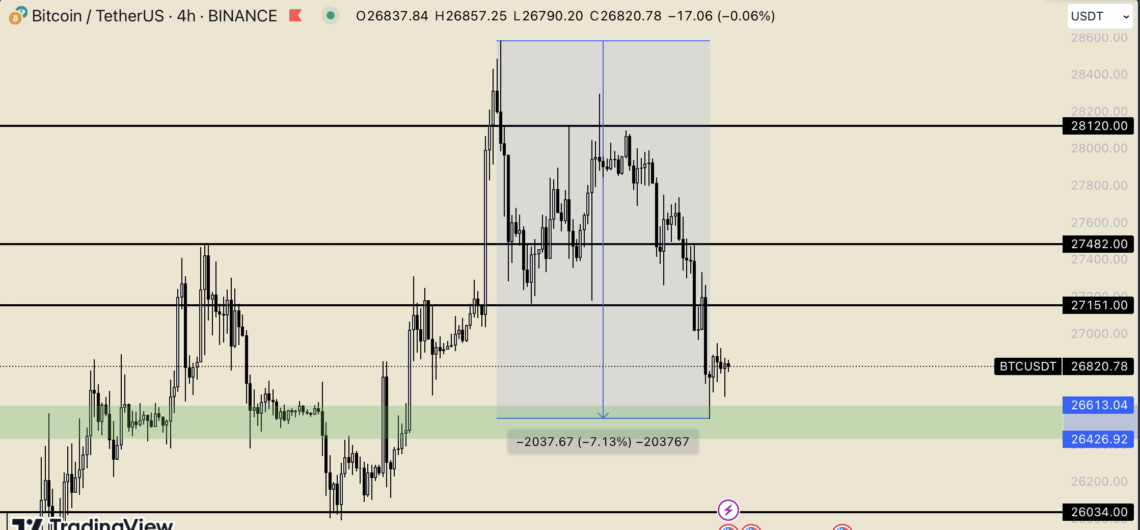

Israel– Palestine The escalation of the war created selling pressure in the crypto market. The leader of cryptocurrencies, which managed to reach $ 28,580 on October 2, in just ten days It decreased by 7.13 percent.Creating fear in the market and investors in terms of time-price performance BTCIt is currently priced around $26,800.

BTC is getting closer to the $26,613 – $26,426 range. This region, which is a deciding factor for the short and medium-term price structure, is likely to lead to larger declines if it is not protected by buyers. A volume breakout of $26,426, BTCIt can push its price up to $25,000.

Known for his work on trade Kyrr.io founder Karasu He stated that the Israeli-Palestinian war is not a new development and that this situation has not affected the financial markets much. He added that this war should not be equated with Russia-Ukraine.

“For the continuation of the upward movement, $25,000 must not be broken!”

Karasu

Karasu emphasized that the focus should be on getting bonds in both the US and Germany to rise above 3 percent. Saying that BTC should not remain below $ 25,000 for increases, the phenomenon stated that the Israeli-Palestinian tension will not shake cryptocurrencies much as long as it is priced above this level. Karasu said that it would not be right to expect an increase in altcoins unless there is an increase in the BTC price up to the 55-56 percent market dominance band.

Karasuin one hour’s time BTC/ USDThe graph is as follows:

Some easing of geopolitical troubles, spot Bitcoin ETFcritical positive news such as approval for and BTC Staying above $27,450 will strengthen the positive scenario. In such a situation, $28,000 levels can be targeted again.

“The safe haven of this industry is Bitcoin!

trader Omer

cryptocurrency analyst Trader Omer He stated that in times of chaos, products with limited supply (Bitcoin, gold, silver, etc.) come to the fore. Expressing his views on the crypto industry, the trader said, “Investors see BTC as a safe haven” regarding the money outflows in altcoins.

Commenting on Bitcoin’s current dominance in the market as a natural development, Trader Ömer said, “It is a normal situation in the current period that the outflows in altcoins have a larger share than the outflows in BTC.”

Addressing the price structure in BTC, the phenomenon underlined that closings below $ 27,000 will strengthen the possibility of a drop to $ 25,000. He stated that in order for positive scenarios to be discussed, $27,000 should be “strongly defended” by buyers and $28,000 should be targeted.

Frequently mentioned with its crypto analysis HirozakiThe connection between geopolitical developments and the crypto industry coinholic commented for his readers. The impact of events taking place in front of everyone’s eyes on Bitcoin Charlie mungerThe phenomenon, which was expressed by the saying “It does not require intelligence to understand something that everyone knows”, made striking comments.

“Wasn’t there a war during the bull season?”

“If the wars and conflicts in the Middle East had affected the price of Bitcoin so far, the bottom would be 1 million dollars right now,” he said. Hirozaki He gave an example of this situation from the past. He stated that at the beginning of 2014, after peaking at $1150, BTC fell to $200 and could not exceed this level until May 2017, adding that that date also marked the beginning of the civil war in Yemen and the start of the war against the Salafist terrorist organization in Iraq and Syria by western powers. he stated.

Bitcoinwith geopoliticsaddressing the connection between developments Hirozaki , said: “The period from two years after the creation of Bitcoin until today is perhaps the most unstable period in the Middle East. The Syrian and Libyan civil war continued from 2011 until today. Can all this Bitcoin rise be attributed to this? No. “Anyway, none of the conflicts and wars between Israel and Palestine have had an impact on the price of Bitcoin so far.”

“Bitcoin halving will not be like the ones in the past”

Hirozaki

Key events that will determine changes in BTC price Binance, SECAnd ETF Emphasizing the future by the phenomenon, he said that positive developments do not appear unless a surprise occurs. Stating that the only clear element for BTC is the halving, Hirozaki said, “There is a prevailing opinion that it will not be like the past halvings, and sometimes I get closer and further away from this view. “We are entering a period of stagnation for a while and where opportunities are flashing like a fire,” he said.

Another analyst speaking exclusively to Coinkolik Jamal the Market Maker He argued that BTC price movement has little to do with the war. However, referring to the risks in BTC in case the war escalates, Jamal the MMHe said that the decline in BTC was inevitable with the involvement of large or crypto states such as the USA in the war.

“I expect a drop to $26,000!”

Cemal The Market Maker

Giving an example from the Russia-Ukraine war, the phenomenon stated that the decline experienced was instantaneous. Stating that BTC has been declining since $ 28,000 and that the war accelerated this situation, Cemal The Market Maker announced that he expects a decrease to $ 26,000.

Crypto investors are running away from altcoins!

Last 40 days BTC.D (Dominance When you look at the ) chart, it is clearly seen that the upward trend continues. BTC.D, which was 49.05 percent at the beginning of September, is currently at 50.98 percent. BTC.D, which increased by 4.65 percent in such a short time, reveals that investors are leaving altcoins and turning to Bitcoin.

Although it makes corrections from time to time, BTC.D, whose main direction is upwards, continues to decline after months due to the anxiety created by geopolitical risks. It exceeded the 51 percent level. BTC.D, which was last seen in these regions on July 12, came to the same area again. The fear that the Israeli-Palestinian war has brought to the financial markets has a strong possibility of increasing BTC.D for a while and crushing altcoins.

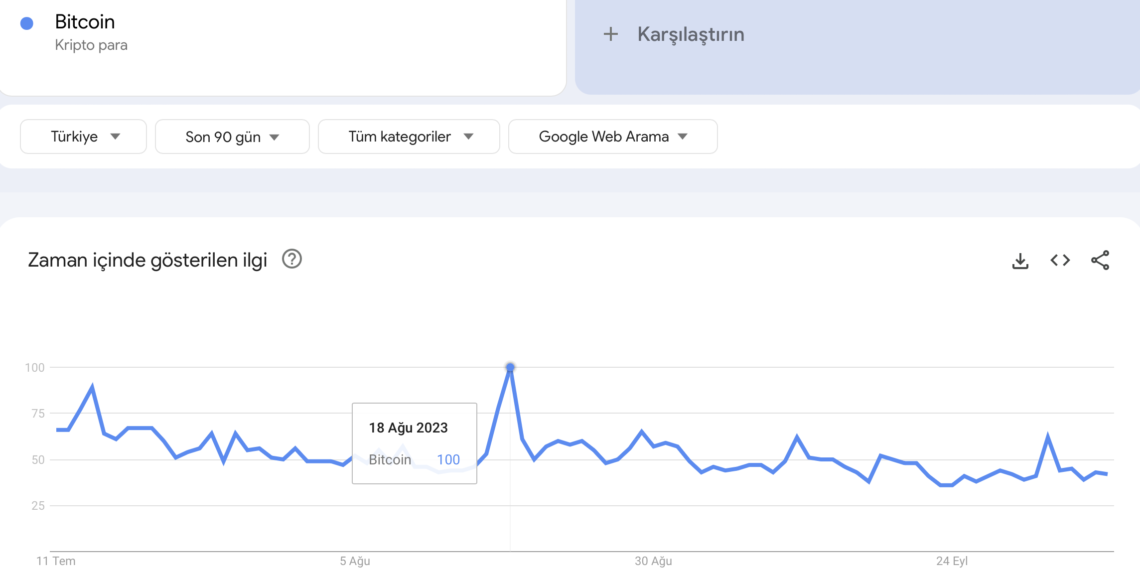

There is a decline in Google searches!

Google trends Data from showed that interest in crypto is on a downward trend. Searches for “Bitcoin”, which last reached 100 points on August 18, have not recorded a clear increase since then. The word “Bitcoin”, currently at 42 points, revealed data that investors are moving away from the crypto industry.

Successive ETF applications in August pushed almost all crypto metrics positive. But today’s various geopolitical risks have turned these statistics completely upside down.