In the views of Chicago Fed President Austan Goolsbee, the focus of the discussions on the tightening cycle at the Federal Reserve is now more the need for an interest rate hike not. While Goolsbee declined to express his opinion on whether the central bank should raise rates again, he did say that the tightening process is likely over.

According to Goolsbee, the Fed’s assessments on rate hikes should not be made in the coming period, especially at a time when important data on prices and inflation will be announced. “I don’t like to speculate before the meeting, especially when important data on prices and inflation come in,” Goolsbee said.

Continuing his words, the Chicago Fed President said, “If the conditions we have seen in the last few months continue, the focus of our discussions will not be how much interest rates should be raised, but how long they should keep rates at these levels,” he said. He signaled that he would not come.

Market Agrees With Goolsbee About Rates!

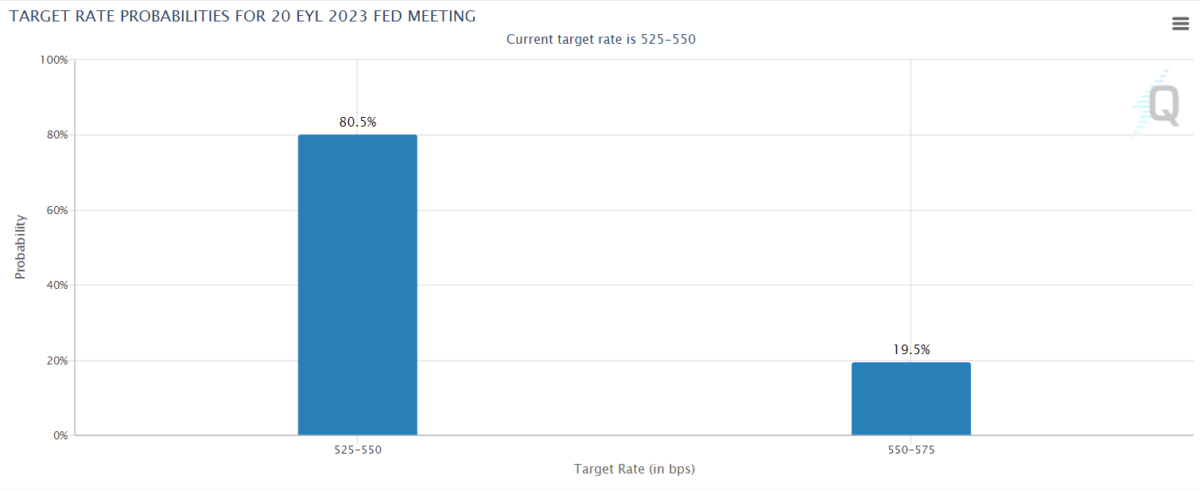

According to the information we gathered from FedWatch data compiled by CMEGroup from investor movements in the market and revealing the expectations regarding the Fed’s rate hike, investors agree with Goolsbee. At the FOMC meeting, which will take place 23 days later, on September 20, investors predict that with 80.5 percent probability, interest rates will remain constant at the current level of 5.25-5.50 percent. The remaining 19.5 percent expect rates to be increased by another 25 basis points to 5.50-5.75 percent.