Jupiter Token Defies Market Trends Amid Crypto Liquidations

In a tumultuous start to the week for cryptocurrency markets, which witnessed liquidations soaring to monthly highs as several major tokens experienced double-digit declines, the native token of the Solana-based decentralized exchange (DEX) aggregator, Jupiter, is standing out with a remarkable performance fueled by a new buyback initiative. Recent data from TradingView indicates that JUP has surged by over 34% against Bitcoin over the past week, despite an 11% drop in the last 24 hours, contrasting with BTC’s nearly 4% decline.

This impressive outperformance is attributed to a series of significant announcements made during Jupiter’s inaugural event, Catstanbul 2025, which addressed existing concerns regarding its utility. The pseudonymous founder of the protocol, known as ‘Meow’, disclosed that 50% of all protocol fees would be allocated for purchasing tokens from the open market, with these tokens being transferred to a “long-term litterbox,” essentially a reserve meant for long-term holding.

This strategic move not only led to a notable increase in JUP’s price but also signified a strong level of investor confidence in the project’s future trajectory and strategy, as highlighted by Ryan Lee, Chief Analyst at Bitget Research. He noted that growing attention towards Jupiter could potentially draw in new users and enhance liquidity within the Solana ecosystem over time.

In a statement provided to CoinDesk, Lee emphasized that the buyback program could serve as a crucial catalyst for long-term growth, with estimates suggesting it could contribute hundreds of millions of dollars to the buyback volume annually.

Jupiter’s Market Impact and Community Concerns

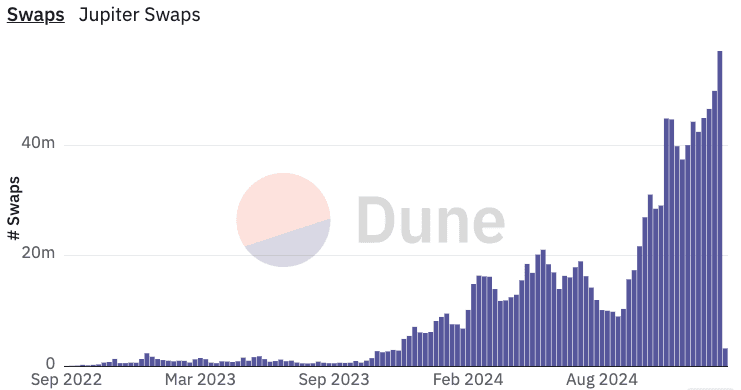

As the leading DEX aggregator on Solana, Jupiter has facilitated nearly $2.2 trillion in total volume through over 1.25 billion token swaps, according to data from Dune Analytics. In just the last 24 hours, the platform recorded a trading volume of $6.5 billion across 6.9 million swaps.

However, while the announcement of the buyback program has positively impacted JUP prices, it has also raised eyebrows within the community. Chris Chung, the founder of the Solana swap platform Titan, expressed disappointment regarding the news that Jupiter would impose a 5 basis points (bps) fee for basic swap trades in its default ‘Ultra’ mode. This fee increase is seen as a setback for traders, particularly in light of Solana’s value proposition of offering lower costs and higher throughput.

The Ultra mode is designed to include features such as real-time slippage estimation, dynamic priority fees, and optimized transaction landing, further enhanced by the introduction of a new security tool dubbed “Jupiter Shield”. Lee remarked that while Jupiter’s success is commendable, it may entail risks of centralization, noting that an increase in its dominance could result in over-reliance on a single project, which contradicts the foundational principles of blockchain aiming for decentralization and a distribution of influence.

Chung further criticized the fee increase, asserting that it was particularly disappointing to see a paid model introduced without any perceivable performance improvements over the previous free version, especially given that the features included are fundamental to executing transactions effectively.

Strategic Acquisitions and Future Outlook

In addition to the buyback initiative, Jupiter has taken notable steps towards expansion by acquiring a majority stake in Moonshot, a memecoin trading platform that gained attention for featuring on the website of former U.S. President Donald Trump’s memecoin, reportedly attracting over 200,000 new users to the blockchain.

Moreover, Jupiter has also acquired SonarWatch, an on-chain portfolio tracker. Chung views these acquisitions as indicative of Jupiter’s ambition to dominate the Solana ecosystem, a move that he believes could be detrimental to innovation and the overall user experience. He characterized Jupiter’s actions as a manifestation of “monopolistic behavior,” allowing established players to further inflate prices in the absence of competition, which runs counter to the ethos of decentralized finance.

Additionally, Jupiter has announced the forthcoming launch of Jupnet, an omnichain network intended to consolidate all of crypto into a single decentralized ledger for enhanced user and developer convenience. The public beta version is anticipated to debut in the coming months.

While concerns regarding the potential concentration of power within a single player persist, there may be a silver lining. Jupiter’s dedicated focus on the Solana ecosystem could pave the way for a new wave of developers to engage with the platform, fostering the creation of innovative and unique products. Mike Cahill, Co-Founder and CEO of Pyth Network’s core contributor Douro Labs, emphasized that Jupiter’s recent initiatives represent a strong commitment to enhancing DeFi infrastructure and liquidity dynamics. He suggested that this innovative approach could catalyze an influx of builders into the Solana ecosystem, potentially resulting in a surge of new memecoins and decentralized applications (dApps).

As of the time of this report, Jupiter has not responded to CoinDesk’s request for comments.