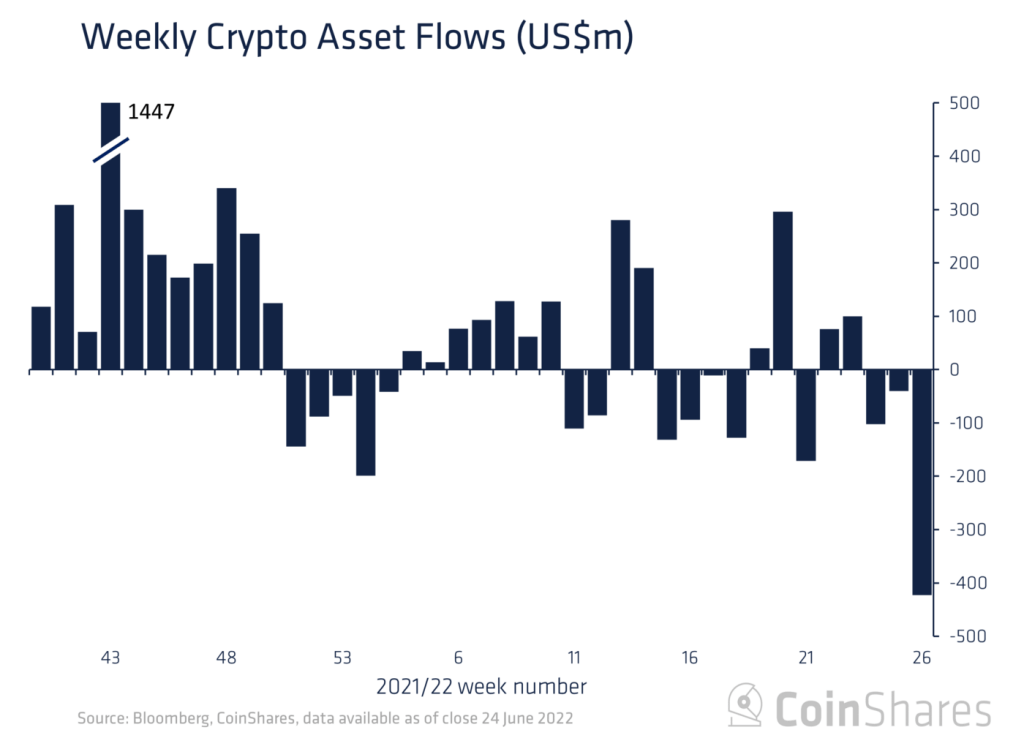

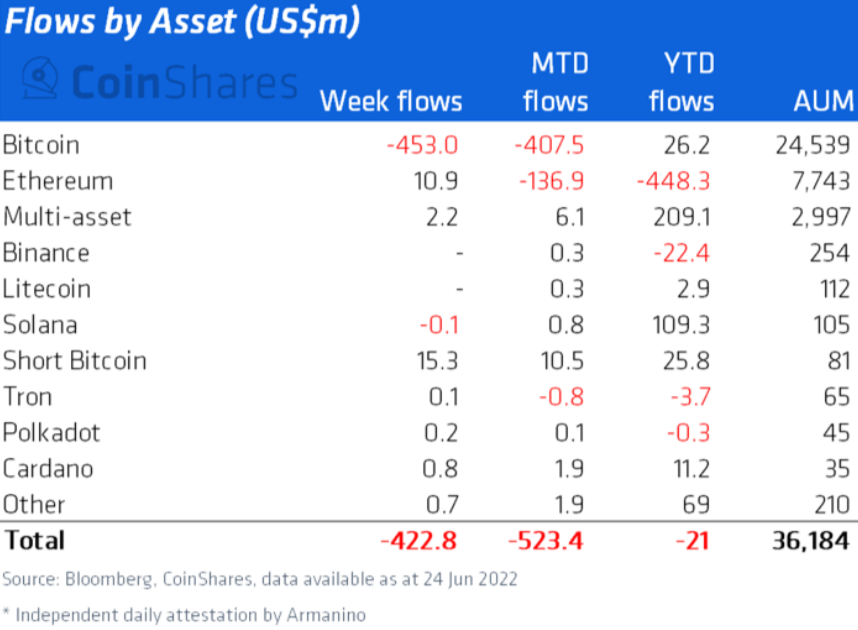

According to the latest reports, there was a total net outflow of $423 million in digital asset investment products last week. This figure marks the biggest exit ever. Meanwhile, eyes focused on Bitcoin, which saw a total net outflow of $453 million in just one week. Moreover, the leading altcoin changed its 11-week exit destiny and finally witnessed the inflows of funds.

Outputs in digital assets break all-time record

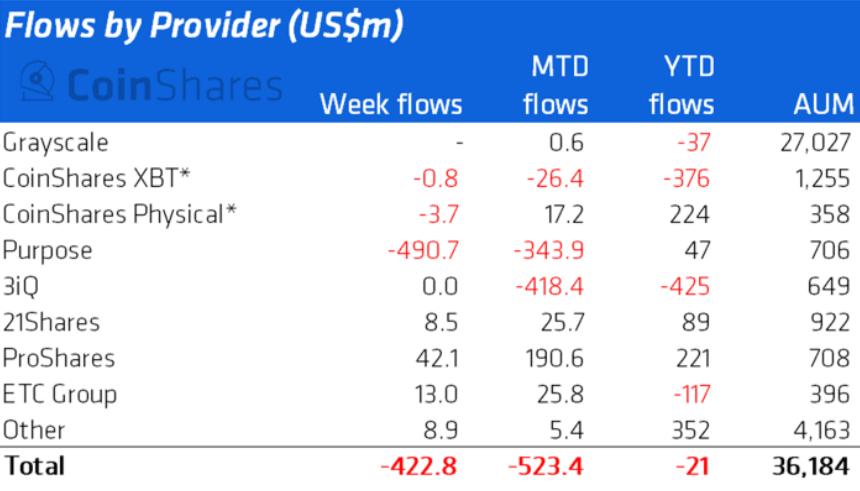

CoinShares, Europe’s largest digital fund management company, has released its weekly digital asset fund flow report. According to the report, a total of $423 million was outflows in digital asset investment products last week. This figure marks the biggest outflow since the outlets widened. Compared to the previous biggest outflow of $198 million in January, it’s possible to see the size even better.

On the other hand, it is not the largest by total assets managed (AuM). This record was achieved in the bear market of February 2018, which saw exits representing 1.6% of AuM. Last week’s exits were the 3rd largest on record, representing 1.2% of AuM.

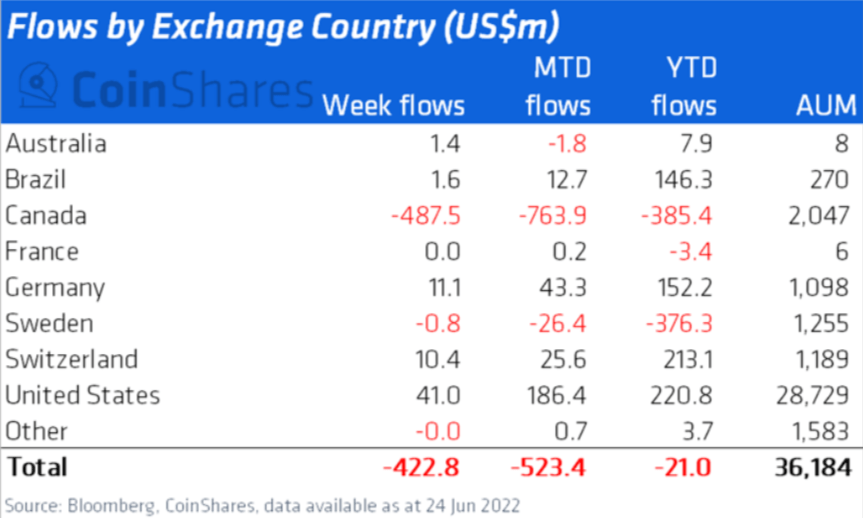

Canadian stock markets stand out in regional exits

Regionally, exits were almost exclusively from Canadian exchanges and a particular provider. Debuts took place on June 17. However, it was reflected in last week’s figures due to trade reporting delays. It’s probably also responsible for Bitcoin’s plunge to $17,760 that weekend. Ignoring this $493 million outflow, it turns out that other providers saw a total of $70 million in inflows. It also highlights the feeling that there is quite a polarization among digital asset investors, according to the report.

This time, the leading crypto lost funds, while the leading altcoin received investment

Meanwhile, leading crypto Bitcoin saw a total net outflow of $453 million during the week. This outlet has deleted almost all entries since the beginning of the year. It also left the total Bitcoin AuM at $24.5 billion, the lowest point since the start of 2021. Therefore, the attention of investors is focused on Bitcoin.

Short-Bitcoin launched its first US-based short-term investment product last week. For this reason, it managed to secure a total of $15 million in entries. On the other hand, there were exits from the old short investment products.

cryptocoin.com As you can follow from its news, the leading altcoin Ethereum has seen exits for 11 weeks in a row. This time, however, the fate of Ethereum has changed. The leading altcoin managed to attract $11 million in investments after 11 weeks of exiting in a row. A noteworthy point is that Solana (SOL), which attracted funds in the previous weeks, debuted this week.

$ 2.2 million was entered into the multi-asset (multiple investment) fund. In addition, two Ethereum rivals Polkadot (DOT) and Cardano (ADA) are among the altcoin projects that have received investment. Tron (TRX) is also positive, with a small $0.1 million entry.