According to CoinShares’ latest weekly fund flow report, institutional investors are lacking in demand despite positive price movements. Fund flow for the 6th consecutive week ended with a negative note. Institutional funding from Bitcoin and ETH generally tended to move to these 4 altcoins.

Bitcoin (BTC) sustains negative sentiment

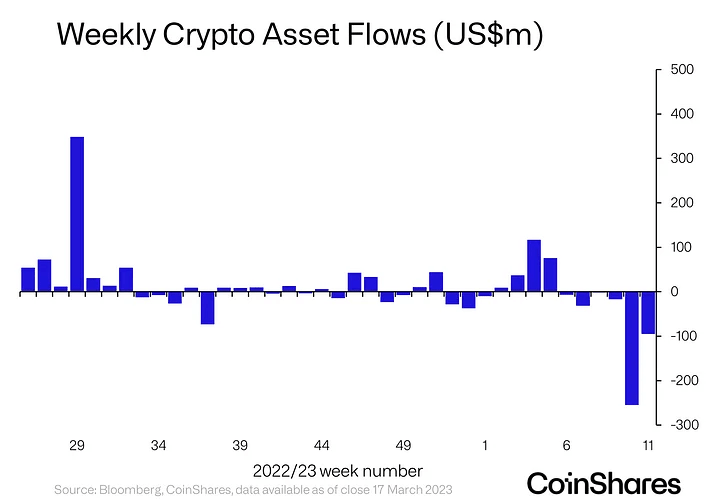

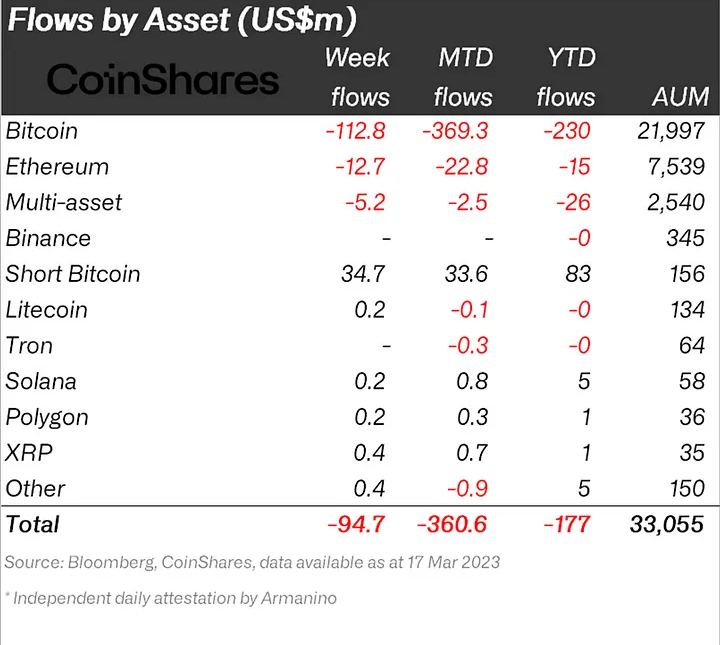

Cryptocurrency investment products saw a total output of $95M for the 6th week in a row, with the 5-week total being $406M, representing 1.2% of total assets under management (AuM). AuM is up 26% from last week, at $33 billion, the highest level since Three Arrows Capital’s collapse in June 2022. Transaction volumes in investment products doubled the average with $2.6 billion.

In stark contrast to the broader market, Bitcoin remains the focus of negative sentiment, seeing exits in investment products totaling $113 million last week and a total of $424 million over the past 6 weeks. Despite the exits, the total AuM increased by 32% over the week. Conversely, AuM has dropped 13% over the same period, despite short-Bitcoin inflows that hit a record $35 million last week. This sentiment was obviously counterintuitive to the rest of the crypto market, but it may be partly due to the need for liquidity during this banking crisis, a similar situation seen in March 2020 when the COVID panic first hit.

BTC and ETH escaped institutional fund headed for these 4 altcoins

Except for Ethereum ($13 million outflows last week), it reversed the trend, seeing inflows reaching $1.3 million only last week, according to CoinShares’ report. This positive sentiment lends more credence to the idea that the outflow in larger crypto-assets is driven by the need for liquidity. According to the data, the 4 altcoins that recorded a positive note flow in this environment are as follows:

- XRP (XRP): $0.4 million

- Litecoin (LTC): $0.2 million

- Solana (LEFT): $0.2 million

- Polygon (MATIC): $0.2 million

Despite high fund loss, experts expect Bitcoin (BTC) to make ATH in the short term

Matt Huang, co-founder of Paradigm startups, believes that Bitcoin is going through bubble stages that affect its overall health. Huang is of the opinion that these bubbles triggered by short-term investors can help Bitcoin in the long run. This is because every time the market witnesses a bubble, the adoption of Bitcoin increases and the cryptocurrency gains more acceptance.

#Bitcoin whales dumped over $200m yesterday, while open interest has grown by 20k #BTC in the past few days.

I don't see any meaningful spot accumulation besides stablecoins being converted into #Bitcoin.

I will take the under of @balajis bet. pic.twitter.com/N7G1q1bMpJ

— James V. Straten (@jimmyvs24) March 18, 2023

cryptocoin.comAs Coinbase, we have included the 7-digit price predictions of Balaji S. Srinivasan, the former CTO of Coinbase, in this article.