Tron DAO Reserve bought two cryptocurrencies with a total value of $50 million. He announced that his aim is to strengthen USDD reserves. Currently, USD has become more than 147% collateralized.

Tron bought two cryptocurrencies to support its stablecoin

Tron DAO Reserve announced that it has received $50 million worth of BTC and TRX. Officials stated that the purchase was made to add to USDD’s reserves. In addition, Tron said that the BTC and TRX acquisition was done ‘to protect the entire Blockchain industry and crypto market’. It was announced to the public with the following tweet, which also included a statement on the subject.

https://twitter.com/trondaoreserve/status/135635732525621257

Currently USDD’ collateral ratio of more than 197%

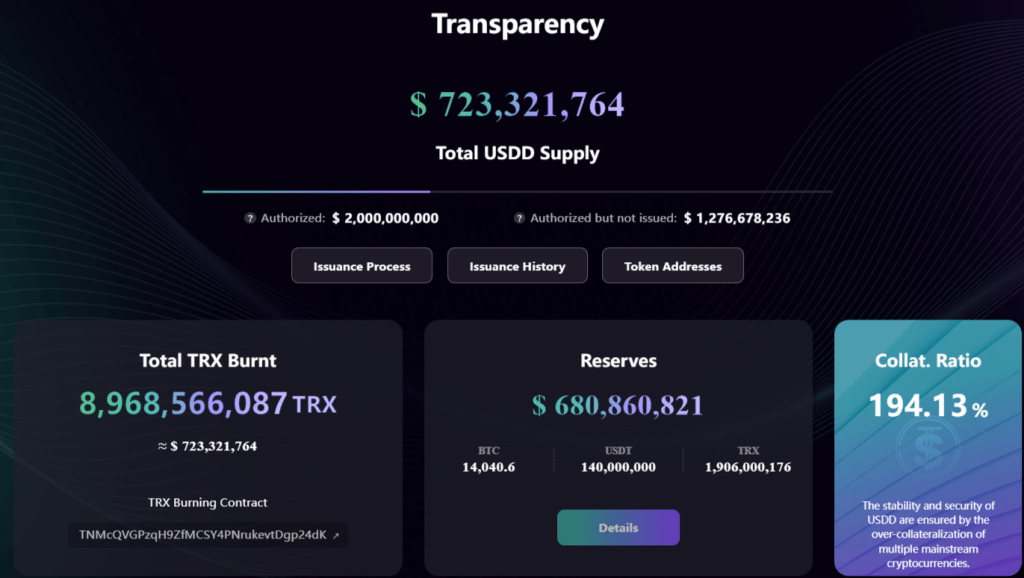

Tron DAO’s goal is to secure the USDD stablecoin with a minimum of 130%. To achieve this goal, he bought crypto money. He decided to buy a total of $50 million worth of Bitcoin and Tron (TRX). The following screenshot provided by the USDD website shows the collateral rate. Currently, the USDD algorithmic stablecoin is more than 194% secured.

The above snapshot also reveals that the US Dollar is currently backed by 14,040.6 Bitcoin (BTC), 140 million Tether (USDT), and 1.906 Billion Tron (TRX). The current value of USDD reserves is around $680,860,821 million.

Leading crypto plunges to new local low of $28.099

consecutively from Cryptokoin.com As you follow, Bitcoin saw $ 27,049 today. Bitcoin only recently fell to this low. Tron DAO, on the other hand, bought a total of $50 million in Bitcoin and TRX at a time when it was experiencing a significant drop.

Also, according to crypto analyst Max Clark, the daily trend of BTC still indicates a pessimistic outlook for Bitcoin for the next few days. Continued selling pressure below the 50-day moving average is suggested by the daily MFI, RSI and MACD indicators (white).

6-hour Bitcoin chart

6-hour Bitcoin chart The analyst is evaluating on the 6-hour chart. In this context, he says the $28,000 support zone could act as a backdrop for selling in the short term. Additionally, the 6-hour MFI and RSI indicate that the market is currently in an oversold condition. Given this situation, he considers $28,000 to be a useful support level for Bitcoin. As is known, bear markets for cryptocurrencies typically have low trading volume on weekends. Given this, he recommends extreme caution before attempting to keep Bitcoin long at current levels.