While these 5 altcoins were purchased, this outflow of 32 million USD was seen in crypto money investment products last week.

4 coins that were sold while buying these 5 altcoins

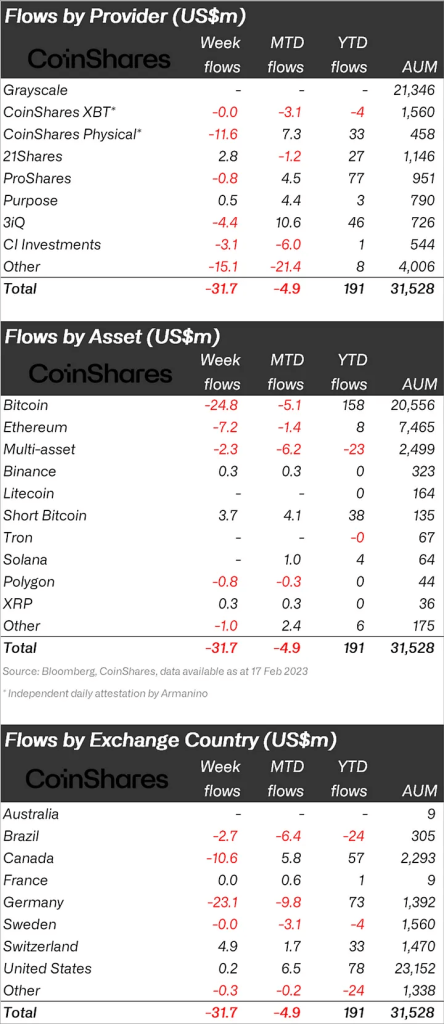

Cryptocurrency investment products saw a total outflow of US$32 million last week, the biggest outflow since late December 2022. Exits mid-week were much higher at US$62m, but sentiment improved with US$30m entry on Friday.

The negative sentiment among ETP investors was not expressed in the broader market as Bitcoin prices rose 10% over the week. This price increase brought total assets under management (AuM) to $30 billion, its highest level since August 2022. This is due to ETP investors being less optimistic about the latest regulatory pressures in the US than the broader market.

Bitcoin bore the brunt of the negative sentiment, seeing around $25M exits, while short-term bitcoin investment products saw $3.7M inflows and some of the biggest inflows in YTD at $38M, with Bitcoin at $158M. He came second after

The negative sentiment was very mixed with Ethereum, Cosmos, Polygon and Avalanche seeing exits of $7.2 million, $1.6 million, $0.8 million and $0.5 million respectively. Aave, Fantom, XRP, Binance, and Decentraland saw entries between $0.36 million and $0.26 million. Blockchain stocks saw a total of $9.6 million in entries last week, with 6 consecutive weeks of entries highlighting more constructive sentiment among investors.

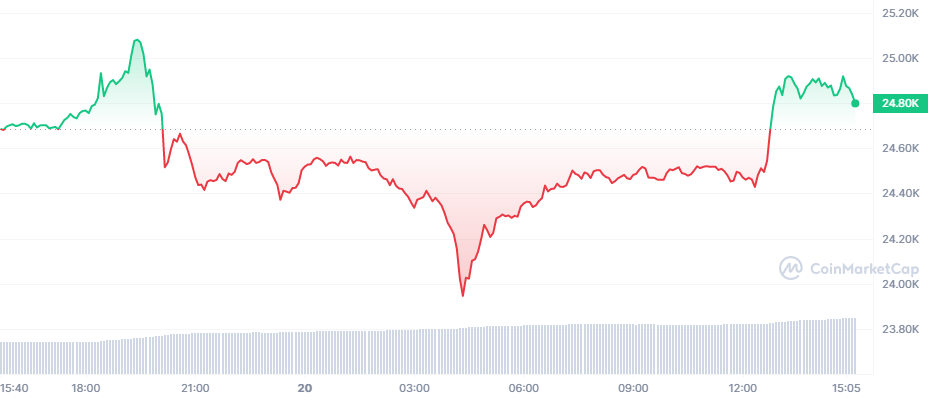

BTC rises and falls

It’s been a crazy week for Bitcoin, the largest cryptocurrency by market cap, hitting six-month highs before suddenly pulling back on Thursday, but then rallying again. cryptocoin.comAccording to data, BTC is instantly traded at $ 24,835.

Despite the BTC drop, it is still 14% higher than seven days ago. The reasons for its rebound from the previous support around $22,000, the ensuing decline and subsequent rally have changed. They underline the continued sensitivity of cryptos to macroeconomic conditions and industry-specific events, even if BTC sometimes behaves irrationally.