Have a good week everyone, the markets breathed a little easier with the Consumer Price Index data, which came below the expectations on the US side on Wednesday last week.

Annual CPI increased by 3%, making its lowest progress since July 2022. The Core Consumer Price Index, which excludes food and energy and is the most important indicator used by the Fed to measure inflation, increased by 4.8%, showing its lowest increase since 2021.

Although inflation has slumped to 3%, it is still higher than the Fed’s 2% target, and a 25 basis point increase is still expected with 93% probability at the FOMC meeting on July 26, according to the CME FedWatch Tool.

Speaking after the CPI data, St. Louis Fed Chairman James Bullard; He had made hawk statements that inflation was still very high and that early steps should not be taken back. A few days later, Bullard announced that he would resign on August 14.

On the crypto money markets side, we got some very good news. The SEC has accepted the spot Bitcoin ETF filings from BlackRock, VanEck, Invesco, Fidelity, and WisdomTree for review. With a possible spot Bitcoin ETF adoption, the liquidity that is the lifeblood of crypto markets will begin to come.

You can see the dates of Bitcoin spot ETF applications prepared by Bloomberg with the tweet I quoted from the Coinkolik Twitter page:

#Bitcoin spot ETF başvurularında kritik tarihler…

Via: @TheBullduck pic.twitter.com/eAB7IwOKl1

— Coinkolik (@Coinkolik) July 14, 2023

Another good news came from Ripple. As the litigation process has been going on for 2.5 years, the judge has decided that Ripple’s XRP exchange sales do not violate the federal securities law. Experts stated that not considering XRP as a security will set a precedent for other cryptocurrencies.

With the summary decision, we saw a 99.15% increase in XRP. This case is important because as you know, in the past months, SEC stated that 13 coins, including ADA, SOL and MATIC, are securities. If the case is concluded in favor of Ripple, it will also serve as a guide in the regulation process.

There is no heavy data flow in the economic calendar this week. We will follow the Chinese growth data, the UK CPI data, the US unemployment benefits applications and the CBRT interest rate decision.

Economic Calendar

Monday, 17 July 2023

China – Gross Domestic Product (GDP) (YoY) Expectation: 7.3% Previous: 4.5% 05.00

19 July 2023 Wednesday

UK – Consumer Price Index (CPI) (Annual) Expectation: 5.5% Previous: 6.1% 12.00

Thursday, July 20, 2023

USA – Applications for Unemployment Benefits Expected: 243k Previous: 237k – 15.30

Türkiye – CBRT Interest Rate Decision – 14.00

Bitcoin Technical Analysis

Bitcoin continues to move sideways between the $ 29,400 – $ 31,400 levels. The price will tend to move downwards unless candle closes come in at $31,400 on the daily. The $29,572 level is our first key zone. The price can break here and get support to the upside, but if it doesn’t get enough liquidity, it may want to pull back to our other key zone, 28.300.

Crypto Related ETF

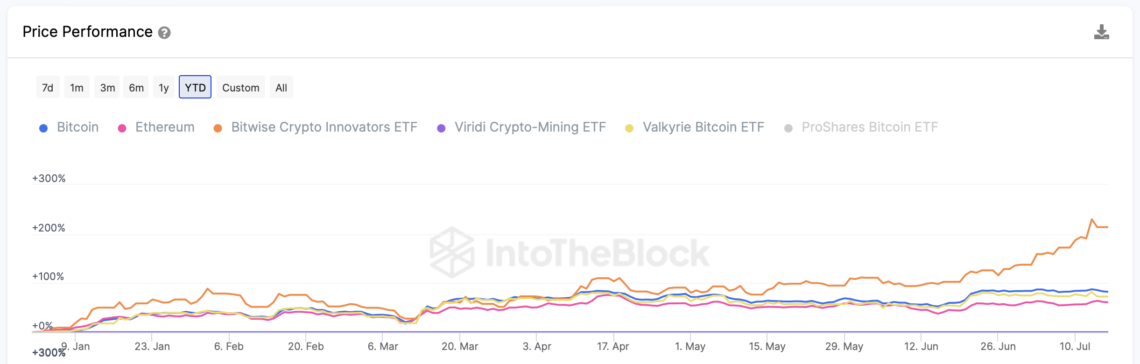

With the spot BTC ETF occupied a lot, let’s take a look at crypto-related ETFs currently. This indicator compares price fluctuations between Bitcoin, Ethereum and selected capital market assets.

The chart above is used to compare the returns generated by traditional finance assets and crypto market assets as of the beginning of 2023. The price performance indicator allows investors to identify the investments with the highest and lowest returns.

Top 100 Cryptocurrencies In The Last Week According To CoinGecko Data

- XRP

- Stellar (XLM)

- Compound (COMP)

- Left (LEFT)

- Synthetix Network (SNX)

Featured Cryptocurrency News of the Last Week

The US Government has transferred 9,825 Bitcoin (BTC)!

The popular onchain company lookonchain published a critical report. In his latest report USA government’s BTC Evaluating the transfer movements, the company drew attention. Moving 9,825 BTC ($297.6 million) 13 hours ago, the government transferred to 2 new wallets. 8,200 BTC ($ 248 million) was transferred to one wallet and 1,625 BTC ($ 49 million) to the other wallet.

The decision in the XRP case pleased Ripple

In a lawsuit filed by the Securities and Exchange Commission (SEC) against Ripple Labs dating back to 2020, Judge Analisa Torres ruled in favor of the company on July 13 in the United States District Court for the Southern District of New York, stating that XRP is not a security. gave.

SEC accepts BlackRock’s Bitcoin ETF application

The United States Securities and Exchange Commission (SEC) responded to this move by BlackRock, which applied for a spot Bitcoin ETF in the past months. The SEC accepted the application filed by BlackRock. It should be noted that this does not mean that the SEC has approved BlackRock’s Bitcoin ETF application.

Thodex founder jailed

Faruk Fatih Özer, the founder of the crypto exchange Thodex, was sentenced to 7 months and 15 days in prison in the trial where he was charged with “smuggling”. In the decision rendered by the Anatolian 17th Criminal Court of First Instance, it was also decided to postpone the announcement of the verdict.

Elon Musk announces xAI

Elon Musk, one of the favorite names of the crypto money community, has recently made statements about the functioning of artificial intelligence. Emphasizing in his statements that the current functioning of artificial intelligence is dangerous for humanity, Musk came up with an initiative in this area as well.

Determining the name of the artificial intelligence initiative as xAI, Musk said that he has a mission to be different from his competitors in terms of data collection and privacy.