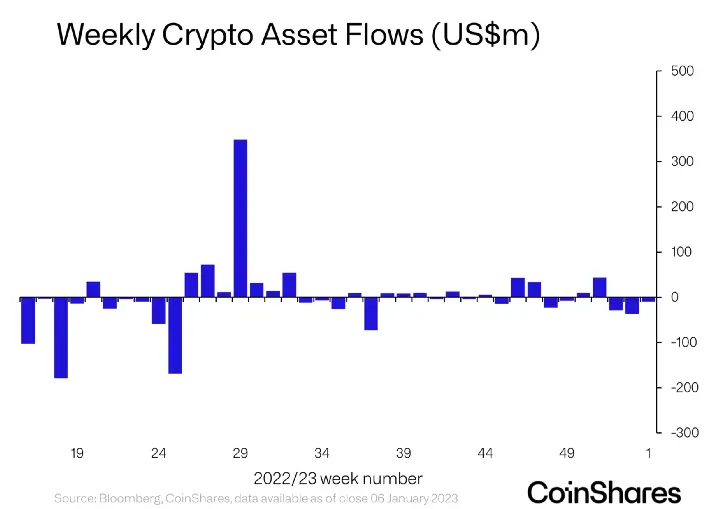

CoinShares’ first weekly fund flow report of the year shows that after 2022, the weakest year since 2018, the altcoin market maintains a negative atmosphere with small outflows of $10 million.

Fund flow reports highlight the negative mood in the altcoin market in recent weeks

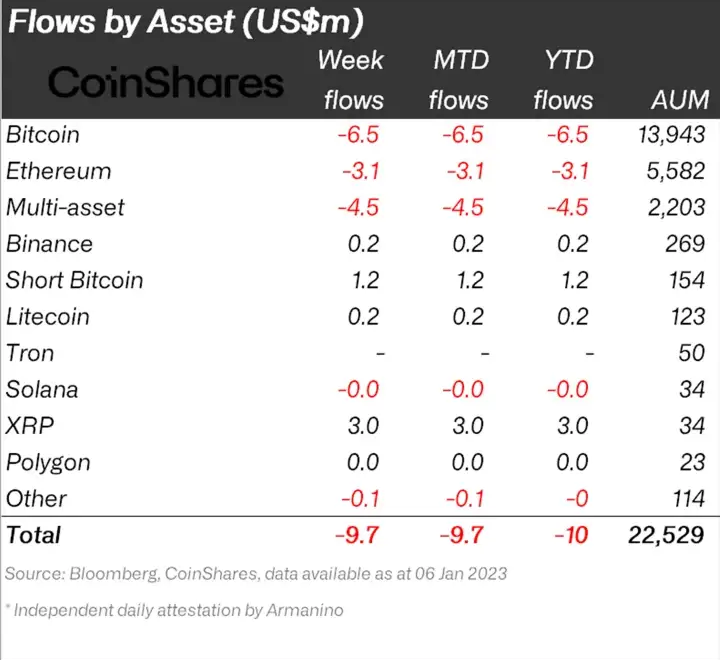

CoinShares weekly fund flow report released Monday, January 9 revealed that institutional investors pulled $10 million from crypto investment products last week. Cryptocurrency investment products saw a total outflow of $9.7 million, highlighting the mildly negative sentiment that has persisted for the past 3 weeks.

Bitcoin, in particular, has seen minor spikes totaling $6.5 million for the third week in a row, implying that the mood at the beginning of 2023 remains negative. Over the same period, short Bitcoin investment products saw small inflows of $1.2 million.

Bitcoin volumes average $5 billion per day during the week compared to $9 billion in 2022, while trading volumes remain low, with exchange-traded products averaging $173 million daily. Regionally, Germany and Switzerland saw small inflows of $0.6 million and $0.8 million, respectively, while negativity focused on Brazil and the United States, with outflows of $4.5 million and $4.1 million, respectively.

Institutional money flows into these three altcoin projects

On the altcoin side, Ethereum continued its negative fund flow streak and saw small outflows of $3 million, marking an 8th consecutive week exit. The leading altcoin was the only investment product that lost funds for the week. On the other hand, XRP topped the trend with inflows totaling $3 million, representing 9% of the total AuM. CoinShares analysts believe that the increasing clarity of its legal case with the SEC is increasingly being viewed as suitable for XRP by the investment community. In the overall chart, the top fundraising projects with XRP peaking are:

- Binance (BTC), $200,000

- Litecoin (LTC), $200,000

- Solana (LEFT), steady

- XRP (XRP), $3 million

- Polygon (MATIC) remained stable

cryptocoin.com As we reported, crypto investment products had their weakest year in 2022 since 2018. Recent data from Glassnode suggests that Bitcoin’s volatility dropped significantly in the last month of last year. This volatility offers the opportunity for both individual and large investors to take advantage of the opportunity to buy cryptocurrencies after a stagnant 2022.

One of the reasons for this is that in the previous cases, such as April 2019 and August 2020, when Bitcoin experienced low volatility, BTC recovered in the short term and witnessed an increase in its price.