On-chain research Lookonchain identified a suspicious wallet that made heavy purchases shortly before the Binance listing news, then closed its position with a profit of $100,000.

Binance insider trading claim: $200,000 in hours

According to blockchain detective Lookonchain, a mysterious wallet purchased $208,000 worth of Gains Network (GNS) less than 30 minutes before it was listed on Binance. After the altcoin was listed on the exchange, it took advantage of the price increase and made a profit of $ 106,000.

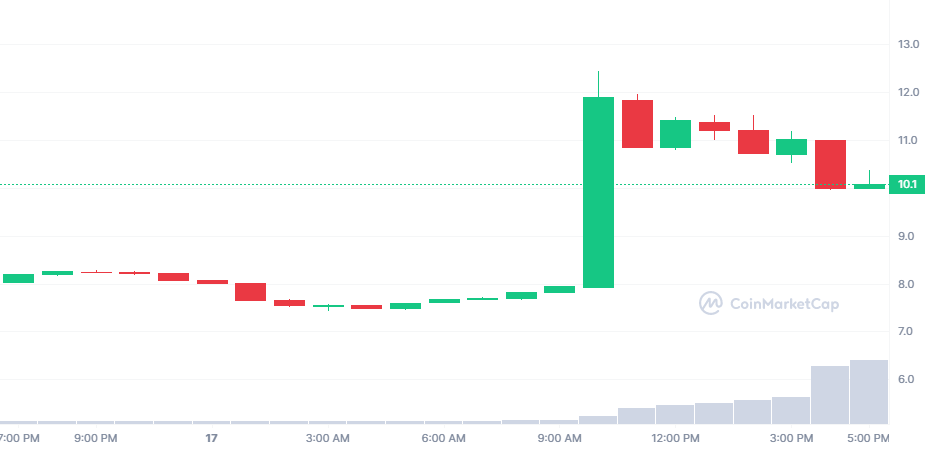

Gains Network (GNS) has risen at a triple-digit rate following the announcement of its listing on Binance today. The DEX token jumped from $7.92 to $12.01 right after the listing. The respective wallet bought the tokens from decentralized exchange aggregator 1Inch before selling it in the same place after the price rose.

A smart money bought 26,881 $GNS at a cost of $208,335 before #Binance announcement of listing $GNS.

Then sold 26,881$GNS and got $315,082.

This guy made $106,747 in a few hours!https://t.co/B5gTvWwAN5 pic.twitter.com/f7G0yyIMPm

— Lookonchain (@lookonchain) February 17, 2023

In another transaction, a wallet that bought $500,000 of GNS at $7.38 about a week ago sold for $11.22 after Binance listing, making a total profit of around $250,000.

GNS is currently trading for over $10, holding over 20% gains in the last 24 hours. It went from $6 to over $12 shortly after being listed on Binance.

cryptocoin.comAs we reported, Binance today added Gains Network (GNS) to its Innovation Zone.

Coinbase executive reports past insider trading

Last month, Conor Grogan, head of product at rival exchange Coinbase, said in a Twitter thread that something that had been prominently featured on Binance for more than 18 months had occurred. Grogan drew attention to the following transactions in a tweet where he said “Binance seems to have a prominent model for 18+ months”:

I found linked wallets:

-Bought $900,000 Rari seconds ago and left minutes after it was listed

-Bought ~78K ERN between June 17th and June 21st and sold immediately after listing announcement

-Does the same with TORN

It appears that there is a pattern of Binance front-running over 18+ months

I found connected wallets that:

-Bought $900k Rari seconds before and dumped minutes after listing

-Bought ~78K ERN between June 17 and June 21 and sold right after listing announcement

-Did same w/ TORN https://t.co/yAolrfeHkO pic.twitter.com/VRq3vzfcgd— Conor (@jconorgrogan) January 23, 2023

Grogan also said that someone is likely insider trading: “An insider is most likely getting information from a rogue employee who is affiliated with the listing team and has details about new listing announcements, or from a trader who found some kind of API or staging/test trade exchange leak.

Binance officials responded

Binance chief strategy officer Patrick Hillmann responded by saying that company policy restricts Binance employees from trading for short periods by imposing a 90-day lock on token sales. He said the policy has been in effect since 2021:

Insider trading has been a strict policy at Binance at least since I started here in 2021. We have an internal security team that monitors multiple platforms for possible employee trading activities and this is a zero tolerance policy. Here is the fastest way to get fired.

This has been a strict policy at Binance at least since I started here in 2021. We have an internal security team that monitors multiple platforms for possible employee trading activity and it is a zero tolerance policy. It is the quickest way to get fired here @WuBlockchain https://t.co/nBpKVadsTG

— Patrick Hillmann (@PRHillmann) January 10, 2023