Santiment analysts report in a new report that whales are pulling massive amounts of stablecoins from exchanges as altcoins continue to rise.

Are altcoins withdrawn from exchanges a disastrous collapse signal?

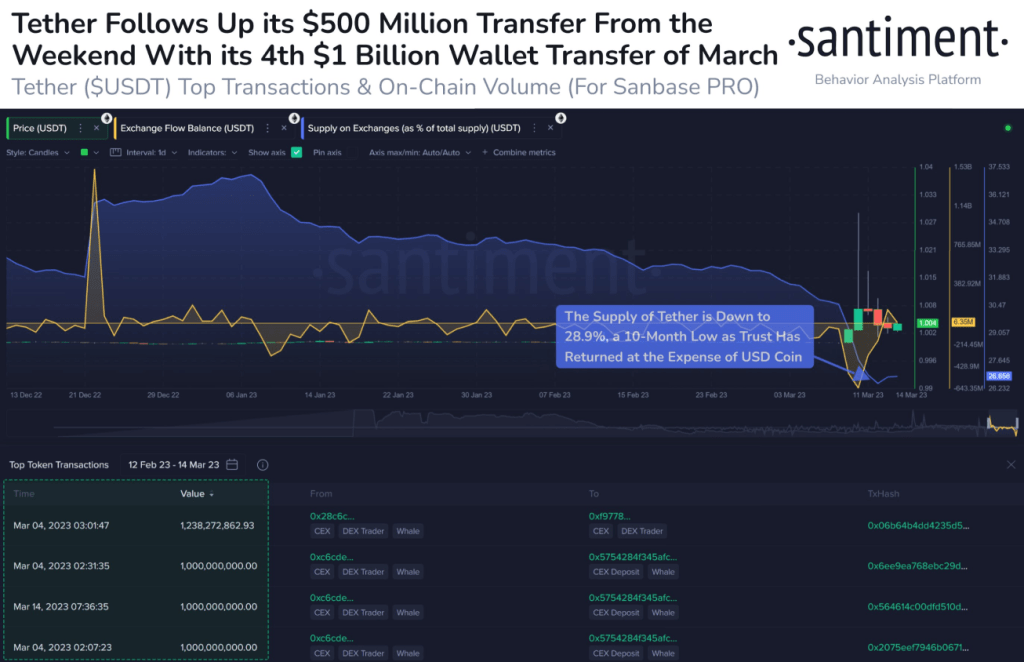

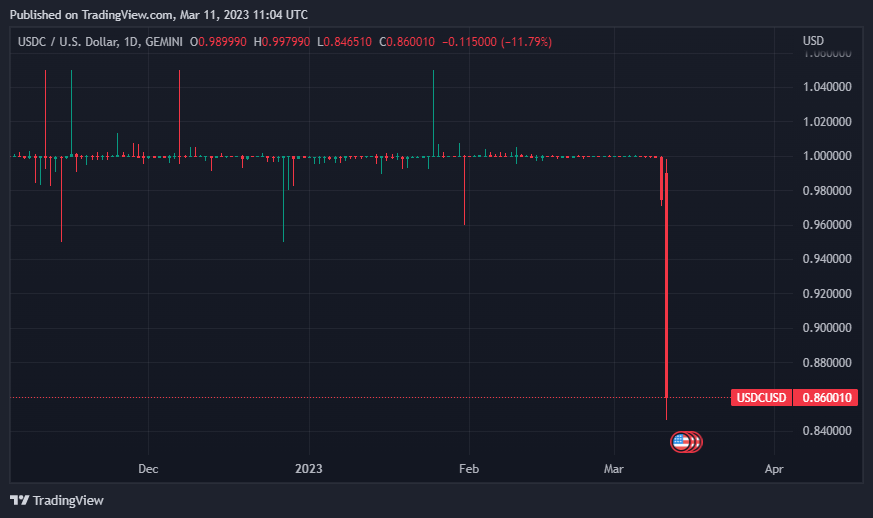

Santiment analysts have identified four Tether (USDT) transfers worth $1 billion or more in the past 10 days. In response to the turbulent events of last week, when several crypto-friendly banks went bankrupt and the USDC lost price stability, whales are pulling massive amounts of USDT from exchanges.

Stablecoins typically represent demand-side liquidity, so removing Tether (USDT) from exchanges is considered a sell signal.

🐳💸 There have been 8 #Tether transfers valued at $1 billion or more over the past year. 4 of them have come in the past 10 days. Whales have moved $USDT out of exchanges at a rapid rate with the bank collapse and $USDC concerns being big contributors. https://t.co/lm0luYywj9 pic.twitter.com/lIaAc1BeVD

— Santiment (@santimentfeed) March 15, 2023

Tether is quickly leaving the exchanges

Santiment analysts noted large-volume Tether transfers worth $1 billion or more in the past ten days. Whales are rapidly removing USDT from exchanges in response to concerns about bank failures and the USDC losing price stability.

Since stablecoin reserves on exchanges typically represent demand for cryptocurrencies such as Bitcoin, a decrease in stablecoin reserves can be perceived as a sell signal. Also, smaller stablecoin reserves on exchanges show that buying pressure on large-volume cryptos like Bitcoin is decreasing, negatively impacting its price.

Tether’s $2 billion USDT print raises alarm

Tether, the largest stablecoin by market cap, minted $1 billion worth of USDT on the Ethereum and Tron networks on Wednesday. Stablecoin’s market cap rose from $72.1 billion to $74.6 billion between March 12 and March 14, causing concern among crypto investors.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 1,000,000,000 #USDT (1,004,070,000 USD) minted at Tether Treasuryhttps://t.co/6HjS8x47Yl

— Whale Alert (@whale_alert) March 14, 2023

Tether’s recent issuance of one billion USDT tokens may have caused momentary FOMO among investors, but the crypto market quickly came to terms after its CTO’s remarks. Investors need to be careful as things could get risky in the coming days due to the chaos caused by the collapse of traditional financial banks.

Tether CTO Paolo Ardoino announced that $2 billion printed on Ethereum and TRON are not issued transactions and will be used as inventory in the next period issuance.

Stablecoins are at the center of FUD news

Over the past few weeks, USDT has made headlines with various FUD news. This was not because of a lawsuit or legal process, but because other US-based stablecoins were hit by the bankruptcy of three US banks. cryptocoin.comIn this article, we have included what happened last week at USDC.

In summary, Tether’s market cap jumped from $66 billion at the start of 2023 to $73.6 billion as of March 15, an increase of more than $7 billion. Its CTO, Paolo Ardoino, states that investors should not be alarmed by this data and that the newly minted USDT will be “used as stock for issuance requests and swaps.”