A recent survey by DebtHammer shows that retail investors in the US take out loans to buy altcoins and do not pay their bills.

Almost a quarter of US investors used a loan to buy crypto

According to a recent survey by DebtHammer, a large number of individual investors in the US have taken loans, often at exorbitant interest rates, to purchase cryptocurrencies. More than half of such investors are now at a loss. DebtHammer surveyed more than 1,500 people in the US to learn about their crypto investment habits and how they are affecting the already indebted country.

Loan preference for altcoin investments

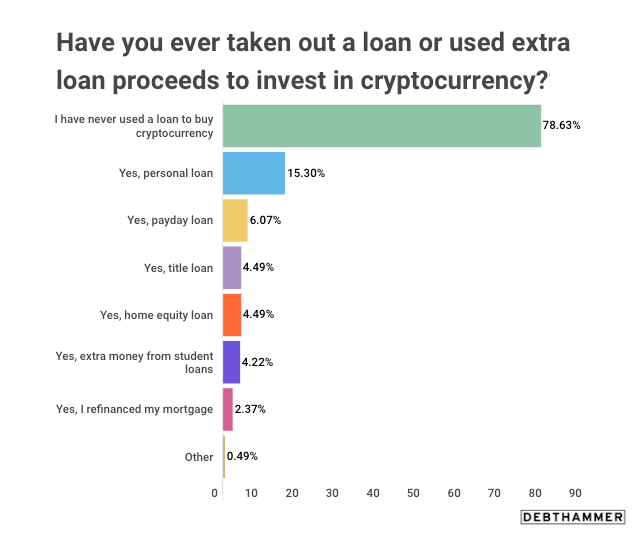

The survey shows that over 21% of crypto investors use loans to pay off their crypto investments. Personal loans seem to be the most popular option among investors. More than 15% of respondents use loans to finance their crypto purchases. Many have also used payday loans, title loans, mortgage refinancing, home equity loans and even remaining student loan funds to buy crypto.

About 1 in 10 investors using payday loans used it to buy cryptocurrencies. According to the survey, most borrowed between $500 and $1000 to invest in crypto. However, researchers at DebtHammer noted that despite the small amount borrowed, these are risky purchases. Because payday loans average around 400% APR.

More than 15% of investors who buy altcoins on credit are on the verge of bankruptcy

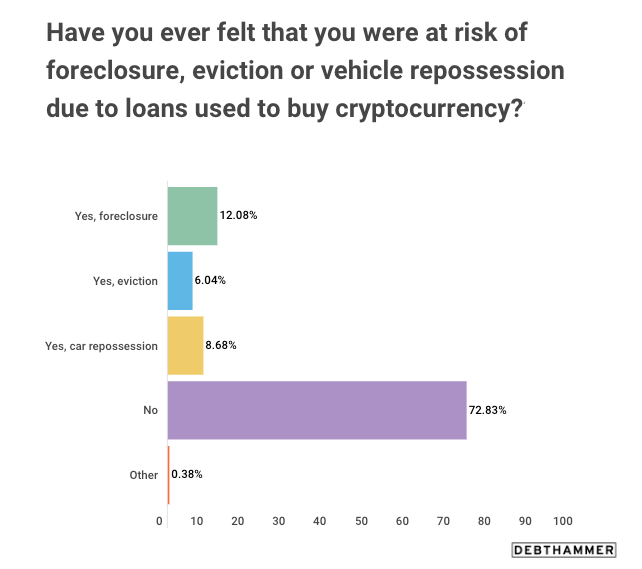

Individual investors using loans to buy crypto say their purchases are not always fruitful. Nearly 19% of those surveyed find it difficult to pay at least one bill due to their crypto investments. Others, about 15%, say they are worried about eviction, foreclosure, or confiscation of the car.

Loans aren’t the only way for investors to buy cryptocurrencies when they’re short of cash.

Credit cards are also used for crypto investments

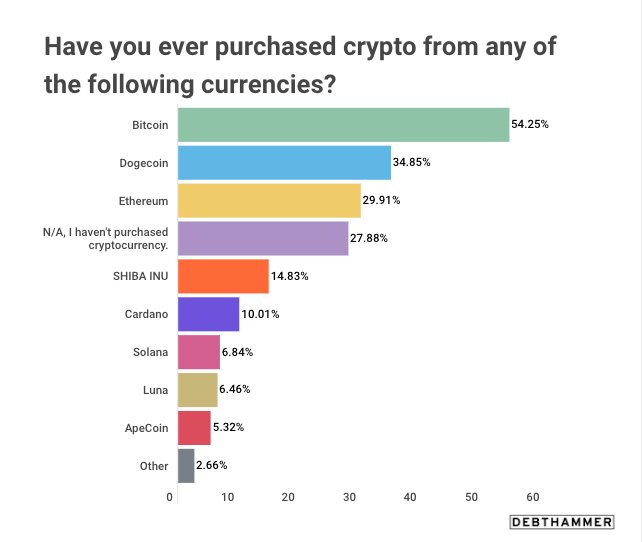

According to the survey, over 35% of respondents said they use a credit card to buy crypto. All of the borrowed money went to just a handful of cryptocurrencies. Survey, more than half (54%) of respondents use borrowed money to buy Bitcoin (BTC). Dogecoin (DOGE) came in second. About 30% of respondents say they are buying Ethereum (ETH).

Slightly less than 23% of people who borrowed money for investments said they did because their prices fell. About 15% of investors consider altcoins a good long-term investment. Also, 17% said crypto prices have been “historically low.”

A significant percentage (18.5%) of respondents said they borrowed money to buy cryptocurrencies because they were offered a 0% promotional interest rate by their credit card company or bank.

However, not everyone who gambles wins

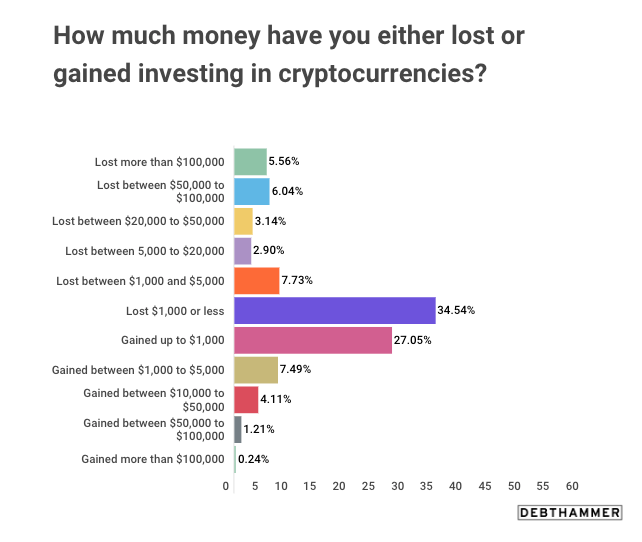

About 60% of those who borrowed money to invest in crypto lost money. Also, more than a third lost 1,000 or less. 6% say they have lost between $50,000 and $100,000 and 5.5% say they have lost more than 100,000. Investing in cryptocurrencies with borrowed money also does not mean significant gains. The majority, or 27%, only made up to $1,000. Only 7.5% earned between $1,000 and $5,000.

cryptocoin.comAs we covered in our analysis, Bitcoin is currently trading just under $20,000.