Venture capital firm Paradigm moved $3.5 million of MakerDAO’s MKR tokens following a16z’s maneuver. Other company a16z moved its $7 million stake in the altcoin project to crypto exchange Coinbase last week.

Institutional investors are selling these altcoin tokens!

Paradigm Capital is set to sell the MakerDAO governance token MKR for $3.5 million Wednesday afternoon, according to Blockchain data from Arkham Intelligence. Accordingly, 3,000 MKR transfers were made from Paradigm’s crypto wallet to an OTC trading wallet. Paradigm did something similar in March. He sent about $20 million worth of MKR to the same wallet. He then transferred the tokens to the crypto exchange Coinbase.

Paradigm’s MKR transfers. Source: Arkham Intelligence

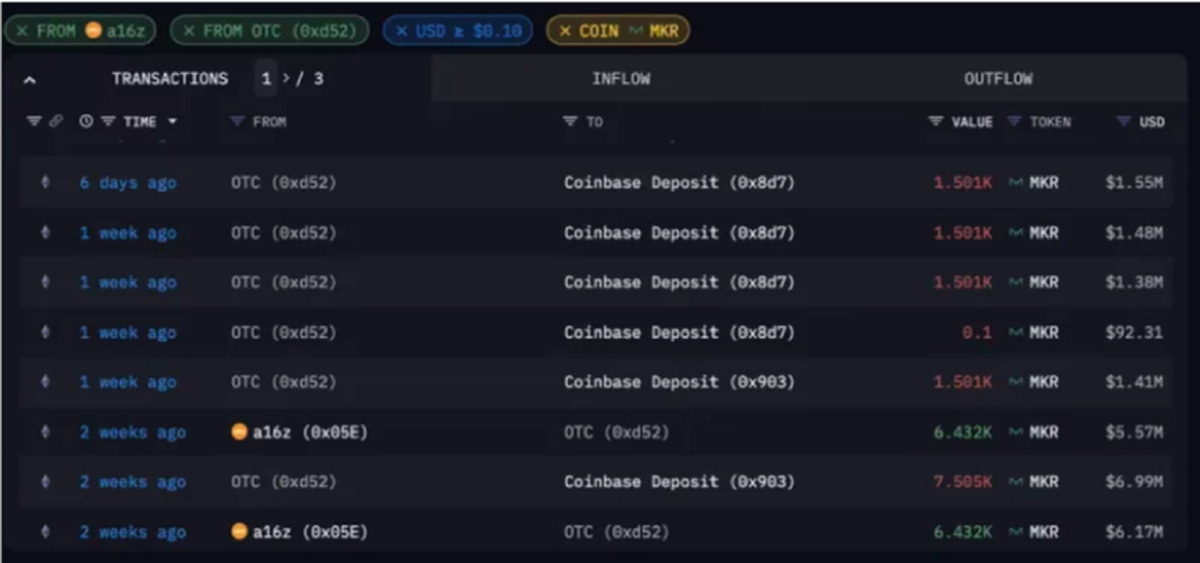

Paradigm’s MKR transfers. Source: Arkham IntelligenceMeanwhile, Andressen Horowitz (a16z) deposited $7 million in MKR tokens on Coinbase earlier this week. He made this transfer to potentially sell the tokens. Paradigm’s final move follows a16z’s maneuver.

cryptocoin.com As you follow, the altcoin price has reached its highest level since last August. Thus, the transactions of VC firms were spurred by a new buyback scheme that removed the tokens from the market. MKR is currently changing hands at $1,190. At this price level, it increased 73% in one month. Thus, it vastly outperformed the 12.7% monthly return of the CoinDesk DeFi Index.

Paradigm and a16z are early investors in MakerDAO

MakerDAO is one of the largest decentralized finance (DeFi) lending platforms. It is also the issuer of the $4.6 billion DAI stablecoin. The protocol is managed by a decentralized autonomous organization (DAO) where holders of MKR tokens can vote on governance proposals.

This development comes as part of MakerDAO founder Rune Christensen’s vision for Endgame as it goes through a major overhaul that includes splitting the platform’s structure into autonomous units that can issue their own tokens and overhaul MKR and DAI. While the plan was approved by a governance vote, it also sparked some backlash among community members and investors in the protocol. Delegates and developers resigned from their posts and a16z was openly opposed to the changes.

Paradigm and a16z are among the leading companies that invested early in MakerDAO. Paradigm acquired 5.5% of all MKR tokens in a $27.5 million investment round with Dragonfly Capital in late 2019. On the other hand, a16z bought 6% of the MKR supply in 2018 for $15 million.

According to Arkham data, the OTC wallet where Paradigm tokens landed has a history of receiving MKR and transferring to Coinbase. Following Paradigm’s $20 million transfer in March, a16z also posted a total of $11.7 million MKR to the account at the beginning of July. After that, he dumped the tokens on Coinbase.

A16z’s MKR is transferred to OTC wallet. Source: Arkham Intelligence

A16z’s MKR is transferred to OTC wallet. Source: Arkham Intelligence