What levels will be at the door for Bitcoin in the coming days? This is perhaps the most famous question of recent days. Now analysts are looking for the answer to this question. Let’s have a look at the details.

What does PlanB expect for Bitcoin?

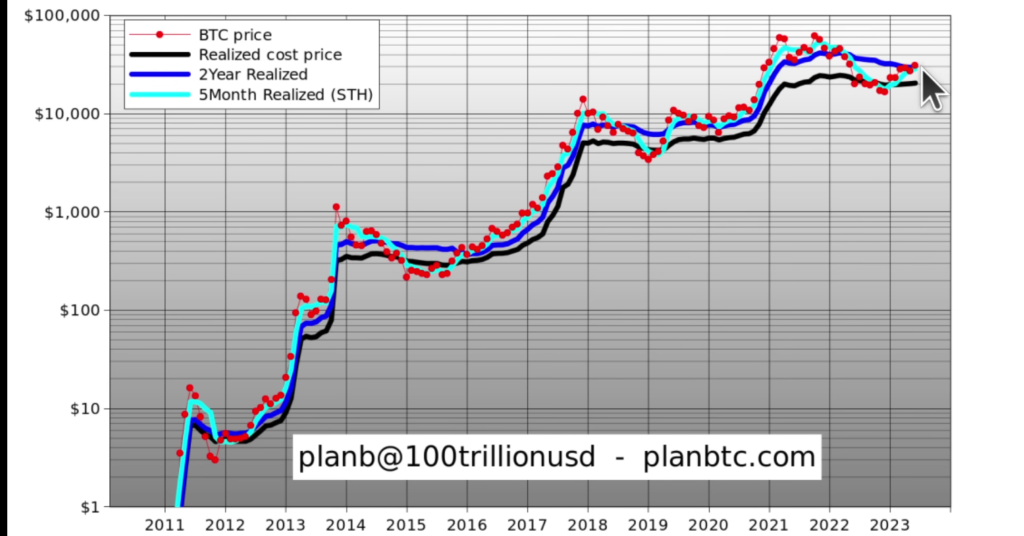

PlanB points to an indicator that signals an impending accelerated bull market for Bitcoin (BTC). As Bitcoin’s realized cost price crosses significant thresholds, PlanB suggests a more pronounced uptrend is likely.

PlanB explains that when the Bitcoin price exceeds the two-year realized cost price, historically significant upward moves follow. It is important that this threshold is crossed soon, with the short-term cost price being exceeded. Accordingly, it marks a new and potentially promising development for Bitcoin.

A breakthrough in the actual cost price

PlanB observes that the realized cost price values, which have been stagnant for years, are now collectively moving upwards. Crossing the two-year realized price threshold traditionally marks the beginning of an accelerating bull market. In particular, the fact that the lines representing the realized price and the two-year realized price start to rise after a prolonged decline raises the curiosity about the future of Bitcoin.

PlanB’s analysis highlights positive indications for Bitcoin’s bull market. In addition, the actual cost price points to potential upward momentum. So what happens as the two-year realized price threshold is crossed and market dynamics show promising trends? The cryptocurrency community is eagerly awaiting Bitcoin’s next moves. After that, an uptrend occurs.

The rise of BTC dominance

Renowned crypto analyst Benjamin Cowen warns investors that Bitcoin (BTC) and altcoin markets are likely to experience another downturn before reaching new highs. Cowen argues that the recent rally in Bitcoin is due to capital shifting from altcoins to BTC rather than new investments entering the market. According to Cowen, this dynamic raises concerns about the sustainability of BTC’s recent bounce.

Whatever the direction of Bitcoin/USD, Cowen predicts that Bitcoin’s dominance in the crypto market will continue to increase. He emphasizes that insufficient liquidity in the altcoin market may affect the valuation of Bitcoin in the short term. It also predicts a phase where it could lead to a secondary scare similar to previous market cycles. Cowen underlines that altcoins pose higher risk as Bitcoin absorbs more liquidity from the rest of the market.

Altcoin liquidity and BTC’s bull run

Cowen highlights the historical pattern of liquidity moving away from the altcoin market and flowing back into Bitcoin. Accordingly, it lays the groundwork for a final correction before the next halving followed by expansion. He cites the difficulty of pinpointing the exact point at which altcoin liquidity becomes insufficient to support Bitcoin/USD prices. Cowen advises caution when evaluating altcoin investments until a clearer bottoming process occurs.

Benjamin Cowen’s analysis points to a potential bearish leg for both Bitcoin and altcoins as liquidity shifts from altcoins to Bitcoin. As Bitcoin’s dominance grows and liquidity dynamics play an important role, investors need to keep a close eye on market conditions. It is also recommended to be careful when evaluating altcoin investments.

Affected emotions and uncertain price action

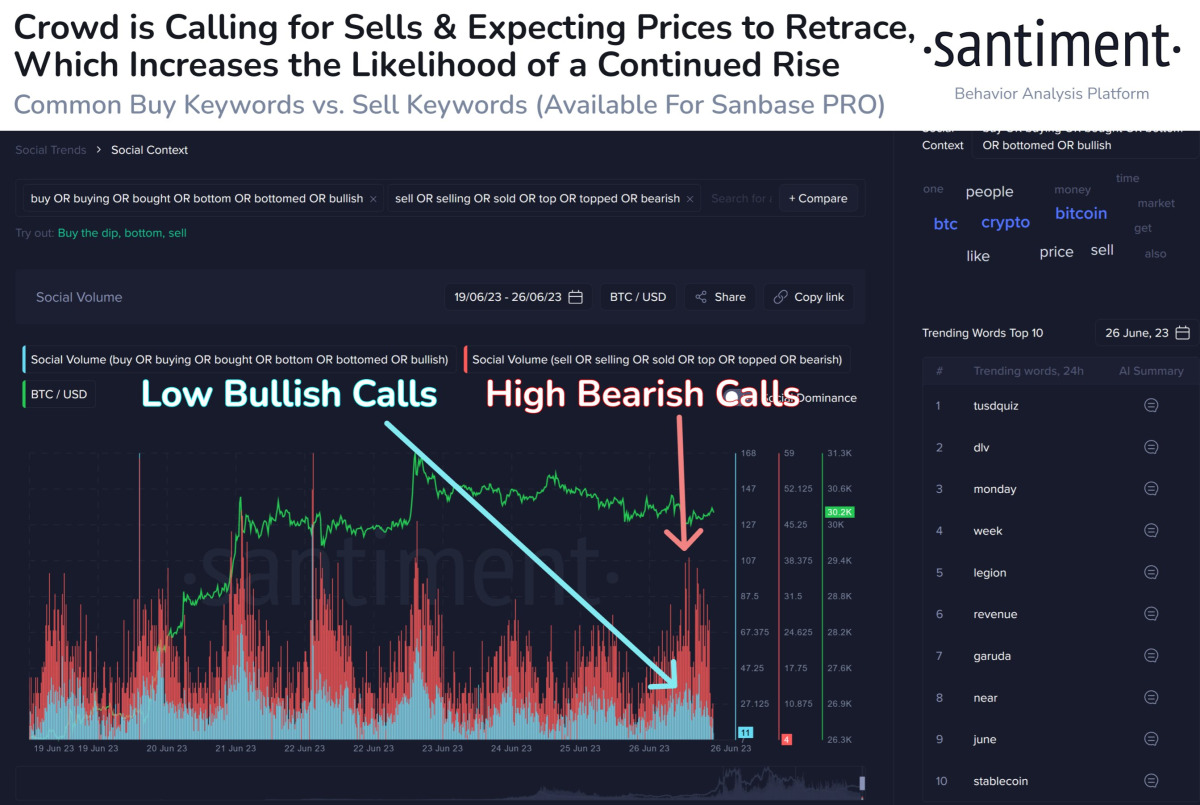

Despite minor gains, the bearish effect remains strong. Accordingly, this leaves the upcoming BTC price action uncertain. Investors have been grappling with fear, uncertainty and doubt (FUD) since the beginning of the 2022 bear market. Even during bursts of ascension, these feelings tend to only last for a short time. On the last breakout, BTC price surpassed $30,000. However, market sentiment remained bearish.

Market participants are familiar with the ongoing trend. Now they expect a drop in BTC price after a period of consolidation. Analysis of the famous on-chain platform Santiment indicates that traders are looking for better buying opportunities. It also reveals that they expect a drop from $29,000 to $27,000 in the near future.

BlackRock’s Bitcoin ETF application and crypto adoption

Some analysts attribute the 21.5% appreciation of Bitcoin in 11 days to BlackRock’s application for a spot Bitcoin exchange-traded fund (ETF). Additionally, the launch of cryptocurrency services in Hong Kong by HSBC Bank and the popularity of the ProShares Bitcoin Strategy ETF also fueled cryptocurrency earnings. These developments point to the increasing adoption and interest of institutional investors.

The regulatory environment for cryptocurrencies in the US may be improving, with a draft bill aimed at clarifying digital asset trading platforms. On the other hand, Gunter Lackmann, an analyst at MN Trading, believes that this is reflected in Bitcoin. Accordingly, he emphasizes that the recent rise of Bitcoin is much more aggressive than expected. In addition, Lackmann points out that it is important that the level of 30 thousand provides support. According to him, Bitcoin is likely to consolidate here for a while.

Positive momentum and regulatory response for Bitcoin

cryptocoin.com On the whole, Bitcoin bulls benefited from the margin and futures markets, supported by the positive momentum from spot Bitcoin ETF requests and institutional inflows. Moreover, some US lawmakers have advocated a more rational stance, voicing their concerns about the SEC’s regulatory approach.

What will happen for BTC given the positive regulation scenario and increased institutional interest. Bitcoin bulls are likely to sustain the $30,000 support level in the coming weeks. Jim Wyckoff said that Bitcoin futures prices for July rose in early US trading on Monday. But he noted that futures prices hit “another contract high” on Sunday.