After starting the week with an upward trend, the gold price started to decline before the weekend and fell towards $ 2,000. However, the yellow metal managed to hold steady above this key level. Investors will be keeping a close eye on headlines on the US debt ceiling negotiations and banking stocks next week.

This development will put pressure on the gold price.

Gold became one of the preferred ports for investors as fears of the deepening banking crisis in the US rose. However, the recent movement of gold indicates that the yellow metal has lost some of its appeal. In addition, according to market analyst Eren Şengezer, it is possible for investors to stay away from betting against the yellow metal if there are new developments that point to ongoing problems in small or medium-sized US banks.

Market participants will also pay close attention to headlines related to debt ceiling negotiations in the US. If US lawmakers do not raise the debt limit, it is reported that the US may not be able to pay its federal debt on June 1 due to weaker-than-expected tax collection in April. Therefore, negotiations are likely to continue towards the end of the month. However, a short-term risk rally is likely if an agreement is reached as early as next week. In this context, the analyst makes the following assessment:

As a result, the USD is likely to weaken against its rivals. In this scenario, it is possible for US T-bond yields to rise, making it difficult for gold to gain bullish momentum. On the other hand, the cautious stance of the markets due to the lack of progress in the negotiations will support the USD and put pressure on the gold price.

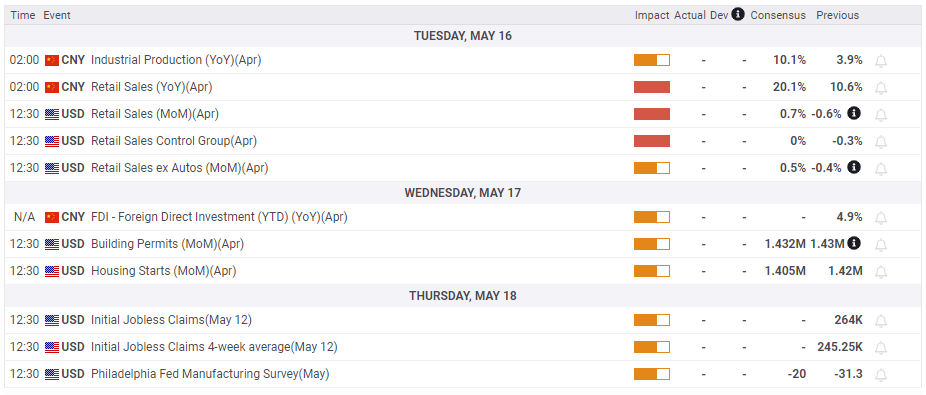

China and US Retail Sales data will be on the agenda

On Tuesday, Retail Sales data from China and the United States will appear on the economic calendar. Stronger-than-anticipated growth in Retail Sales in China will likely trigger a positive reaction below, according to the analyst. On the other hand, the opposite is also true.

Meanwhile, expectations are for Retail Sales in the US to increase by 0.7% in April. This data is likely to have a significant impact on the Federal Reserve’s rate outlook. Therefore, the analyst expects a low market reaction. Weekly Initial Jobless Claims and April Building Permits will be the other mid-range data to be released from the US next week.

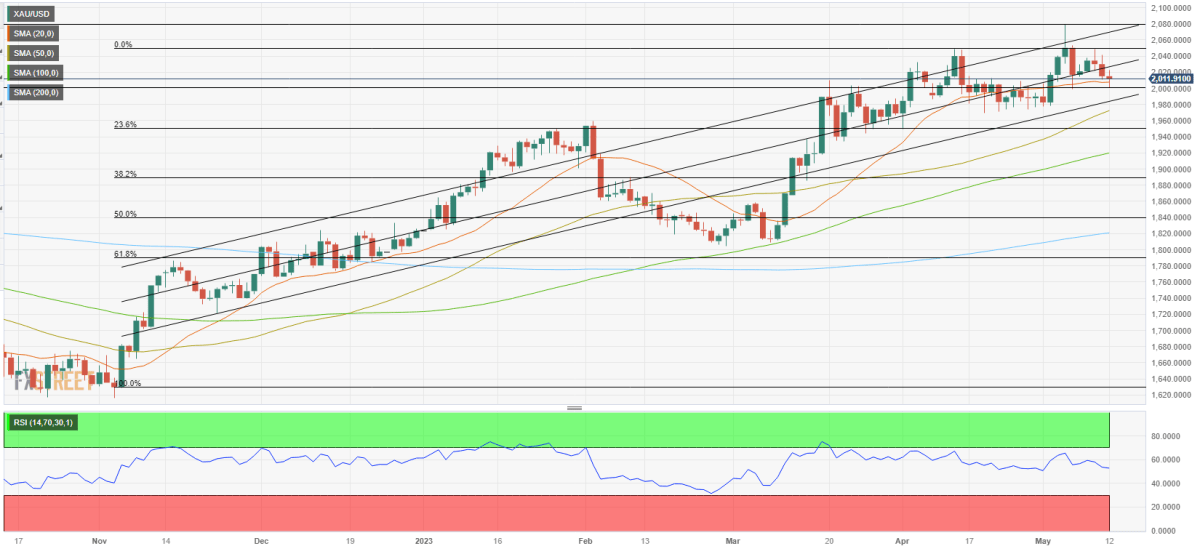

Gold price technical view

Analyst Eren Şengezer draws attention to the following levels in the technical outlook of gold. The Relative Strength Index (RSI) indicator on the daily chart has dropped towards 50. Gold price closed the week in the lower half of the downward channel, which has been rising since November. This reflected the loss of momentum under the bullish.

On the downside, $2,000 (psychological level, static level) stands as key support. With a daily close below this level, gold price is likely to face the next support at $1,975 / $1,980 (lower boundary of the ascending channel, 50-day SMA) before targeting $1,950 (Fibonacci 23.6% retracement of the recent uptrend). If the gold price manages to climb above $2,030 and stabilize there, it could gain bullish momentum. Thus, a rally is possible towards $2,050 (static level) and $2,080 (all-time high, upper border of ascending channel).

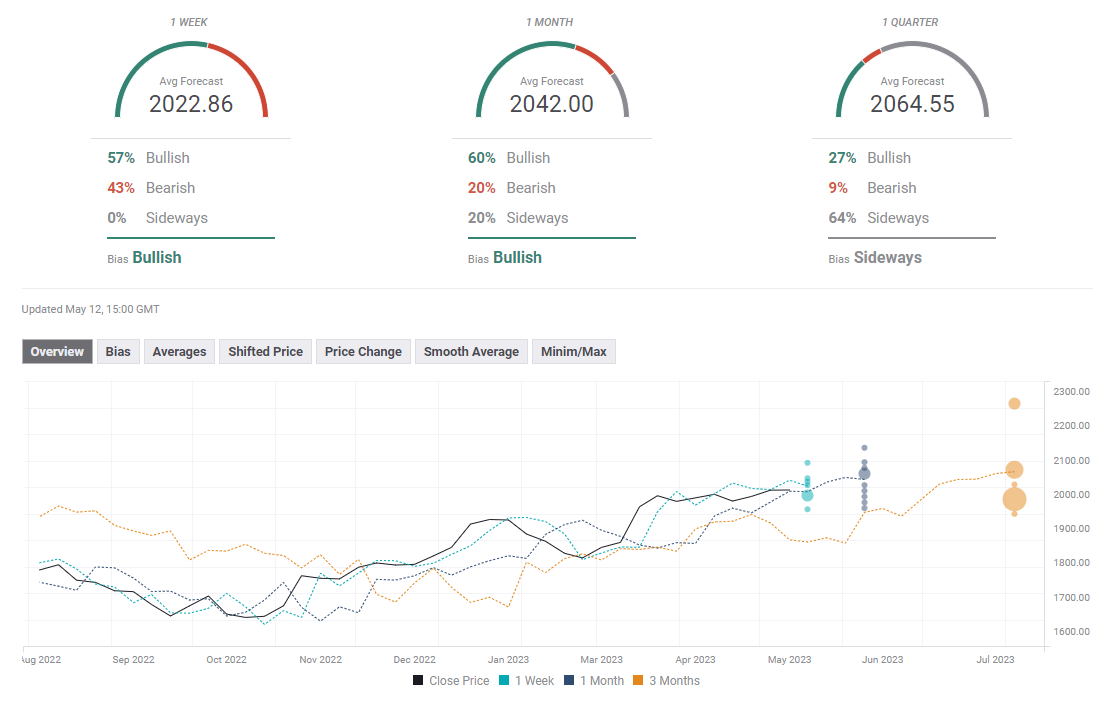

gold forecast survey

The one-week target on the FXStreet Forecast Survey stands just above $2,020. Accordingly, forecasts point to a slight upward trend in the short term. The majority of surveyed experts also adhere to the bullish view on the one-month outlook.