Bitcoin remains the primary investor focus, with inflows totaling $69 million representing 90% of weekly flows.

Bitcoin primary investment focus

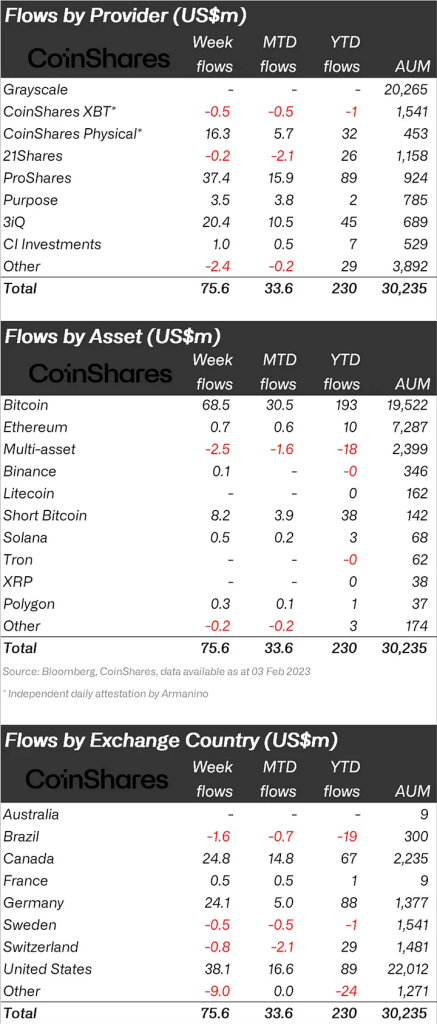

Digital asset investment products saw inflows totaling US$76 million last week. This is the 4th consecutive week, with year-to-date inflows currently at US$230 million, underscoring a decisive shift in investor sentiment for the start of 2023. Total investment assets under management (AuM) are up 39% year-over-year, currently at $30.3 billion, the highest level since mid-August 2022. Regionally, entries focused on the US, Canada and Germany with $38 million and $25 million.

Bitcoin remains the primary investor focus, with inflows totaling US$69 million representing 90% of total weekly flows. The remainder of the entries came from short-term Bitcoin, which totaled $8.2 million over the same period, highlighting continued divergence over the sustainability of this rally.

Short-bitcoin entries remain relatively small compared to Long-bitcoin entries, with entries in the last 3 weeks totaling US$38 million, representing 26% of the total AuM. So, it makes sense from a relative scaling standpoint, but that trade hasn’t worked well so far year-to-date, with the total short Bitcoin AuM down 9.2%.

Among the altcoins in this report, Solana ($0.5M), Cardano ($0.6M) and Polygon ($0.3M) saw small inflows, while Polygon saw $0.5M outflows). Despite improving clarity on staking, Ethereum only saw $0.7 million in inflows.

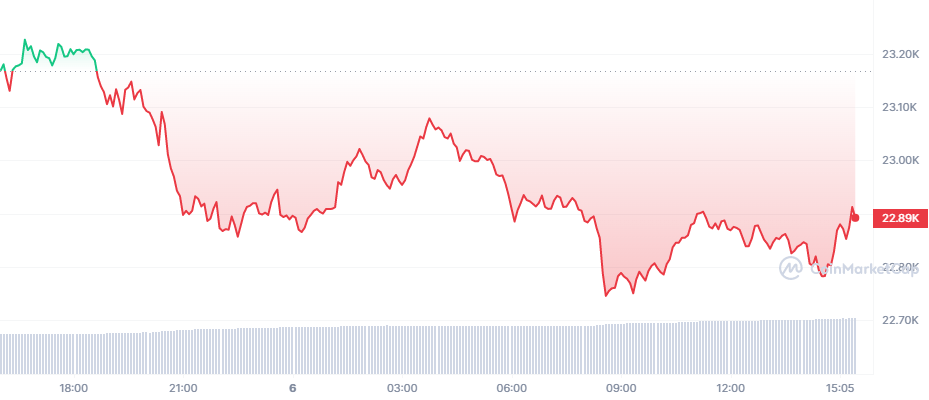

Price analysis

cryptocoin.com According to the data, Bitcoin price is $ 23,894 and 24-hour trading volume is $ 22 billion. It’s down 1% in the last 24 hours. It ranks first in the lists with a live market value of 480 billion dollars. The current amount of Bitcoin in circulation is 19,281,825 tokens out of a final maximum supply of 21 million.

Recently, Bitcoin has been showing a bearish trend with an immediate support area of $23800, according to data from analysts. If it exceeds this level, it could lead to further losses in price. It eventually settles at $23000, which is marked by an ascending trendline and can be seen as a potential support point.

RSI and MACD indicators indicated that there could be an increase in selling pressure, which could cause BTC price to drop to $22,750 as the next level of support.

Currently, the 50-day exponential moving average points to positive momentum for BTC/USD above $23,300. This suggests that a rebound may be imminent. If the price rises above $23,950, it could potentially rally as high as $24,500.