Gold prices rose on Monday as the US dollar pulled back slightly. Meanwhile, investors lowered their bets on a 100 basis point rate hike at the Fed’s upcoming meeting. Analysts interpret the market and share their forecasts.

“It’s possible we might see a short squeeze for gold”

cryptocoin.com Spot gold fell to its lowest level in nearly a year last week. It then recovered and closed the week above $1,700. At press time, spot gold was trading at $1,715.65, up 0.50%. U.S. gold futures rose 0.86% to $1,718.3.

The dollar index broke out of its highest level in 20 years last week. However, it started the week with a slight decline. This made dollar-priced bullion cheaper for other currency holders. Meanwhile, the University of Michigan’s preliminary survey of consumers for July showed that consumers see inflation at 2.8% over a five-year horizon. Stephen Innes, managing partner of SPI Asset Management, comments:

Friday’s University of Michigan inflation component came in softer. After that, the market retracted the idea of a 100 basis point rate hike. The central bank falconry is already priced in. Last week, gold held the $1,700 level. The Falcons are likely to be disappointed with the Fed’s rate of gains of just 75 basis points next week. That’s why we’re likely to see a short squeeze.

SPDR Gold Trust, assets plummet

The FOMC will be held July 26-27. Markets expect the Fed to raise interest rates by 75 basis points at the meeting to combat rising inflation. Fed officials signaled on Friday that they would stick with it.

Meanwhile, markets expect the ECB to raise interest rates by 25 basis points at its policy meeting this week. Gold is accepted as an inflation hedge. Higher interest rates are hurting the attractiveness of non-interest-bearing bullion.

Also, alongside major central bank meetings, market participants are waiting to see if Russia will restart gas flow through the Nord Stream 1 pipeline on July 21. SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, said its holdings fell 0.3% to 1,014.28 tons on Friday.

Pablo Piovano: No further losses in gold price preferred in near term

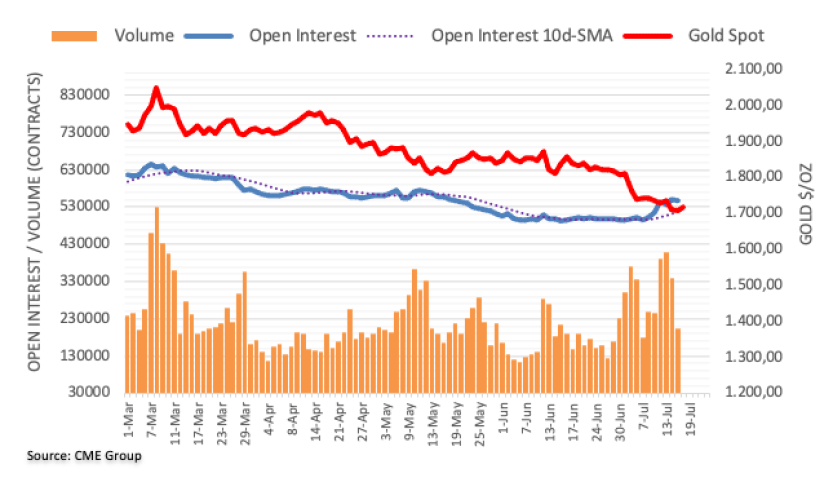

Open interest on gold futures markets fell by about 6.3k contracts at the end of last week, according to preliminary data from CME Group. It also partially reversed the previous daily increase. Volume on the same line fell for the second consecutive session, this time with more than 135,000 contracts.

Gold prices once again visited the $1,700 region on Friday. However, although it closed with modest losses afterwards, it rose slightly. The decline, however, was amid declining open interest and volume. According to market analyst Pablo Piovano, this indicates that a drop below this zone does not seem appropriate at the moment.