Bitcoin (BTC) outpaced both long and short-term investors in May and June. But the data shows that trading may be “easier” than many imagine. On-chain analytics platform Whalemap states that Bitcoin whales have ruled nearly all market performance in recent weeks.

Whales help peg Bitcoin (BTC) to $30,000

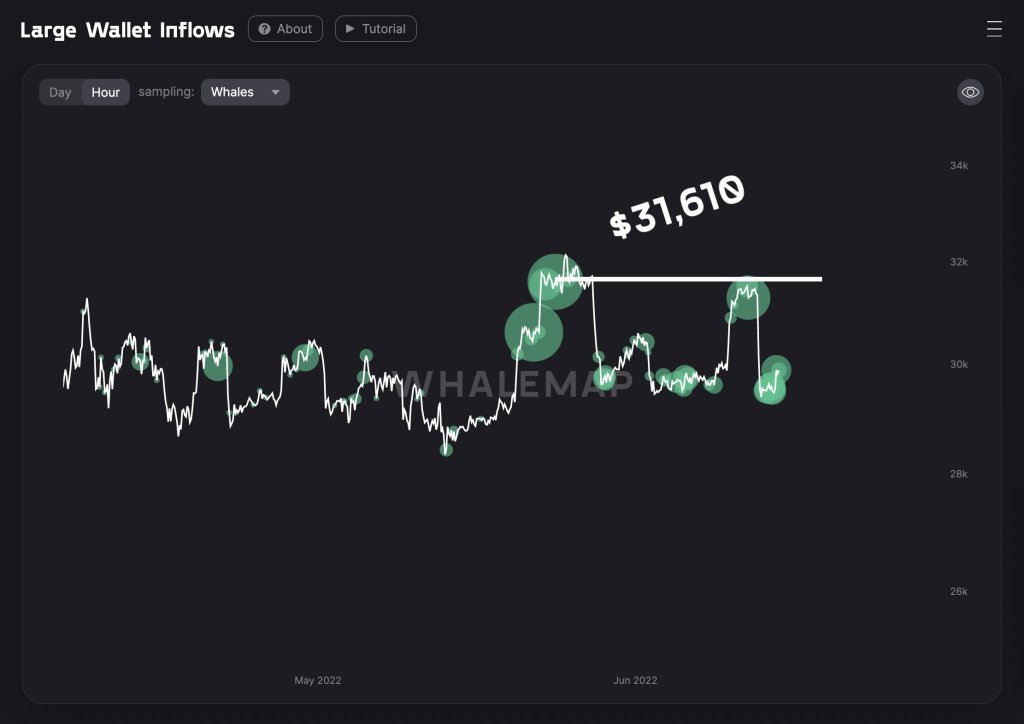

Whalemap researchers published a new analysis on June 7. The researchers say BTC local peaks and troughs coincide with areas of high whale activity.

When Bitcoin’s largest wallet chooses to buy or sell assets, the price reacts accordingly. So, for those looking to reduce risk trading short timeframes, it may be sufficient to move based on where popular whale levels are. “Can it get any easier than this?” Whalemap summarized this in a part of a Twitter post.

Bitcoin whale wallet caption graphic / Source: Whalemap / Twitter

Bitcoin whale wallet caption graphic / Source: Whalemap / Twitter As cryptokoin.com reports, some whales are getting more attention than others. Last week, such an asset on Binance contributed to Bitcoin’s narrow trading range with a series of buys and sells. Meanwhile, popular analyst Credible Crypto made a new comment on Twitter on June 8. The analyst noted that this Binance whale has marked every local top/down for the past two weeks. In addition, the analyst made the following assessment:

I was watching it come and go. It accumulates at the lows and limits the price at the highs. Most recently, before this pump that we’re seeing right now, it filled 2,000 BTC (60 million) at a local low of 29.2k.

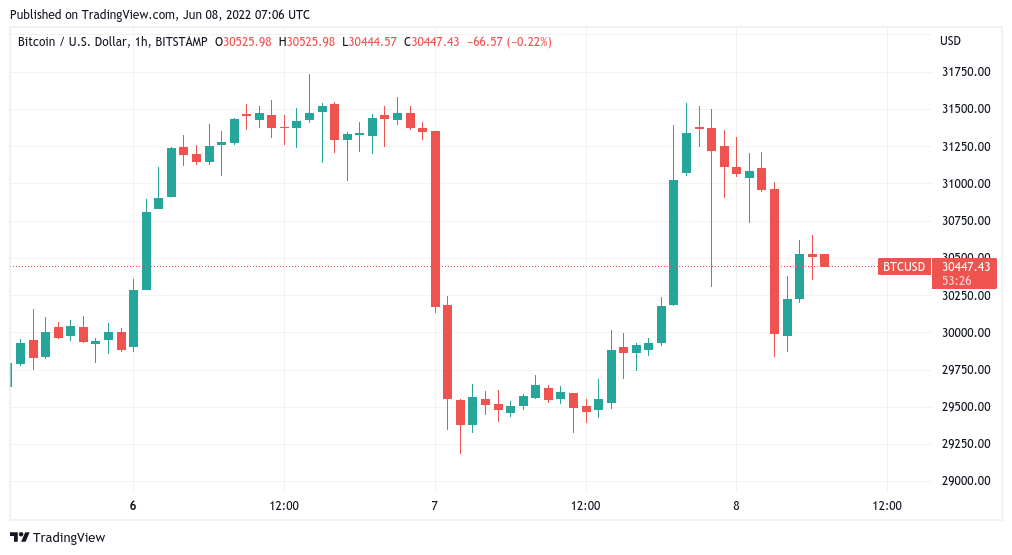

Data from TradingView shows that the BTC plateau has reversed, almost losing all the gains from the initial bull trend.

BTC 1-hour candlestick chart (Bitstamp) / Source: TradingView

BTC 1-hour candlestick chart (Bitstamp) / Source: TradingView Stock correlation continues to weigh on BTC

Meanwhile, optimism goes beyond internal factors. Aside from that, it remains weak for inflationary macro conditions that favor forward crypto strength. Also, whales keep prices within a certain range. In this environment, Bitcoin’s relationship with exchanges also frustrates traders. Crypto analyst Michael van de Poppe uses the phrase:

Correlation with stock markets is annoying.

The correlation with the stock markets is annoying.

— Michaël van de Poppe (@CryptoMichNL) June 7, 2022

As you know, worldwide monetary tightening is gaining momentum on June 7th. That’s why commentator Bob Loukas agrees that stocks are not more likely to feel relief in the short term. The analyst makes the following assessment:

I still do not (yet) see a macro catalyst for a bottom in stocks. As I mentioned earlier, there is a cyclical bear market outlook that needs more time. Price action on the Cycle front confirms and descends into summer. I’ve been weak for a while. I’m glad I was wrong. I’m not going to do a devastating rally.