The relentless rise in the dollar and fears of a more aggressive US rate hike are putting pressure on bullion demand. That’s why gold prices continued their fifth weekly decline on Friday. Analysts interpret the market and share their forecasts.

“Gold shows no signs of meaningful upside momentum”

Spot gold was down 0.3% at $1,704.59 at press time. The yellow metal is down 2.1% so far this week. U.S. gold futures fell 0.2% to $1,701.70. Jeffrey Halley, senior analyst at OANDA, comments:

Gold has faded against a stronger US dollar this week. But it looks like it is trying to establish a temporary base before $1,700.00. However, it shows no signs of meaningful upside momentum with limited rallies to the $1,750.00 zone.

The dollar continues to suppress demand for dollar-priced gold among offshore investors. cryptocoin.com As you follow, DXY has settled to 20-year highs. “In the larger technical picture, it still looks fragile with risks to the downside,” says Jeffrey Halley.

ANZ Research: Investment demand for gold weakens

Two of the Federal Reserve’s most hawkish policymakers spoke on Thursday. They said they support another 75 basis point rate hike at the central bank’s policy meeting this month.

Higher interest rates and bond yields increase the opportunity cost of holding non-yielding bullion. Benchmark US 10-year Treasury yields fell on Friday. This provided a slight support to the bottom. ANZ Research interprets the developments as follows:

Investment demand for gold is weakening. Gold will remain under pressure due to expectations of large rate hikes by the Fed.

“Unless these happen, gold is unlikely to see any bullishness.”

The strong dollar is pushing gold down, according to Philip Streible, chief market strategist for Chicago Blue Line Futures. The analyst notes that after the consumer inflation data, traders raised their expectations from 75 basis points to 100 basis points. Streible shares these insights:

Gold is unlikely to see any gains unless inflation gets worse enough to stop rate hikes or other central banks start to get as aggressive as the Fed and weaken this dollar.

Meanwhile, markets are pricing in a 100 basis point rate hike for July. Fed’s Christopher Waller commented that “markets may have outgrown themselves”. Also, weekly jobless claims in the US rose for the second week in a row. This indicates some cooling in the labor market.

Pablo Piovano: Door open for more losses for gold

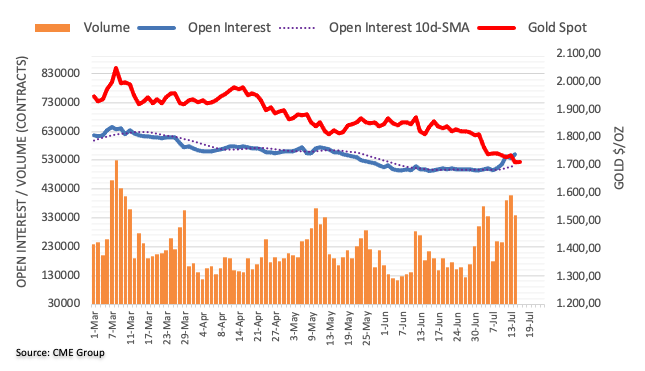

Open interest on gold futures markets has started up again. Nearly 16.7k contracts were up on Thursday, according to advanced data from CME Group. Instead, volume shrank by around 68.1k contracts after two consecutive days of declines.

Gold prices stretched its leg down. The yellow metal briefly visited the region below $1,700 on Thursday. According to market analyst Pablo Piovano, the move took place amid rising open interest, which suggests the downtrend continues, at least in the very near term. Meanwhile, the analyst notes that the $1,700 area continues to offer solid traction for the time being.