The Shapella upgrade implemented on April 12, which released ETHs locked in the December 2020 period, led to an increase in staking activities contrary to expectations. On-chain data shows that the leading altcoin is in demand, especially from institutional investors.

Leading altcoin Shapella then broke a record in staking activities!

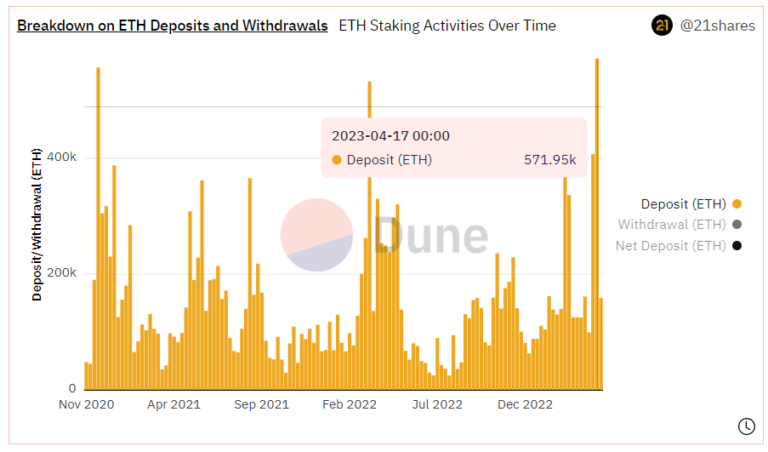

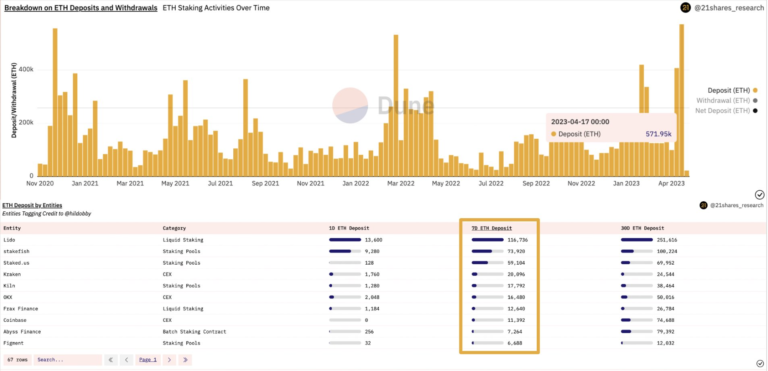

According to Dune Analytics’ weekly Ethereum staking report, the Ethereum network registered 571,950 ETH entries during the week of April 17. Specifically, according to the chart, staking activity has been increasing noticeably in recent weeks. It recorded the highest daily number on April 24. On this date alone, 126,080 ETH entries were made into the pools.

The Ethereum network is not only breaking records in staking activity. At the same time, it briefly surpassed $2,000, a psychological resistance level for the price. Reports suggest that institutional buyouts are behind the bull surrounding the leading altcoin.

Institutional investors show interest in Ethereum again

This increase was largely due to institutional staking service providers, as 21Shares research analyst Tom Wan explained in a tweet published April 24. Price momentum is driven by large investors looking to reinvest their rewards after the pullback.

Also, after a long period of low activity, Ethereum finally experienced a significant influx of investments. According to data from CoinShares, Ethereum’s investment products saw $17 million in inflows in the week ending April 21. cryptocoin.comWe have included the details of the report in this article.

Altcoin analysts were right

Meanwhile, some analysts had predicted that the Shapella upgrade would lead to an increase in staking activities. In particular, high interest was expected for a few weeks after the staking ETHs were released. Recent data show that these predictions of experts partially come true.

Ethereum price is gaining upward momentum in terms of price, along with the increased interest. April 26 helped retake a critical resistance within ETH, as was the case across the market.

How is the Ethereum price?

ETH price managed to gain around 7% on the day. The price rally dominated the market as a whole, with BTC rising around 8.6% in the same period.

All things considered, whether the positive staking momentum will continue will depend on continued interest from institutions and other major investors looking for new ways to increase their profits.

Is the selling pressure still on the table?

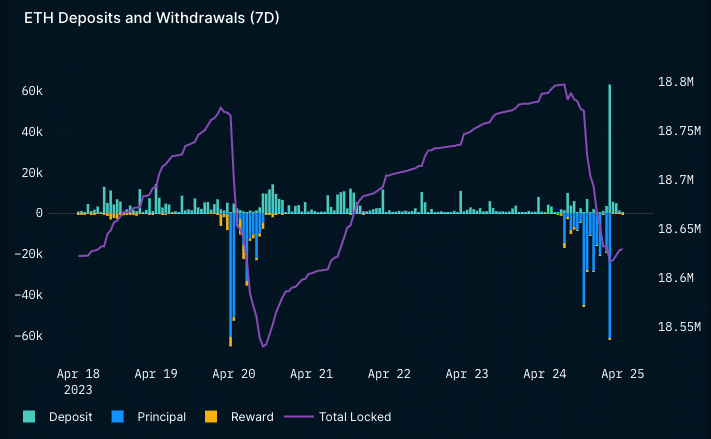

With these, fears around a possible selling pressure are easing. This may have influenced the decision of investors to turn their attention to altcoin. According to Nansen, the ETH sent to the Beacon deposit contract outweighed the withdrawals. As of April 24, deposits were 63,009 and principal withdrawals were 61,312.

While pullbacks were evident last week, the overall sentiment since the upgrade has attracted deposits that are far better than sell intent. At the time of writing, ETH price has been preoccupied with pushing this interest above $2,000.