After being wiped out in May, Terra (LUNA)-based altcoin projects are opting for Polygon over Ethereum.

More than 50 Terra projects migrate to Polygon

Ryan Wyatt, Polygon Studios CEO and esports pioneer, provided an update on the migration of Web3 protocols from Terra (LUNA). According to the latest data, numerous protocols have migrated to Polygon Network after Terra LUNA and UST collapsed in May.

Ryan Wyatt claims that more than 48 projects have already shifted development responsibilities to Polygon Network (MATIC), including the Derby Stars HQ play-to-win protocol and the NFT ecosystem One Planet. The CEO of Polygon Studios said on May 15 that his ecosystem will allow protocols to be transferred to Polygon during the most dramatic part of the Terra (LUNA) collapse. He said Polygon will “set aside cash and resources” to ensure that both projects and their communities move smoothly through Terra (LUNA).

Terra’s TVL drops to almost zero

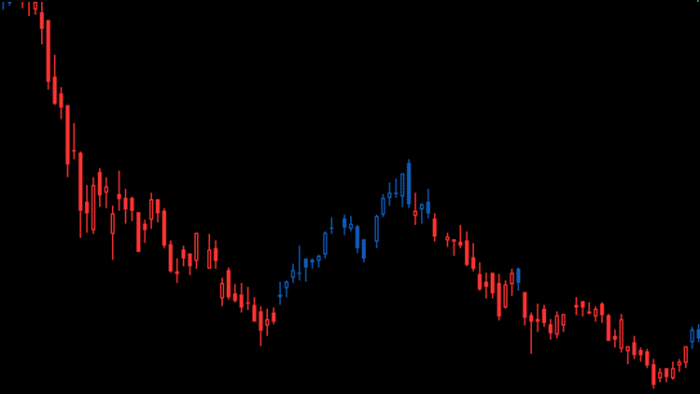

Significant liquidity withdrawals from the Anchor Protocol (ANC), which underpins the ecosystem, have resulted in the collapse of Terra’s (LUNA) ecosystem. In a matter of days, both UST and LUNA dropped to almost zero. Terra’s Do Kwon relaunched the Blockchain as Terra 2.0 on May 27, 2022. But the dApps ecosystem was destroyed. Terra (LUNA) was the second largest smart contract platform by TVL before the collapse, behind Ethereum (ETH). According to DeFi Llama monitoring, TVL measurements have decreased by nearly a thousand times recently.

Why did LUNA crash?

Terra’s dramatic collapse has deactivated the cryptocurrency market as a whole. It wiped out more than $200 billion in the market. Meanwhile, Luna Terra’s value dropped by about 80 percent. It’s almost worthless now. It should be noted that stablecoins work on the game of supply and demand. Any stablecoin developed must be backed by some collateral to stabilize its price.

There are 3 types of stablecoin mechanisms for this:

- Crypto-backed where the token is secured by cryptocurrencies

- Backed by fiat where the token is pegged to USD or Euro

- Or algorithmic coins that rely on algorithms to protect their supply and demand and fix their price to one dollar.

A common view is that stablecoins are not subject to wild price fluctuations and general crypto volatility, making them a safer investment. That wasn’t the case with Terra, but it’s not the first stablecoin to drop. We’ve seen stablecoins like Basis Cash (BAC) and Empty Set Dollar crash before.