Last week, debt crisis speeches were made in Washington, USA. A new one has been added to the recession fears of the USA, which has been following a tight monetary policy for a while and increasing interest rates by fighting inflation.

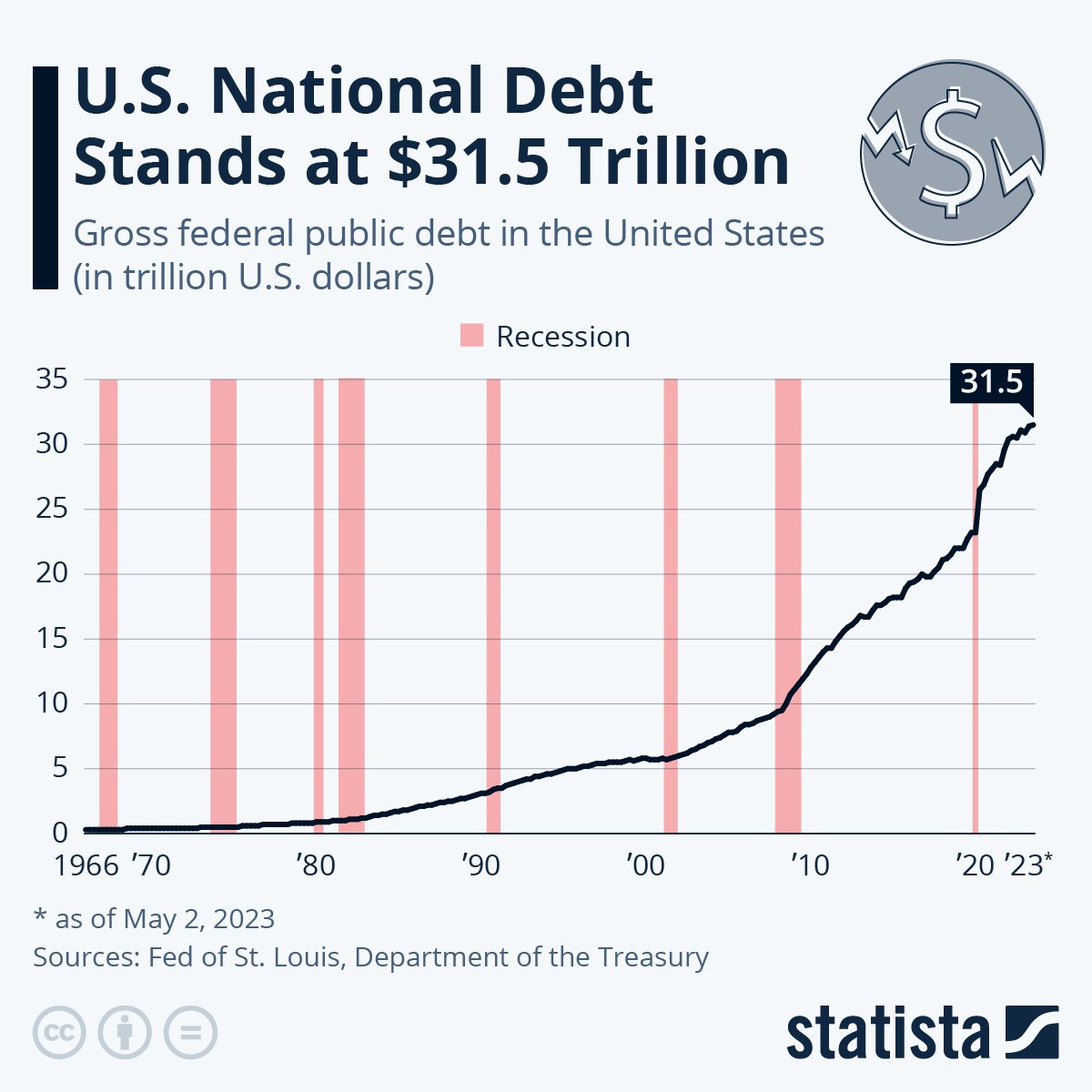

In addition to all this, the losses in Bitcoin in May caused it to loosen from $ 31,000 to $ 25,000. The leading cryptocurrency, which is far from the psychological resistance of $ 28,500, is currently pricing at the $ 28,000 border. In June, the fact that the Treasury Department and the United States could not fulfill their responsibilities also worried the citizens. In this process, we talked about the concerns arising from being dragged into recession. In retrospect, America has a law that, since the beginning of the 20th century, puts a limit on the total amount of debt the government is allowed to have. Although this debt limit was initially set as 11.5 billion dollars, it continued to be increased with new administrations. The important issue is that the debt limit could be increased, but if the debt ceiling was exceeded, the upgrades were not allowed. The limit, which is currently 31.5 trillion dollars, was seen in January 2023. According to the law we mentioned above, it means that the US no longer borrows money. Regarding this debt crisis, which must be paid by the first week of June, President Joe Biden has started new regulatory studies. He met with the Republicans and parliament and faced negative rhetoric. There was no guarantee of an agreement and the pressure on Joe Biden was expected to continue. If the debt ceiling was not increased, more money would be spent than the tax the United States collects from the public. According to new reports, US President Joe Biden has reached a tentative agreement with the House and Republicans. It was approved by the parliament to prevent the country from defaulting.

The stagnant course in the digital asset market is connected to the USA from every point. As you know, the Chairman of the US Federal Reserve, Jerome Powell, recently spoke about the crises in the USA. In the United States, which has been following a tight and aggressive monetary policy for about a year, there have been peaks in interest rate hikes. This situation caused fluctuations in the price level of Bitcoin. This week, we will be focusing on non-farm employment and unemployment data in the US. There are 180K expectations in TDI data, unemployment is expected to rise to 3.5. If the expectations can be met, cryptocurrencies will be positively affected. However, in the opposite case, that is, if the US labor market remains strong, risky assets will continue to be negatively differentiated from the market. A cooling in the US labor market will pave the way for good pricing in cryptocurrencies.

Bitcoin, which has been willing to move upwards since the beginning of the year, priced in the $ 31,000 limit. Since last year, we have gone through a period in which the US Federal Reserve has continuously increased interest rates. With the effect of negative news not only in the Fed but also in the crypto money market, the $ 15,000 band was tested in Bitcoin. In the light of the negative data and crises from the USA within a year, there is no activity and expected bull in Bitcoin. Although Bitcoin is closing May negatively, the data we will follow in the first week of June may drive the price up. Digital asset investment products started to move over the weekend. While the $28,000 limit was tested in Bitcoin, we witnessed pricing above $1900 in Ether. Bitcoin, which closed the week we left behind with a 10% increase and tested $ 28,447, is currently priced around $ 27,900. In case the rises continue, first of all, it remains important to exceed $ 28,500 and $ 28,800. On the contrary, it will increase the pressure on the loss of $27,000, which also coincides with the 50-day moving average, and will push us up to $26,500. In short, positive news and discourses are needed to trigger Bitcoin rises. With the support of positive data, it will rise above $31,000 that it saw on April 14, and then our new target point will be $35,000.