Bitcoin and the crypto market continue to grapple with long-term downtrends. On the other hand, it leaves investors alert to potential factors that could trigger a rally. In particular, analysts are closely monitoring indicators that could signal the end of the bear market in its second year.

Two indicators that point upward for Bitcoin

In particular, a crypto analyst going by the pseudonym Seth_fin points out an issue in an X post on September 16th. Accordingly, it leads to optimism by identifying two technical indicators that point to a potential bullish future. In his post, the analyst emphasizes that the Bitcoin Gaussian channel has turned green. He also notes that this could be interpreted as a bullish signal and a possible reversal of the prevailing bearish trend. The Gaussian channel indicator is a technical tool derived from statistical concepts that predicts price trend directions in financial markets.

🟢🚀 The #Bitcoin Gaussian channel just turned green , and we've retested the mid-band!

📈📊 Looks like the bear market might be in the rearview mirror. But that's not all!

🤯📉 The Bollinger Band Width Percentile is at its lowest, signaling an impending EXPLOSIVE move!… pic.twitter.com/v9XUBkSXIX

— Seth (@seth_fin) September 16, 2023

Secondly, it highlights that the Bollinger Band Width Percentage has reached its lowest level. He also notes that this also indicates an impending increase in price volatility. The analyst emphasizes that while the Bollinger Band Width Percentage indicates increasing volatility, it does not indicate the direction of the movement. Therefore, it does not predict a specific direction.

Possible bullish triggers for Bitcoin

However, it does reference the historical significance of Bitcoin’s halving events. These events, which reduce rewards for miners, are historically followed by significant price increases. The last halving event occurred in May 2020. It also marks the beginning of a significant bull run for Bitcoin.

In particular, the Bitcoin halving event continues to be hailed as a potential catalyst for a surge in bullish prices. At the same time, regulatory developments remain in focus, particularly the potential approval of the first spot Bitcoin Exchange Traded Fund (ETF), which is expected to attract institutional capital into the leading cryptocurrency.

BTC is at a critical level

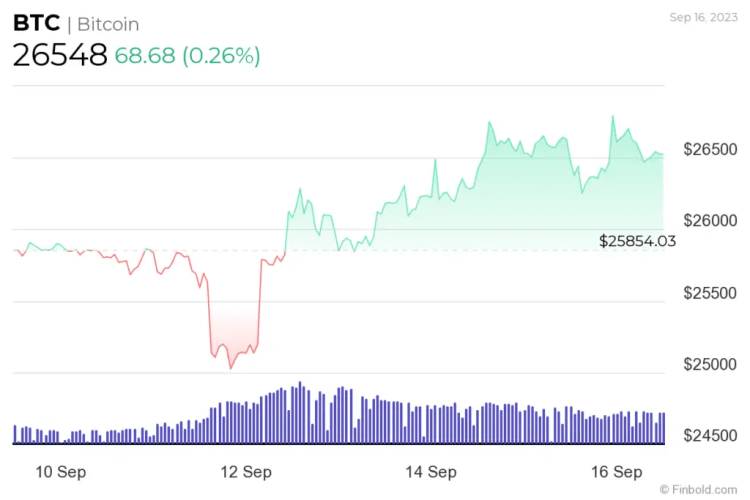

Meanwhile, Bitcoin is struggling to maintain its position above the critical $25,000 support level. It is also extending a period of consolidation marked by repeated failures to surpass the $30,000 mark. Bitcoin is trading above $26,000 on news that German lender Deutsche Bank plans to launch cryptocurrency custody services for institutional clients in partnership with Swiss fintech firm Taurus.

However, market sentiment remains tense due to recent developments in the FTX case. The bankruptcy court approved FTX to begin liquidating its extensive cryptocurrency holdings. This development has the potential to significantly affect the dynamics of the cryptocurrency market. It also potentially leads to increased volatility. These important assets include tokens such as Solana (SOL), Bitcoin, Ethereum (ETH) and others. When we look at Kriptokoin.com, while writing the article, Bitcoin is traded at $ 26,548. It also continues its weekly consolidation trend. Over the past 24 hours, the cryptocurrency has recorded a modest gain of around 0.26%.