According to the data we have transferred as kriptokoin.com, bull forecasts about Bitcoin (BTC) are getting stronger. Although the price of BTC declines to $ 95,000, the famous analyst man thinks Back investors are still not optimistic enough. According to him, the imbalance between supply and demand can carry Bitcoin much higher than expected.

For Bitcoin, the demand increases by folding according to the supply

Bitcoin’s supply is limited and mining awards are decreasing with Halving, which takes place every four years. According to the Analyst Man Back, this process is one of the biggest factors that carries the price of BTC. Currently, the market faces a procurement pressure of 4-5 times the amount of BTC produced by mining.

In particular, the fact that large corporate investors continue to attract BTC from the stock exchanges makes the current supply even more tightened. Bitcoin reserves on the stock markets decrease rapidly, while the receiving request increases without slowing down. This may cause a major leap in the price of BTC in the long run.

Corporate investors collect Bitcoin faster than mining

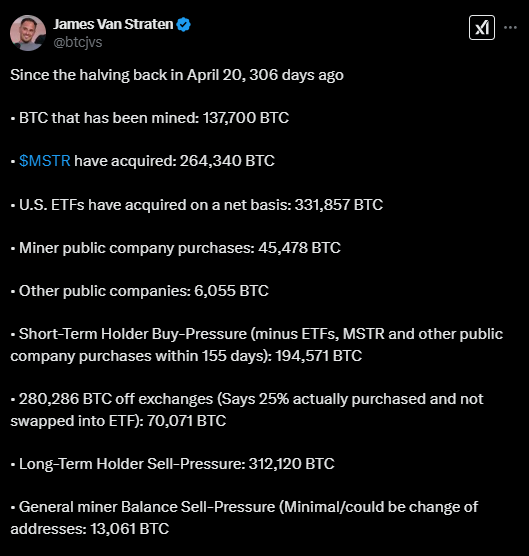

According to the calculations of Coindesk Analyst James Van Straten, the total number of BTCs produced by mining since the last Bitcoin halving has been 137,700. However, in the same period, Microstrategy, USA ETFs, large miners and other corporate investors acquired a total of 449,492 BTCs. This figure is 3.26 times the supply produced by mining.

The decrease in sales liquidity in stock exchanges and the increase in institutional demand may be a harbinger of a strong rise in the price of Bitcoin. If this trend persists, the BTC supply becomes even more scarce and the price may maintain the upward acceleration.

Does Bitcoin turn into an institutional being?

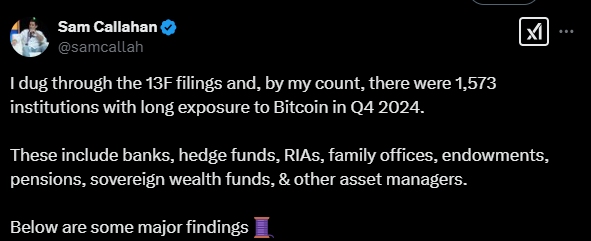

According to Kriptokoin.com data, in the last quarter of 2024, 1,573 major corporate firms kept Bitcoin in their portfolios. Hedge funds, banks, pension funds and asset management companies are going to BTC and show more interest. However, the capital allocated by these institutions to BTC constitutes only 0.13 %of the total portfolios.

This shows that Bitcoin is still at very early stages of corporate adoption. In the coming years, this ratio is expected to increase with ETFs and other investment instruments. If large funds allocate more capital to Bitcoin, price movements can be much more dramatic.

Net message from former Binance CEO CZ: “Election is yours”

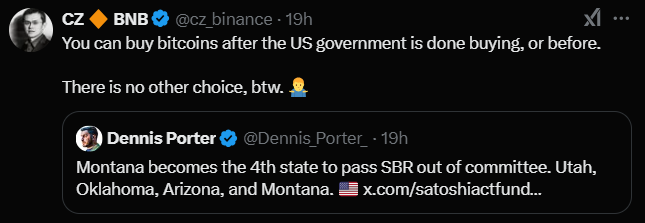

Changpeng Zhao (CZ), former CEO of Binance, gave the following message to BTC:

Do you want to buy Bitcoin before or after the US government? There is no other option.

This statement of CZ implies that the price can rise further in the long run, given the limited supply of Bitcoin and the increasing institutional demand. The fact that large investors collect BTC three times faster can be a strong sign that the market can see new peaks soon.

A critical period begins for Bitcoin investors. If the analyzes are correct, for BTC, 2025 can be a big rally scene!