Notcoin (Note) has recently faced heavy market prints. This continues to worry about investors. The note, which is currently traded for $ 0.004317, has lost 13.16 %in the last 24 hours. However, some technical indicators give signals that support the possibility of recovery.

What does Technical Analysis say about the future of notcoin price?

The TD Sequential indicator used in daily graphs gave a “purchase signal” recently. This usually indicates that a decline trend is over. But the skeptical weather throughout the market questiones the accuracy of the signal given by this indicator. It is a matter of curiosity whether this recovery signal will lead to a long -term rise for note.

On the other hand, the grade price movement has long been tending to decline. After breaking a significant level of demand, 0.005662, this level has now become a strong resistance point. This makes it even more difficult for recovery efforts. In addition, the relative power index (RSI) was 26.24 during the press time. This showed that the notion was in the extreme sales zone.

However, over -sales conditions do not always guarantee recovery. In order to break the superiority of the sellers, buyers need to carry out high -volume transactions. If the price does not exceed $ 0.005662 again, the decline trend will continue.

Number of Notcoin Wallets is decreasing

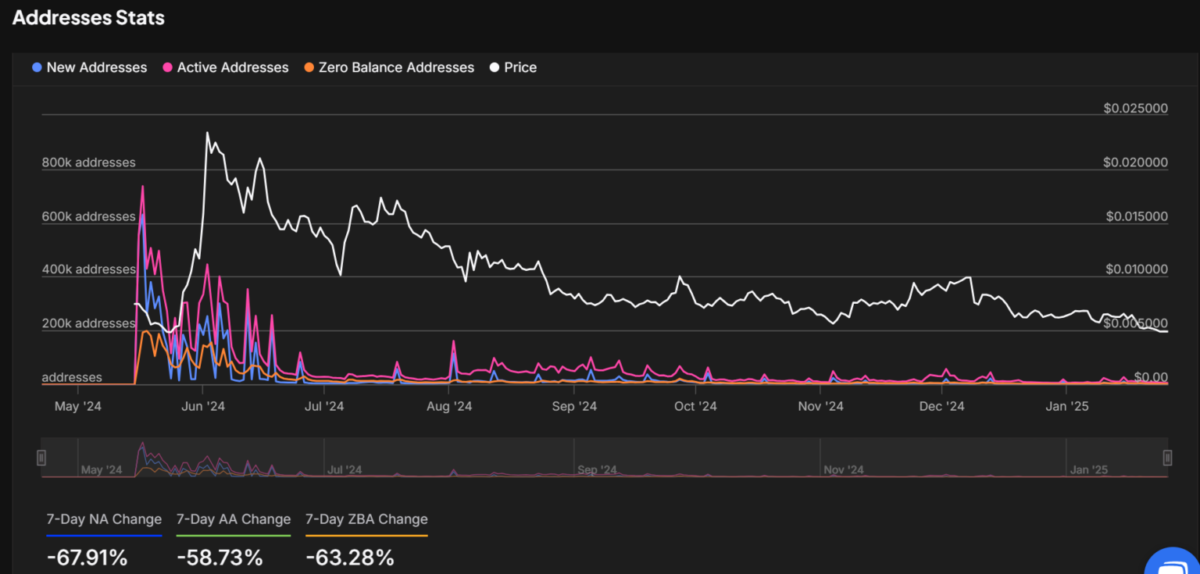

It is clear that the interest in Notcoin is weakened and the address activities are clearly seen. The number of active addresses decreased by 58.73 %in the last week. In the meantime, new addresses decreased by 67.91 %. In addition, a decrease of 63.28 %per zero balance addresses shows that the transactions performed in the Note have decreased. This shows that the interest of individual investors is significantly weakened. Nevertheless, if positive market conditions occur, the note will attract the re -interest of investors. However, the current address data shows that the general appearance of the market is weak.

Process data also gives mixed signals. Transactions between 100 and 1,000 dollars increased by 46.58 %, while transactions between 1,000 and $ 10,000 rose by 21.92 %. This may indicate that investors with medium and high value accumulate. However, micro transactions under $ 10 decreased by 17.08 %, while the total number of transactions remains weak.

On the other hand, open Interest data on stock exchanges reveal a significant decrease in speculative interest on the note. Open interest rate has decreased to only 20.62 million dollars. This shows the uncertainty of investors in grade price movements.

Will the notes price rise?

Although Notcoin’s possibility of recovery is supported by technical indicators, the general situation of the market is far from optimism. Falling address activities, mixed transaction models and decreasing open interest rates increase the insecurity of the market for grade. Investors may be able to recover if they can evaluate opportunities in the extreme sales zone. However, a permanent recovery without a strong volume and renewed market trust does not seem possible.