Cryptocurrency investment products suffered a record weekly loss of $255 million total in the week of March 6, amid the bankruptcy of Silvergate and SVB, the USDC crisis, the US strict regulation policy and macro developments. Institutional funds from BTC, ETH, LTC flowed into these 3 coins. Bitcoin (BTC) price and detailed market data from hereyou can see.

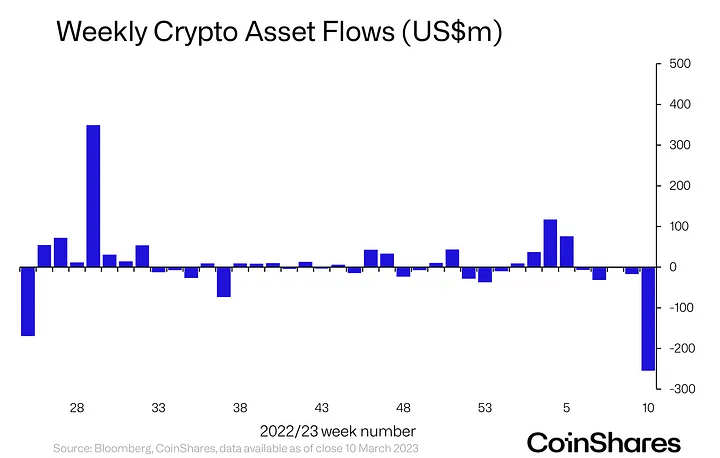

Weekly record fund outflow in cryptocurrency investment products

According to CoinShares’ latest weekly fund flow report, cryptocurrency investment products saw a total output of $255 million for the fifth week in a row. It was the largest weekly outflow on record, representing 1.0% of total assets managed (AuM).

Although the outputs are at a record level, there is a rather small loss as a percentage of the total AuM. This record was in May 2019, when the $51 million output was seen. Total assets managed since May 2019 have increased by 816%. However, AuM dropped 10% during the week, returning to levels seen at the beginning of 2023. Exits also eliminated all entries seen this year, with exits currently standing at $82 million year-to-date.

BTC, ETH, LTC, major cryptos lacking institutional demand

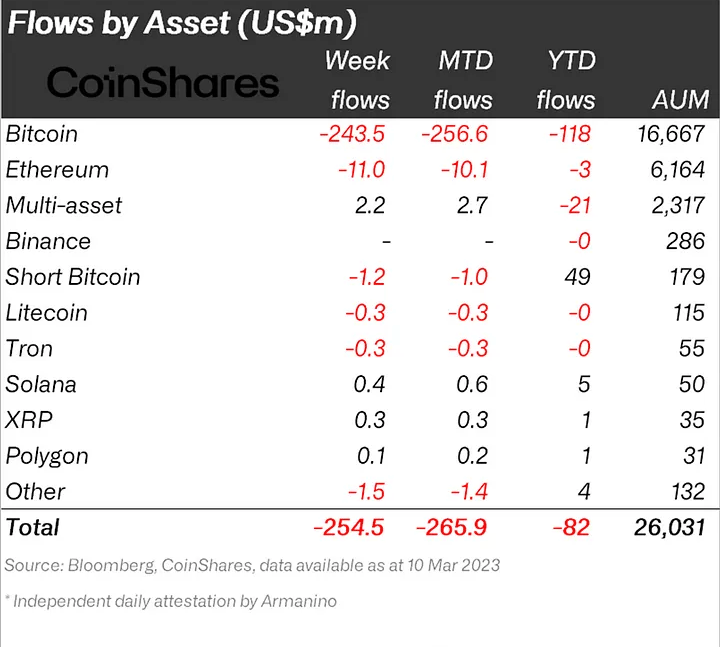

The largest cryptocurrency by market capitalization was the primary focus, seeing a total of $244 million last week. Short-Bitcoin products saw a total outflow of $1.2 million, despite being the investment product with the largest inflows to date, currently at $49 million.

Ethereum also saw a total outflow of $11 million last week, with year-to-date flows also turning negative, but yet to a much lesser extent of $3 million.

Institutional money from BTC and ETH flows to these 3 coins

According to CoinShares’ latest weekly fund flow report, BTC, ETH, and LTC lost $244 million, $11 million, and $0.3 million, respectively, during the week of March 6. Tron (TRX) is among the altcoins that saw a fund outflow of $ 0.3 million. The 3 cryptocurrencies that managed to provide positive fund flow in the same process are as follows:

- Solana (LEFT): $0.4 million

- XRP (XRP): $0.3 million

- Polygon (MATIC): $0.1 million

Fund flow by region

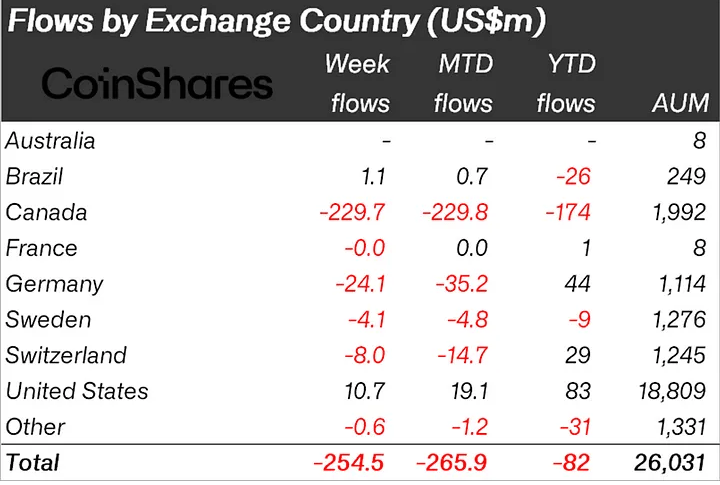

Regionally, the negative sentiment was broad, with the negative sentiment seen in both North America and Europe, with the US leading the way with $11 million in inflows, primarily Long-Bitcoin products.

cryptocoin.com As you follow, the cryptocurrency market has struggled with the crisis in the world banking sector over the past week. The new week starts on a positive note as Bitcoin retraces $22,000.