After macro events and regulatory pressures, the crypto market has plunged into the bottom of the red zone. This time, the leading crypto Bitcoin could not stay out of it. BTC price settled below the $27,000 strong support. However, Binance CEO Changpeng Zhao argues that this is a bullish signal. Thus, CZ is trying to motivate the market.

Binance CEO pointed to the picture 4 years ago for Bitcoin!

cryptocoin.com As you follow, Bitcoin has been trading in a narrow range for a while. However, it eventually broke out of this range with a sharp decline. This downward wave, which was also reflected in the market in general, caused a demoralization among market participants. Changpeng Zhao (CZ), CEO of Binance, the world’s largest crypto exchange, stepped in to boost morale. CZ hinted at a similarity between the last drop and Bitcoin’s movements in 2019. In this context, CZ shared the following on account X:

We were so excited when we saw BTC finally climb back to $10,000 4 years ago. And then it fell for a while. I got a few “comments” for the tweet below. Check out the big picture!

4 … years ago, we were thrilled to see #BTC finally climb back to $10,000 again. And then it dropped for a bit. I got a few "comments" for the tweet below 👇, for a while… 🤷♂️

Zoom out. https://t.co/3q1iVy2rdp pic.twitter.com/6M3XFsP5Ji

— CZ 🔶 Binance (@cz_binance) August 18, 2023

Binance CEO talks about the excitement of BTC raising to $10,000 in 2019. However, he highlights that later on, the price dropped a bit. CZ draws attention to the strong bull market after this drop with a chart that reveals the big picture. In a way, CZ hints that a similar process is still possible.

Bitcoin fell off the cliff!

The leading cryptocurrency dropped to $25,000 on August 17. Thus, it witnessed one of the sharpest price drops of 2023. At the time of this writing, although BTC has recovered to $26,301, it has erased its gains from the mid-June rally.

Bitcoin’s collapse led to carnage in the wider crypto market. Global market cap has dropped 7.42% in the past 24 hours, according to data from CoinMarketCap. Total crypto volume has reached $67 billion, up 81% in the last 24 hours. This was an indication of the intense selling wave. Popular biron-chain analyst likened the ongoing situation to the aftermath of the FTX crash and the US banking crisis. These are two of the strongest bearish events in the crypto market in the past 12 months. The analyst’s observation is based on the Net Buyer Volume indicator, which goes deep into the negative territory. This indicator is calculated by finding the difference between Buyer Bid Volume and Buyer Sell Volume. Negative values reflect that the market is dominated by sellers.

Wow.

The selling pressure is similar to the #FTX collapse and the silicon valley bank crisis.

This is crazy 🥴 https://t.co/hDbNFuaDEX pic.twitter.com/M1vvsTuRxm

— Maartunn (@JA_Maartun) August 17, 2023

Whales on the decline, but others bought the fall

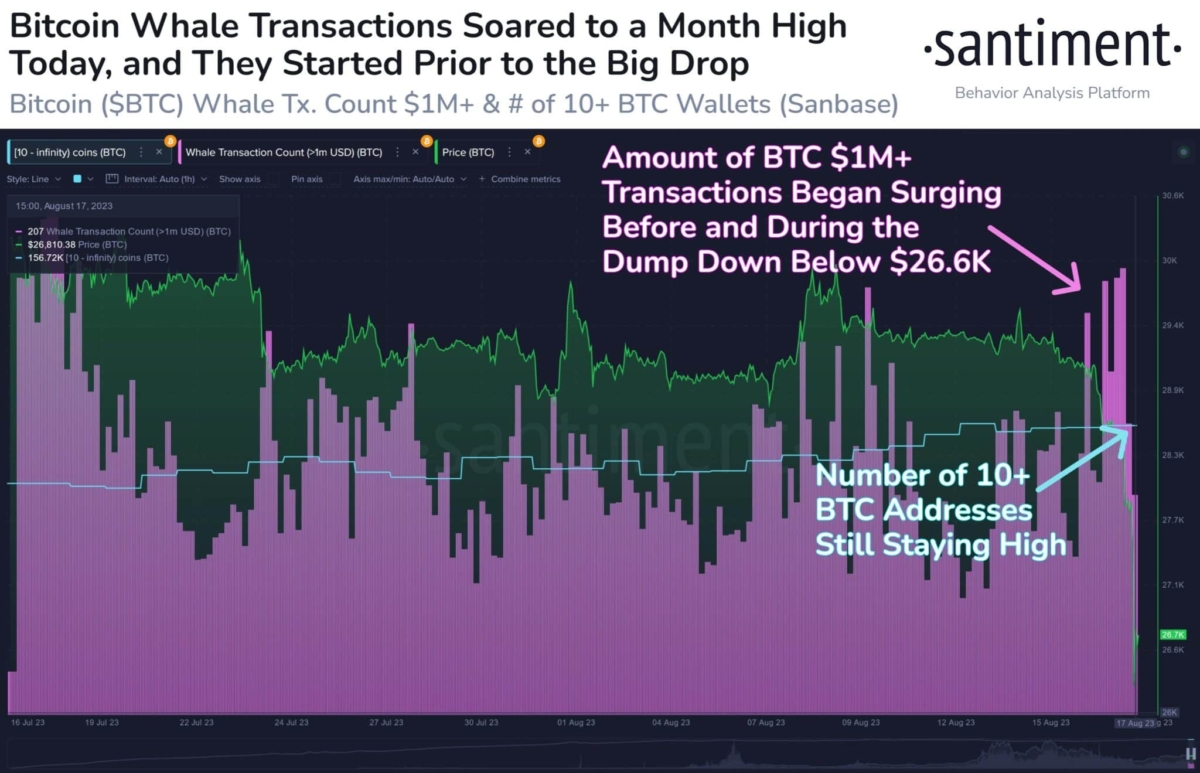

A large proportion of whale investors contributed to the selling pressure. Transactions involving more than $1 million in BTC soared to unprecedented levels last month, according to data from on-chain research firm Santiment. In reality, transactions started piling up even before the meltdown when BTC fell below $29,000 on August 16.

Source: Santiment

Source: SantimentInterestingly, the number of wallets storing more than 10 BTC has not witnessed a huge drop. This probably means that some holders use the drop to fill their crates. Indeed, further examination of user groups confirms this claim. The number of addresses holding 10-100 BTC tokens has increased by 70 in the last 24 hours. Also, at least four more wallets were included in the 100-1,000 user group.