While crypto investors continued to reel from the Securities Exchange Commission’s (SEC) recent lawsuits versus Binance and Coinbase, they also had some potentially positive jobs data to savor on Thursday.

Initial jobless claims in the United States rose to 261,000 for the week ended June 3, versus expectations of 235K. The four-week moving average of 237,250 jobless claims was 7,000 higher than the prior week, while the prior week average itself was revised higher.

The spike pushed initial jobless claims to their highest level since October 2021, a sign that a persistently tight labor market may be loosening.

Tight labor markets have been viewed as an obstacle during the U.S. central bank’s quest to slow inflation. Data indicating that labor markets are beginning to weaken would indicate that the FOMC’s course of prescribed measures is yielding favorable results.

Such weakening would increase the likelihood of the U.S. central bank pausing its nearly year-long streak of interest rate hikes, which would probably be positive for asset prices.

According to the CME Fedwatch tool, the probability that interest rates will remain at the current target rate of 5%-5.25% is 71.4%, down from 72.5% a day prior.

With the next interest rate decision coming on Wednesday June 14, the U.S. Bureau of Labor Statistics June 13 release of core inflation for May looms large. Current expectations are that prices increased 0.3% in May. Higher inflation would understandably be bearish for BTC prices, and lower inflation would have the opposite effect.

Fear and greed unmoved

Despite the noise of this week’s SEC announcements, markets still appear to be reacting as though they’ve heard it all before.

The “Fear and Greed” index, incorporates bitcoin price volatility, market momentum, market capitalization, and online queries to produce a measure of market sentiment. A value of 0 indicates “extreme fear,” while a value of 100 indicates “extreme greed”.

The current Fear and Greed index value is 50, a neutral reading, essentially unchanged since May.

The same can’t be said for regional activity

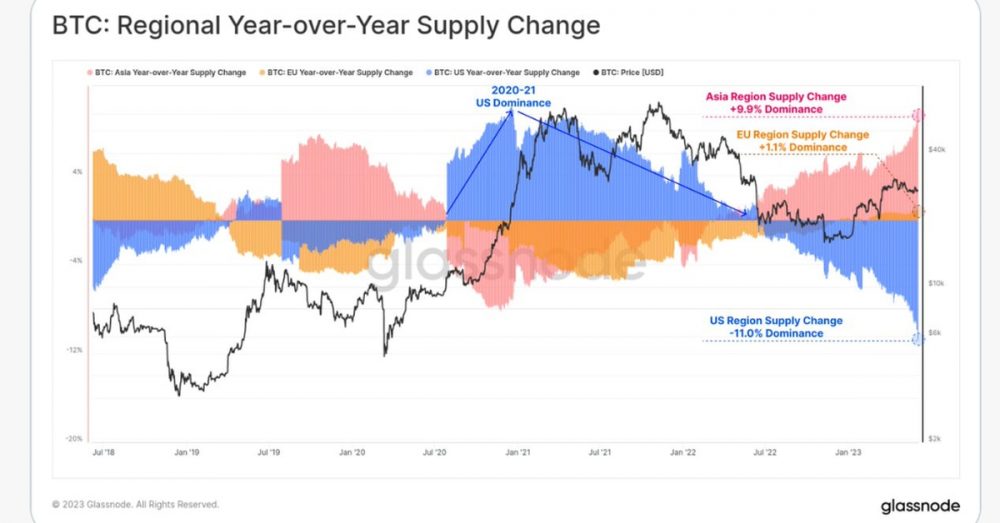

While the lack of price action indicates that investors are unmoved by the SEC’s recent actions, the volume of bitcoin traded within the U.S. has shifted geographically, according to Glassnode data.

The bitcoin supply held or traded within the United States has dropped 11% since mid-2022, with much of the balance shifting to Asian markets.

The SEC’s regulatory stance has likely not altered demand for cryptocurrencies. What appears to be impacted instead is where that demand is satisfied.

This article was written and edited by CoinDesk journalists with the sole purpose of informing the reader with accurate information. If you click on a link from Glassnode, CoinDesk may earn a commission. For more, see our Ethics Policy.