At the same time, there is great disagreement about the health of the market. Some predict the next phase of the uptrend is just around the corner.

In the next developments, new data will emerge from the US starting April 27 that could provide a burst of volatility for risky assets that are currently dormant.

US gross domestic product and jobless claims will precede the March edition of the PCE Index. The latter will be watched sharply by the Fed for clues on inflation.

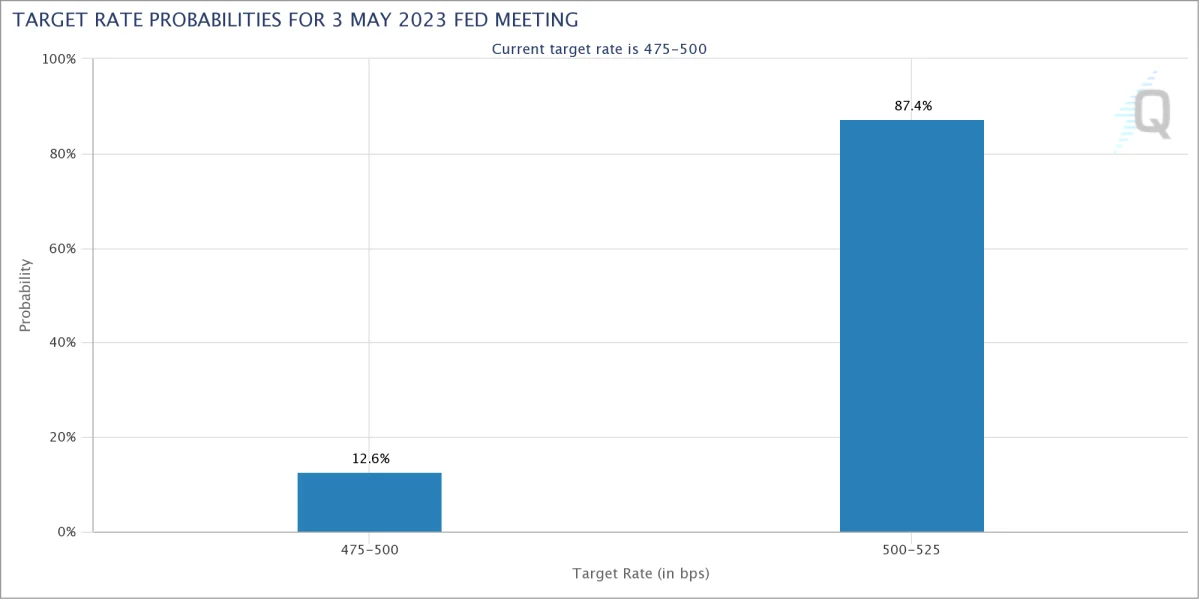

Also, a week later, the Fed will decide how much or not to raise interest rates at all. According to the FedWatch Tool, there is an 87% chance that the Fed will raise interest rates by 0.25% in early May.

Bitcoin will reverse in liquidity scan

An optimistic approach from some Bitcoin analysts has eyed bottoms to continue the bull run. Experts highlight an area in the mid-$26,000 area that has the potential to cross Bitcoin’s 200-week MA at around $25,850.

“Bitcoin is still sideways here,” says popular crypto analyst Michaël van de Poppe. That means it can sweep the bottom once again and then reverse. “I still expect it to take longer over the next few days.”

Meanwhile, popular trader Jelle thinks the worst of the correction is over. Jelle sees similarities with BTC price action in February. However, a positive breakout awaits thanks to the bullish divergence in the RSI. cryptocoin.comAs you follow, Bitcoin price is currently consolidating around $27,200.