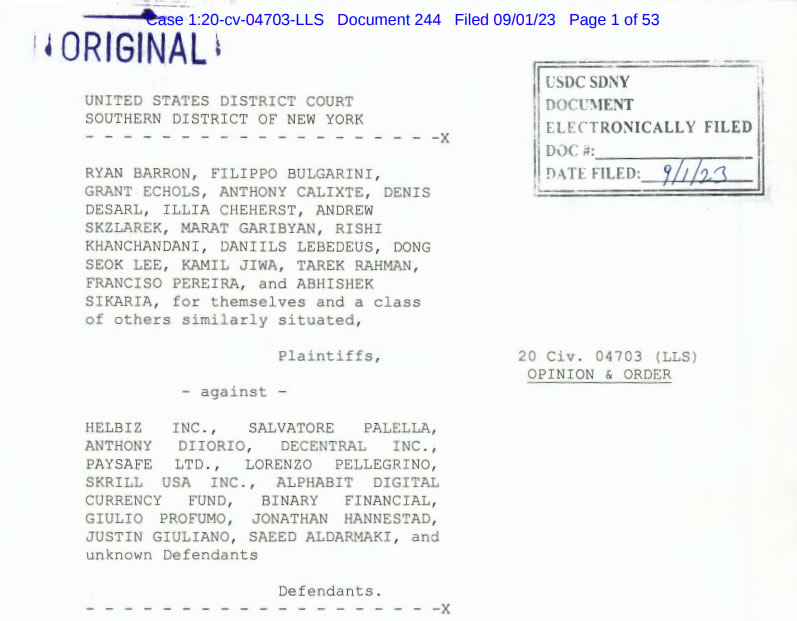

In an important development, the United States District Court for the Southern District of New York has allowed a long-running class action lawsuit against the creators of HelbizCoin to continue. The lawsuit, originally filed in 2020 and with an amended complaint filed in March 2022, includes allegations of fraud, price manipulation and breaches of securities laws for the altcoin. Here are the details…

Decision to continue litigation for altcoin project

HelbizCoin, launched by Italian electric scooter sharing company HelBiz in 2018, had raised a substantial $38.6 million in an Initial Coin Offering (ICO). The ICO attracted the attention of nearly 20,000 investors. It was noteworthy that Anthony Di Iorio, one of the co-founders of Ethereum, took part in the project. Investors at HelbizCoin claim that the cryptocurrency is a fraudulent “rug-pull” and a classic “pump&dump” scam. They claim that Helbiz and its partners are making false statements and promises to entice individuals to purchase the tokens, while secretly holding most of the ICO funds. The final decision, delivered by Judge Louis Stanton on September 1, 2023, had mixed results for both parties. The court partially accepted the dismissal requests, while rejecting the others.

Some defendants, including Paysafe, Skrill, Decentral, and Alphabit, were dismissed entirely due to lack of personal jurisdiction over them. Some claims were also denied, including claims for breach of contract, tortious interference, and certain securities. However, the court upheld the allegations of fraud, price manipulation, violations of securities laws, commodity laws and the RICO (Racketeer Influenced and Corrupt Organizations) Act against some defendants. Importantly, the ERC-20 token used in HelbizCoin was determined to qualify as a security under federal law, which was an important aspect of the decision.

What happened in court?

The journey of this case followed a bumpy course. First dismissed by a lower court judge in January 2021, citing a 2010 Supreme Court precedent, the case was revived by the 2nd U.S. Court of Appeals in October 2021. This decision paved the way for the filing of an amended complaint in March 2022 and ultimately led to the final decision. Attorney Michael Kanovitz, representing the investors, emphasized that blockchain transparency was used in the case. He explained that the complaint included charts that used the Ethereum ledger to show fake trading during the ICO. Also, multiple proofs of “genesis wallets” were presented to early investors in Ethereum, including Anthony Di Iorio. Emphasizing the importance of these findings, Kanovitz said:

Encountering multiple genesis wallets is like a fingerprint that points to one of only a few people in the world. Moreover, these genesis wallets have engaged in similar behavior in publicly sponsored ICOs such as Di Iorio’s EOS.

However, the court did not find sufficient evidence to substantiate Di Iorio’s claim that he made false or misleading statements about the HelbizCoin ICO in Bitcoin Magazine and considered it a speculative conclusion.