Hut 8 Reports Impressive $331 Million Net Income for 2024

Bitcoin mining powerhouse Hut 8 has announced a remarkable net income of $331 million for the fiscal year 2024, as detailed in the company’s recent financial disclosures. This significant financial achievement is largely attributed to the substantial increase in Bitcoin prices throughout the year, highlighting the firm’s ability to capitalize on market trends.

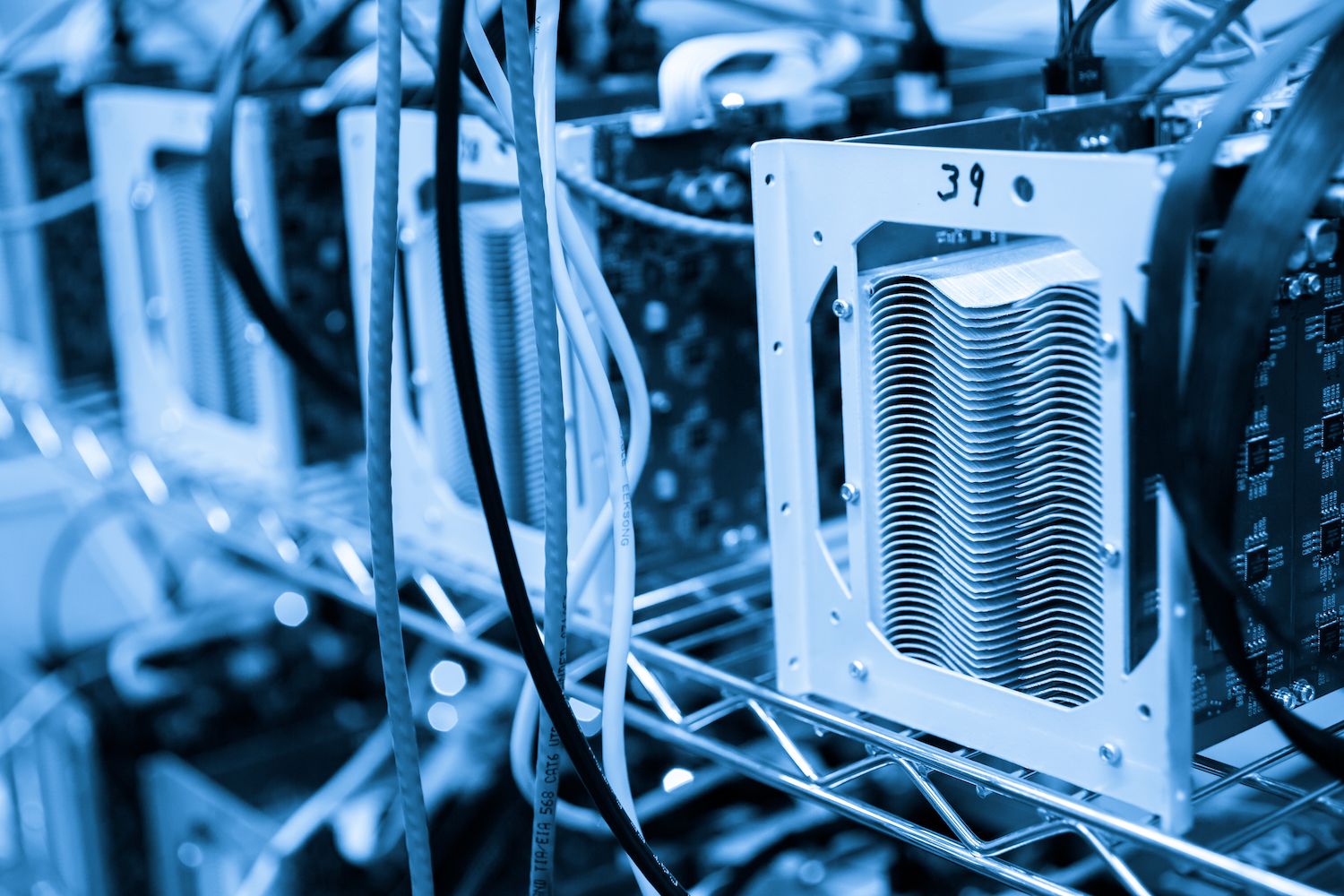

As the year concluded, Hut 8 boasted a substantial reserve of 10,171 Bitcoin (BTC), valued at approximately $905 million at the time of this report. Notably, the majority of this impressive reserve has been strategically pledged as collateral for the acquisition of additional ASIC mining machines, positioning the firm for future growth and expansion.

The company also reported a dramatic decrease in energy expenses, with the costs per megawatt-hour in the fourth quarter declining by an impressive 30% from the previous year, bringing it down to $31.63. Hut 8 managed to maintain around 1,020 megawatts (MW) of operational capacity by the end of December, while also having an extensive pipeline of over 12,300 MW planned for development.

Additionally, Hut 8 has strengthened its partnership with Bitmain, one of the leading entities in the Bitcoin mining sector. The firm secured a lucrative colocation agreement with Bitmain, which is projected to generate an impressive $125 million in annual revenue. Furthermore, Hut 8 is collaborating with Bitmain to innovate and develop a next-generation ASIC miner, underscoring its commitment to advancing mining technology.

In a move to diversify its portfolio, Hut 8 is also increasing its investments in artificial intelligence infrastructure. Through its subsidiary, Highrise AI, the company has entered into a five-year customer agreement for GPU-as-a-Service. To bolster its AI initiatives, Hut 8 successfully closed a strategic investment round, raising $150 million from Coatue, aimed at supporting its AI development efforts.

Despite these positive developments, the company’s stock experienced a decline of 7.25% on the day of the report, bringing its overall valuation to approximately $1.5 billion.

Disclaimer: Portions of this article were generated with the assistance of AI tools and have been thoroughly reviewed by our editorial team to ensure accuracy and adherence to our quality standards. For more details, please refer to CoinDesk’s comprehensive AI Policy.