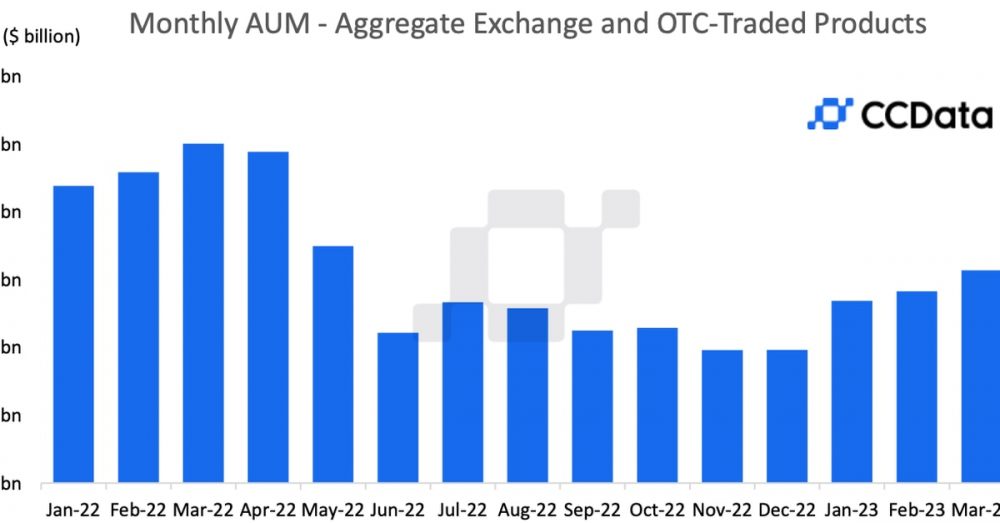

The amount invested in digital-asset products climbed for a fourth straight month in March as cryptocurrency prices continued to soar, according to data from CryptoCompare.

Assets under management increased to $13..4 billion, up 10.9% from February and up 60% versus November, which the total sank to its lowest level of 2022 amid FTX’s collapse.

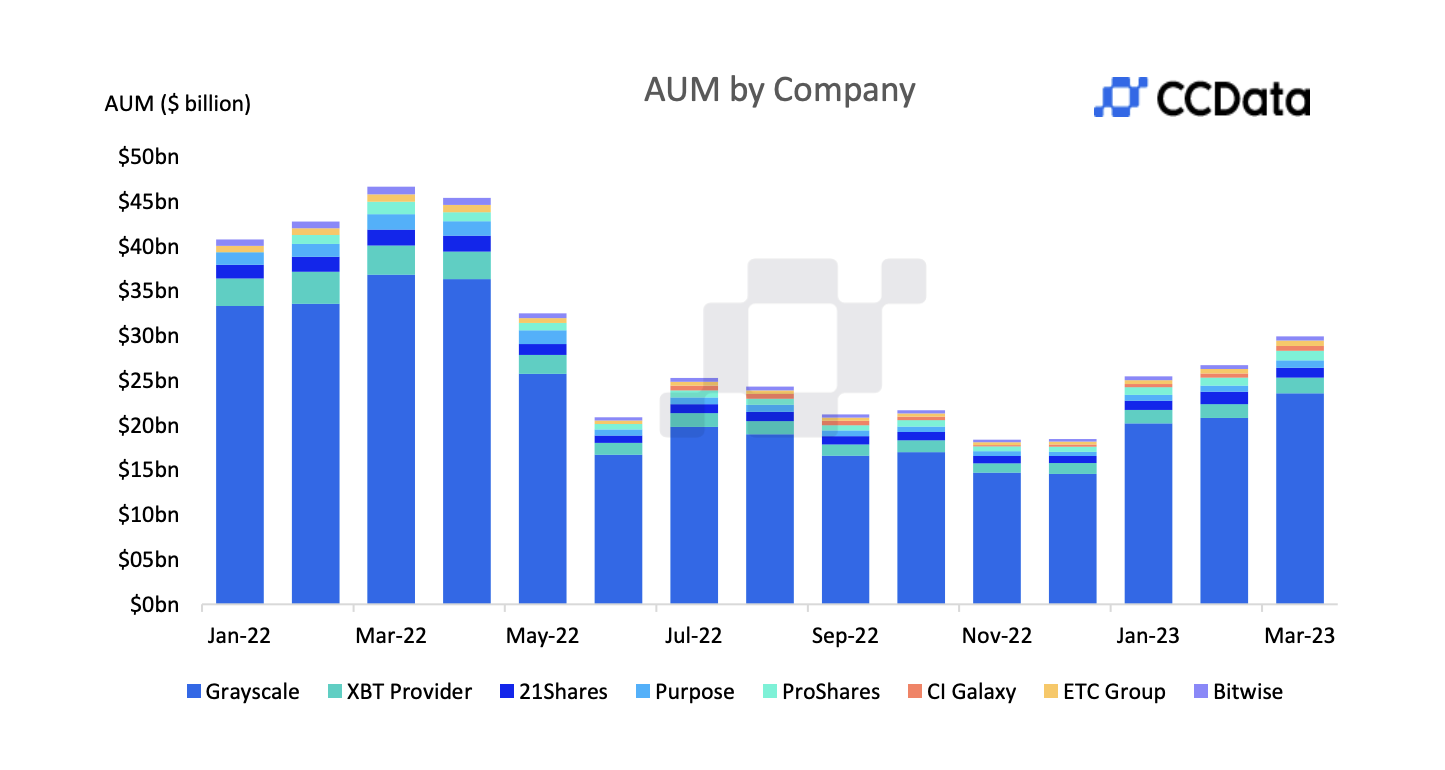

Investments in bitcoin-based products rose 14% to $22.7 billion, while ethereum-related ones increased 6.25% to $7.22 billion. Bitcoin’s share of overall investment hit 72%, reaching a nine-month high in mid-March. Crypto-related products labeled “other” saw assets decrease 13.3% to $1 billion, taking their market share down to 3.2%.

“The increase in bitcoin market share was consistent with the surge in Bitcoin dominance and the shift away from altcoins that investors have been making in response to the recent market turbulence,” said the report.

CI Galaxy recorded the highest increase in assets for the second consecutive month, rising 20.3% to $553 million, followed by ProShares, which saw a 19.1% increase to $1.08 billion.

Recommended for you:

- Bank of America Says Regulation Is Key for Mainstream Adoption of Crypto

- Zero-Knowledge Crypto Startup Proven Raises $15.8M in Seed Round

- The Missing CryptoQueen Has Friends in (Very) High Places

- Join the Most Important Conversation in Crypto and Web3 in Austin, Texas April 26-28

Grayscale remained the dominant player, recording a total of $23.6 billion, a 13.2% increase compared to February. Grayscale is owned by CoinDesk’s parent company, Digital Currency Group.