The decline in the cryptocurrency market forces institutional investors to sell Bitcoin and Ethereum. According to CoinShares weekly crypto report, institutional funds are moving to these 4 altcoin projects…

Institutional money flows to these altcoins as bitcoin falls

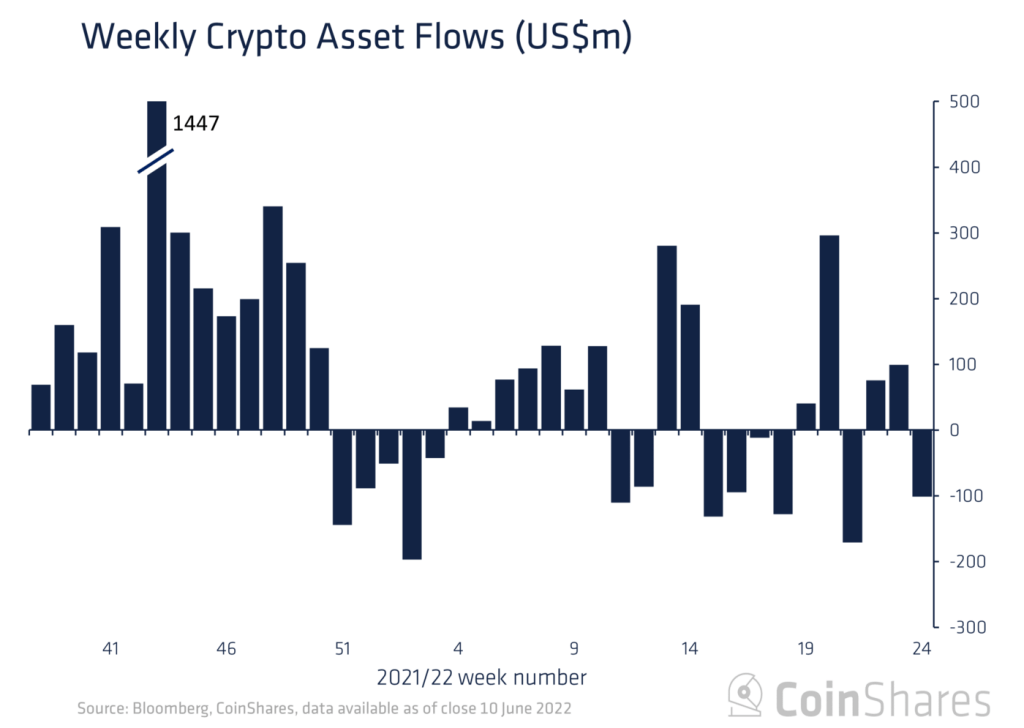

Total value of crypto market, November It fell from $1.5 trillion in the previous month to $961.83 billion today. Current CoinShares data shows that the output of crypto investment products is $102 million compared to last week. Last week, $57 million Bitcoin and $41 million Ethereum outflows were reported amid the Federal Reserve’s monetary tightening and widespread market sell-off.

Institutional investors’ crypto sales totaled $102M

Due to the recent monetary tightening, digital asset investment products have slowed down. Also, sales continued over the past week due to rising inflation and stETH leaving ETH. It is interesting to note that most of the outlets totaling $98 million came in the US. During this time, there was only $2 million net outflow from Europe.

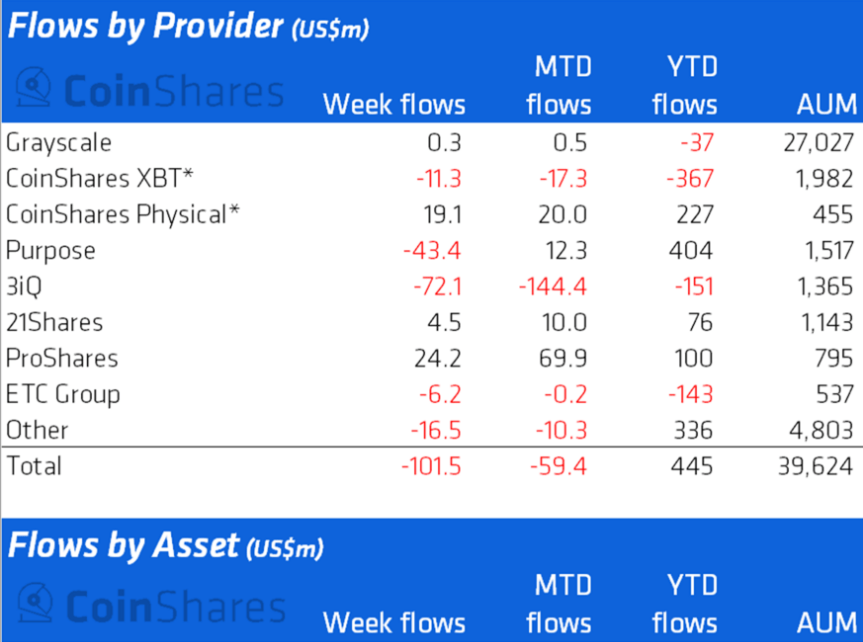

Last week investors 3iQ, Purpose Investments, CoinShares XBT and ETC Group received 72.1 million, 43.4 million, 11.3 million and 6.2 million respectively. amount of money withdrawn. During the same period, investors poured $24.2 million, $19.1 million and $4.5 million into ProShares, CoinShares Physical and 21Shares, respectively. Also, market leader Grayscale recorded just 0.3 million transactions last week.

Institutional interest drops dramatically

The previous week saw a dramatic drop in interest in Bitcoin and Ethereum by institutional investors. A total of $57 million was lost in Bitcoin transactions last week, and $91 million this month. Total assets managed for Long-Bitcoin investment products are currently $27 billion. So far more than the $55 million managed for short-Bitcoin investment products.

Ethereum merge and postponement of stETH-ETH depeg resulted in significant sales in the previous week. Last week, institutions were responsible for $41 million in outflows. This brings the total output to date to $387 million. Additionally, total assets under management (AUM) peaked at $23 billion in November, but have since dropped to the current $8.7 billion.

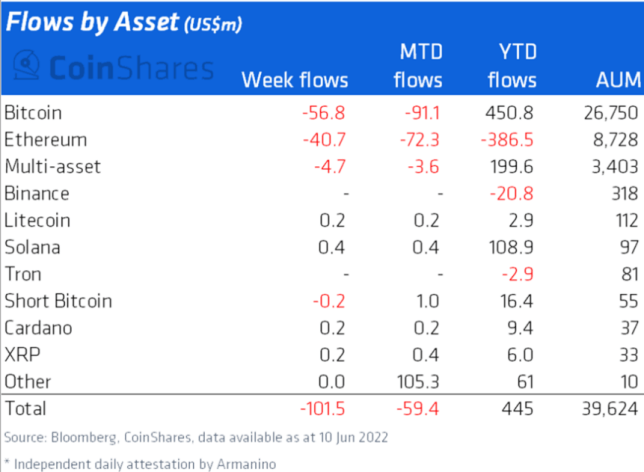

These altcoins saw a net outflow of $4.7M

As a result of the continued downward price pressure, investors are looking at other cryptocurrencies such as Solana, Cardano, XRP and others. they did not buy their currency.

These altcoins lost $400k in net inflows

In addition to major outflows concentrated in Bitcoin and Ethereum, there are altcoins that managed to find funds. Some big investors interpreted the current prices as opportunities. Cardano, Litecoin and XRP lost $200,000 while Solana lost $400,000 in net inflows.

Both Bitcoin and Ethereum reached the ATL level

Today, Bitcoin (BTC) and Ethereum (ETH) values are one year old. the day it reaches its lowest point. Bitcoin price is currently trading at $23,491, down 16%. By contrast, ETH price saw a 19% drop. It is currently trading at $1,229. As a result of the crypto market reaching lows, the most prominent cryptocurrencies are now in danger of being liquidated.