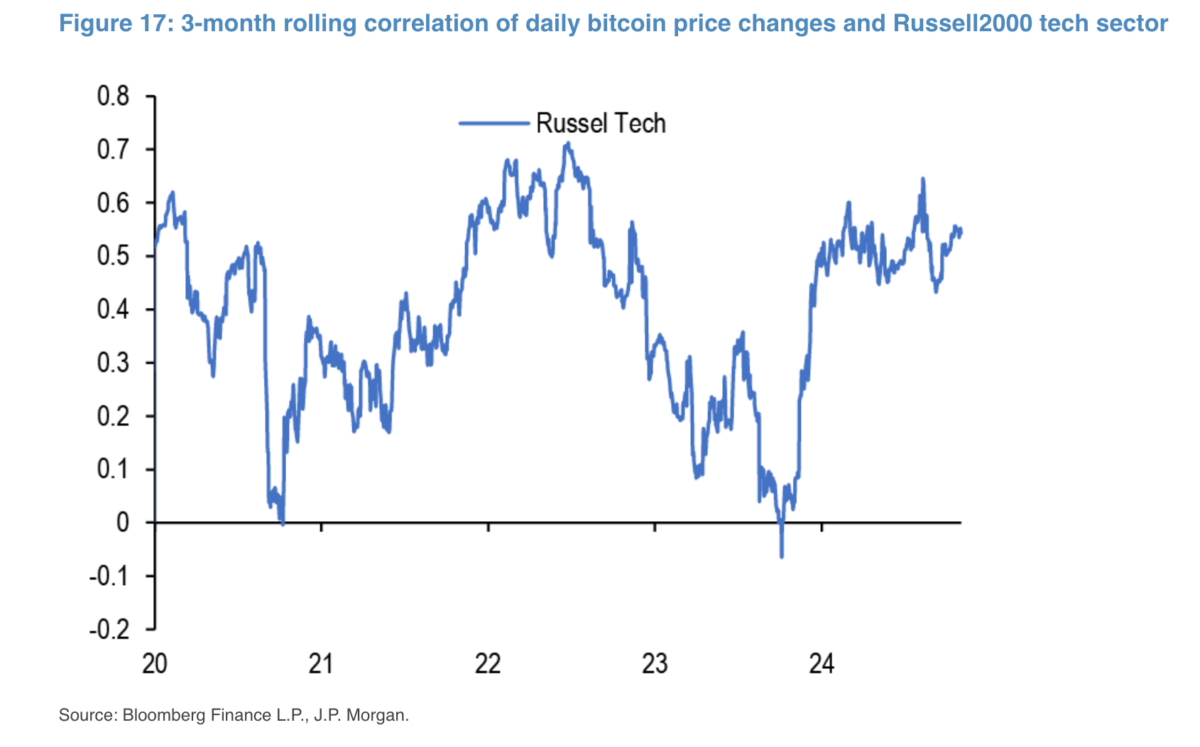

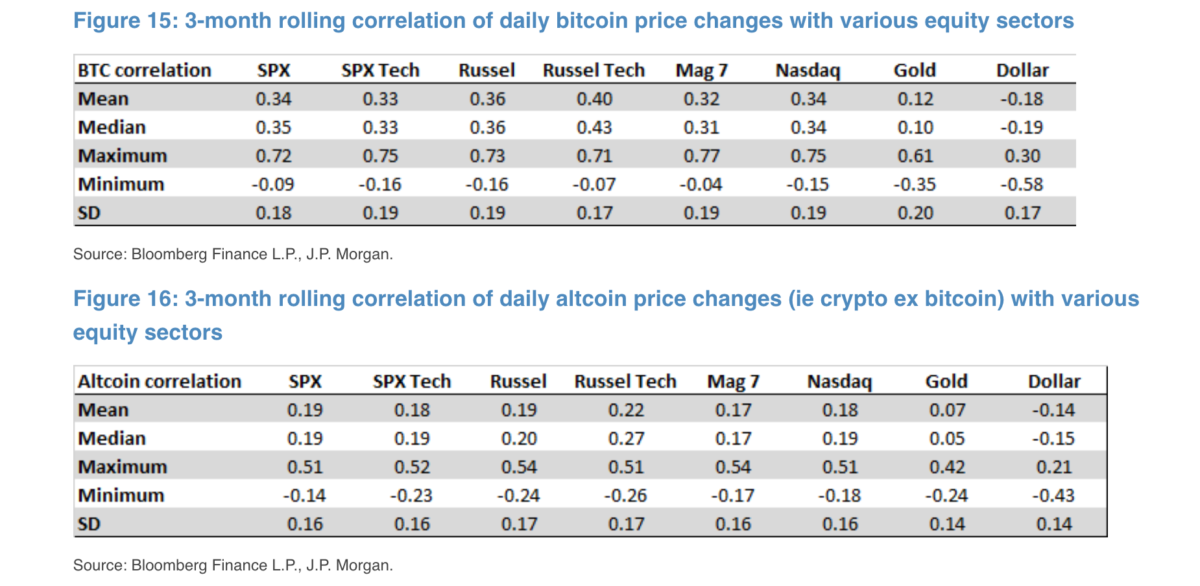

JPMorgan analysts have found that Bitcoin has the highest correlation with small capital shares, especially in the Russell 2000 technology sector. Analysts say that the correlation with BTC price tends to peak, especially in some periods.

JPMorgan analysts detected the Russell 2000 correlation with BTC price!

Crypto and stock markets showed a correlation, while JPMorgan analysts examined which stock sectors are most connected to crypto. Their findings show that Bitcoin has the highest correlation with small capital shares, as measured by the Russell 2000 technology sector. General Manager Nikolaos Panigirtzoglou led JPMorgan analysts in a report published in a report, the following assessment:

This is valid for both Bitcoin and subcoins, but on average the first correlation is higher. The fact that crypton is more related to smaller shares rather than the largest technology shares, the Krypton’s dependence on VC, and the fact that Blockchain/crypto technological innovation typically is the focus of smaller companies rather than the largest technology companies.

Correlation tends to peak, especially in some periods!

The Russell 2000 Index is a US stock market index following the smallest 2,000 stocks in the wider Russell 3000 index. JPMorgan analysts reconsidered the issue of crypto-hisse deed market correlation after simultaneous correction in US technology shares and crypto currencies on Monday. According to analysts, since the crypto-Hisse deed correlation pandemi has remained structurally positive due to two factors. These are: The role of individual investors who have access to lifts in both markets and the technology -oriented nature of both sectors.

JPMorgan’s analysis shows that this correlation with BTC price fluctuates over time. In addition, the technology sector reveals that it tends to peak when it suffers great changes. Analysts say that Bitcoin’s correlation with stocks and shares have become more pronounced in the years when technology has performed better, such as 2020 and 2024, or as in 2022. According to analysts, this model supports the idea that crypton is basically linked to technology and that the technology industry is subjected to a more important re -evaluation by stock investors.