Gold prices rose on Monday as the dollar eased. Bitcoin, on the other hand, lost the $ 28,000 level in the middle of the Binance debacle. Meanwhile, investors are waiting for key US inflation data to be released today, which could affect the Federal Reserve’s monetary policy stance.

Gold will rise to $2,100 sooner or later!

Spot gold was up 0.2% at $2,020.80 at press time. U.S. gold futures rose 0.2% to $2,029.30. Meanwhile, the dollar index (DXY) fell 0.1%, making gold more attractive to offshore buyers. cryptocoin.com As we have announced, the US consumer price index (CPI) data will be released today. Tim Waterer, chief market analyst at KCM Trade, says any sign of low inflation will hold back the dollar as expectations for lower interest rates from the Fed. He also notes that this will likely lead to an uptrend in gold.

Investors also follow developments regarding the US banking sector and the US debt ceiling. US Treasury Secretary Janet Yellen warned on Sunday that failure by Congress to act on the debt ceiling could trigger a “constitutional crisis.” Waterer says gold will be among the “main beneficiaries” if there are signs of further weakness in the US economy. She also states that prices will rise to $2,100 sooner or later, she says.

Edward Meir: We are positive about precious metals

Economic uncertainty and low interest rates increase the demand for zero-yield gold. Marex metal analyst Edward Meir underlines the following in a note:

As we enter May, we are constructive about precious metals… We foresee a trading range for gold (in May) between $1,954 – $2,080.

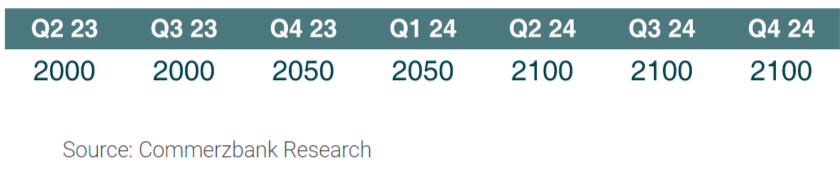

Gold will be around $2,000 for two quarters

Gold price continues to maintain the $2,000 level. Economists at Commerzbank predict that the yellow metal will rise towards the end of the year. However, he expects it to remain steady before this move. In this context, economists make the following assessment:

Over the next two quarters, we forecast gold to be at roughly $2,000. Therefore, we expect it to be only marginally below current levels. Gold is likely to rise permanently and more prominently above the $2,000 level as the Fed makes its expectation of a return in interest rates more clear. But we expect that to happen only towards the end of this year.

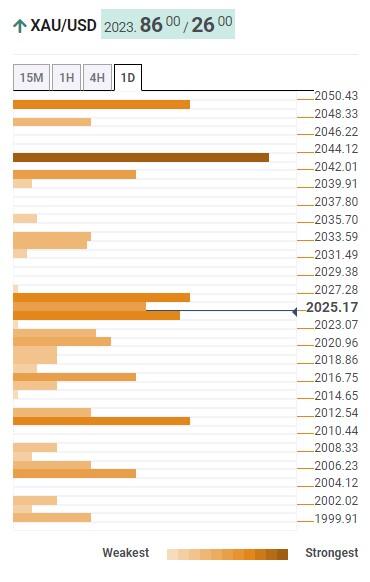

Key levels for gold price

Technical analyst Anil Panchal identifies key technical levels for gold via the Technical Confluence Detector. Accordingly, gold price is struggling with the broad resistance area around $2,023-27, which consists of the one-month Fibonacci 23.6% and the 100-HMA. Following that, the one-month R1 Pivot Point and one-day Bollinger upper band are around $2,045. This will be a tough nut to crack before giving control to gold buyers.

If gold exceeds $2,045, the previous month’s high of around $2,050 and the recent record high of around $2,080 will draw the market’s attention. On the other hand, the one-week Fibonacci 61.8% constrains the immediate downside of gold price around $2,016. A breakout of this could lead the golden bears to the one-day Fibonacci 23.6% and the one-month Fibonacci 38.2%. It is noteworthy that the 10-DMA, Bollinger’s middle one-day band, and Bollinger’s four-hour lower band converge near $2,005 as the last defense of gold buyers.

Technical Confluence Detector

Technical Confluence DetectorBitcoin lost $28,000 amid Binance debacle

Leading crypto Bitcoin (BTC) has printed red indices in the last 24 hours. There has been increased volatility in the market due to the withdrawal issue that arose in Binance. In the midst of this, Bitcoin price lost the important $28,000 level. Now investors and traders are waiting for US inflation data that is likely to affect the Bitcoin price.

According to the latest data, the Bitcoin price has dropped by 3.6% in the last 24 hours. Thus, it lost about $20 billion in market value. This drop came amid a problem with the world’s largest crypto exchange. Binance has temporarily suspended Bitcoin withdrawals for a few hours, citing heavy volume and an increase in transaction fees.