Experienced analyst Ali Martinez argues that Bitcoin (BTC) has more space for growth during this bull run. Basic metrics, such as decreasing MVRV and negative stock market net flows, support more earnings thesis in the near future. How much can the BTC price rise in this cycle?

According to Ali Martinez, the possible loop summit for Bitcoin!

Kriptokoin.comAs you have followed, the leading crypto currency has been a significant rise trend for the last few months. Bitcoin has gained significant gains after Donald Trump won the US presidential elections. While the BTC was traded below $ 70,000 before the election, it exceeded the psychological level of $ 100,000 for the first time in a month. Despite the fluctuation, solid performance continued. Hours before Donald Trump took off, it reached the highest level of all time with almost $ 110,000. In the next 10 days, the BTC experienced more turbulence before stabilizing the current $ 105,000.

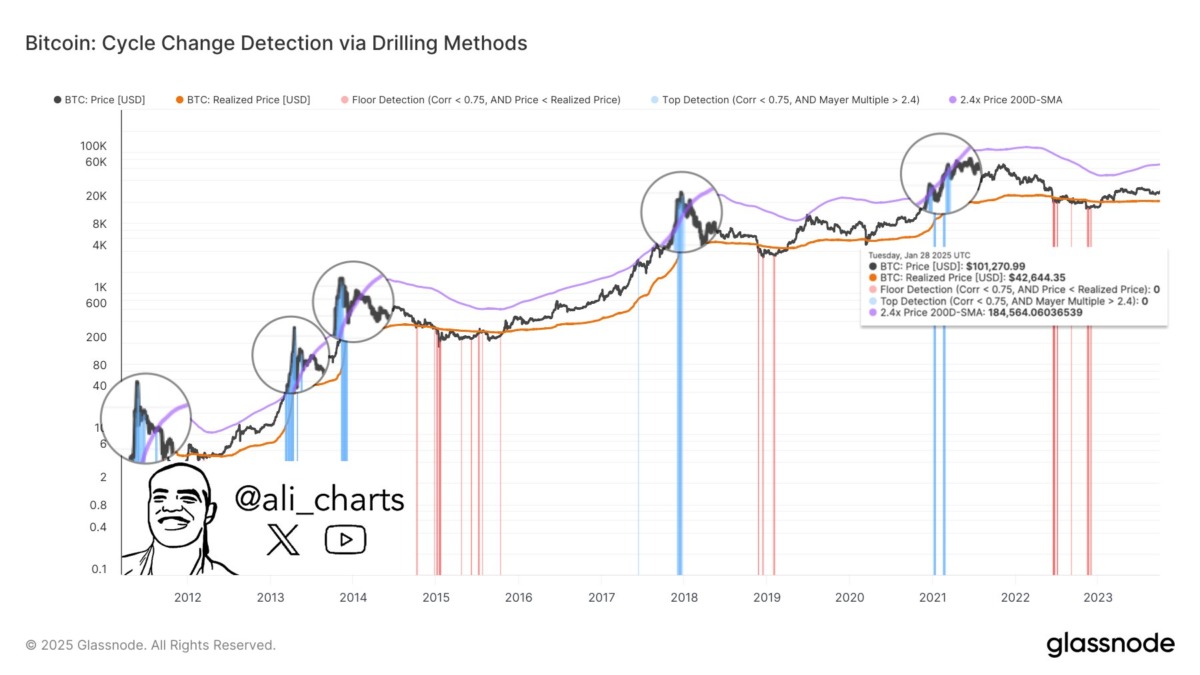

According to many sector participants, during this bull cycle, the price did not reach the peaks that have not yet been seen. Popular analyst Ali Martinez recently suggested that BTC could rise up to $ 184,000 before entering the decline mode. The estimation was based on the assumption that cycle changes typically exceed 2.4 times the 200 -day simple moving average. In this context, the analyst made the following statement with a graphic:

Cycle changes for Bitcoin (BTC) typically occur when 200 -day SMA exceeds 2.4 times. This key level is currently at $ 184,600!

Bitcoin metrics support the rise view!

Many factors indicate that BTC can really develop in the coming months. One of them includes BTC’s historical performance in February. Crypto currency, 8 of the last February 12 has increased with double -digit figures. It should be noted that the next month is a February after Halving and that all previous months have resulted in impressive increases.

It is also appropriate to mention the value of Bitcoin’s market value (MVRV) and the Net flow of the stock market. The first metric is below 2.5, which has been healthy level for the last few days. This shows that Bitcoin may have shifted to a region below the value. BTC’s net flow of stock market was mainly negative last week, and the outputs exceeded the entrances. This can be interpreted as the transition from central platforms to ‘self-Custudy’ methods. Therefore, this reduces sudden sales pressure.

There are other bull forecasts

Ali Martinez is not the only person to foresee more rise for BTC in the near future. Captain Faibik Analyst, an analyst, observed the formation of a “expanding wedge model” in the Bitcoin graph. This model points to a potentially accessible target of $ 120,000 in February.

Popular analyst Michael Van de Poppe and gellexing analyst de Bitcoin rise. Van de Poppe predicts that a new AC can be realized in the coming weeks. Jell believes that 110 thousand dollars are “last obstacle” before “waiting for a new price discovery”.