Bitcoin price is rapidly climbing above the $20,000 level, prompting analysts to speculate on where the BTC price might go.

Is the Bitcoin bear market over?

Although the market is technically still in a bear market compared to last week, investor sentiment is improving. Investor sentiment about the market hit a monthly high, according to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources.

Bitcoin price is currently above the psychologically important $21,000 level and many analysts and traders are posting their thoughts on where the BTC price might go next.

Bitcoin trading volumes remain a cause for concern

Bitcoin price has yet to recover from its pre-FTX levels. However cryptocoin.com As we mentioned, BTC rose above $ 21,095 on January 13 for the first time since November 8, 2022. Some analysts believe that BTC price must stay above the $21,000 support to sustain the current uptrend. Glassnode analysis stated:

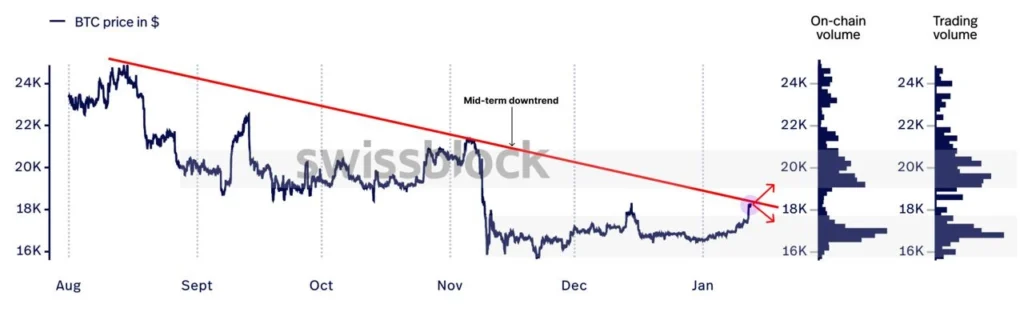

“A renewed uptrend that started on January 1 brought Bitcoin to $18.6 – $18.9k. However, in order to demand a new trade channel around 19-21 thousand dollars, it is necessary to exceed 19 thousand dollars. Resistance is expected around these levels as Bitcoin is facing a medium-term bearish trend. If the price fails to break through the trendline, we expect a pullback towards the $16-17k area.”

The lack of trading volume around $18,000 indicates weakness in current on-chain and centralized exchange (CEX) activity. The largest volumes and overall activity seem to be surrounding the $16,000 level, suggesting that this is a more solid base than the current price range. With less volume surrounding levels above $21,000, Bitcoin’s rally could be capped at $21,095.

Is this just a bear market rally?

Bitcoin still faces headwinds in a tightening macro economy, including major stock market layoffs, Gemini and Genesis legal issues, and the potential formation of a U.S. House crypto-focused subcommittee. Additionally, Bitcoin’s relative strength index (RSI) currently shows BTC as overbought. According to the RSI analysis, a sharp downtrend may occur while the price is correcting.

Macro markets are also at major resistance levels. The US Dollar index (DXY) is in a key support position, which means that risky assets like Bitcoin could start to sell if the index recovers. Bitcoin continues to be correlated with equities and the SPX mini futures index is also showing signs of pullback.

Historical analysis points to a new BTC bottom

Bitcoin is currently below its 200-week moving average and according to independent market analyst Rekt Capital, the Bitcoin price may have hit a macro bottom according to historical data. Historically, the “Death Cross” level has bottomed at $23,500.

While traders and technical analysis are not known for accurately predicting how long a bull or bear market will last, independent market analyst HornHairs cites historical data from 2015 to estimate how long it will take for Bitcoin to hit its all-time high.

$BTC #Bitcoin

2015-2017 bull market: 1064 days

2017-2018 bear market: 364 days2018-2021 bull market: 1064 days

2021-*current* market low: 364 daysDays left until the top if we just carbon copy the cycle timeframe again: 1001 days pic.twitter.com/KoNZxJRuy5

— HornHairs 🌊 (@CryptoHornHairs) January 12, 2023

The bull market from 2015 to 2017 lasted for 1064 days, in line with the bull market from 2018 to 2021, which lasted the same number of days. If traders match the bear market from 2017 to 2018 and 2021 with the current market, it would take 1,001 days for Bitcoin to reach its all-time high.

Despite current circumstances and the strength of the current price breakout, Bitcoin has proven many technical analysts wrong in the past. Risk-averse traders might consider keeping an eye out for increased trading volume with higher prices as an indication of whether Bitcoin is finally entering a bull market.