Last week, we witnessed that Fed Chairman Powell shaped the markets with his statements. Leading inflation indicators for January did not come in line with expectations, so Powell made statements in a hawkish tone, paving the way for a 50 basis point increase in interest rates at the Fed meeting on March 22.

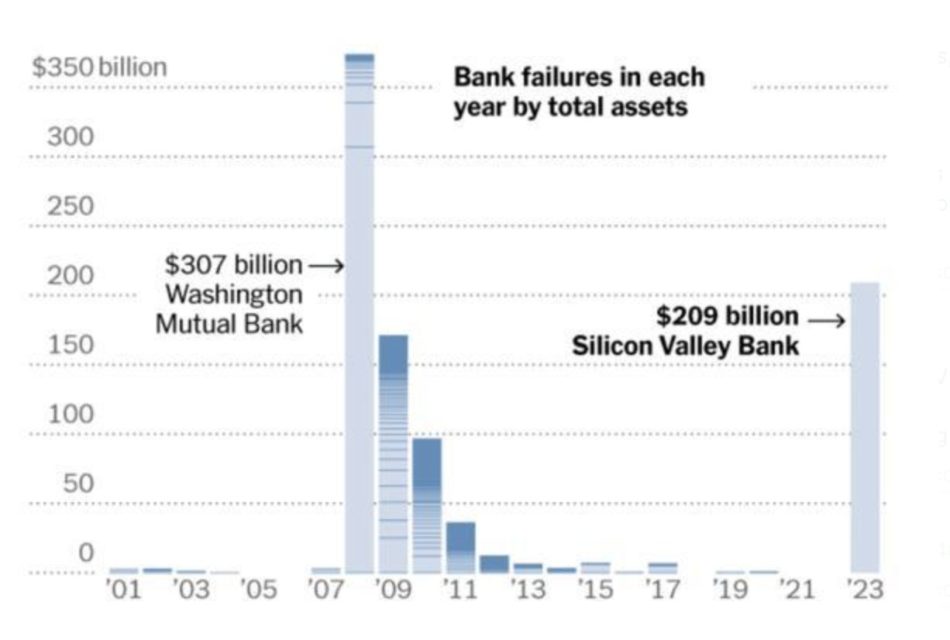

On Thursday, we experienced the biggest banking crisis since 2008. Among the 3 banks that went bankrupt in the USA, the 16th largest bank in the country, Silicon Valley bankruptcy, had a great impact. Bankrupt banks have a direct bearing on the crypto industry and are among the companies that suffered from the exposure effect with the FTX bankruptcy. In a statement made by the Fed, FDIC and the Treasury Department, they stated that deposits in bankrupt and seized banks are under guarantee, but no action will be taken to bail out banks.

Employment data came in on Friday. With the slowdown in the increase in hourly wages and the unemployment rate rising to 3.6%, the 25 basis points increase in the March 22 interest rate decision was brought to the agenda again.

There are intense data flows on the agenda this week. We will follow the US inflation data, the European Central Bank’s monetary policy decision, and Turkey’s inflation data. The US inflation data will undoubtedly be of great importance before the March 22 interest rate decision.

In the cryptocurrency markets, with the bankruptcy of industry-related banks, USDC issuer Circle admitted that it could not withdraw approximately $3 billion from Silicon Valley Bank, while USDC was observed to be a depeg. With the opening of the markets today, USDC has reached the $1 stability again.

Binance has converted one billion dollars of BUSD, which it created to rally the crypto market, into Bitcoin, Ethereum and BNB. We have seen some relief in such cryptocurrency markets.

Economic Calendar of the Week

Tuesday, 14 March 2023

- USA – Core Consumer Price Index (CPI) (YoY) (Feb) Expected: 5.5% Previous: 5.6% – 15.30%

- USA – Consumer Price Index (CPI) (YoY) (Feb) Expectation: 6.0% Previous: 6.4% -15.30

Wednesday, March 15, 2023

- US Producer Price Index (PPI) (MoM) Expectation: 0.3% Previous: 0.7% – 15.30%

Thursday, March 16, 2023

- US Unemployment Benefit Applications Expected: 205K Previous: 211K

- European Central Bank (ECB) Rate Decision – 16.15

- ECB Monetary Policy Announcement – 16.15

- European Central Bank Press Release – 16.45

Friday, March 17, 2023🇹🇷

- Turkey Year-End Consumer Price Index (CPI) Forecast (Mar) Previous: 35.76% 10.00

- Eurozone Consumer Price Index (CPI) (YoY) (Feb) Expected: 8.5% Previous: 8.5% – 13.00

Bitcoin Technical AnalysisI

On the daily chart, Bitcoin price tested the level of 24.500 and continued its movement in the key zone area, which we determined with the black box, but on the 4-hour chart, it broke the key zone level of $ 21,000 – $ 21,600 and closed under the box daily. Again, we saw that the market structure changed in the 4-hour time frame and a new downward swing low was realized. The price may retest $22,500 again, but the direction it would like to go is currently targeting the yellow box zone below $17,600 – $18,500.

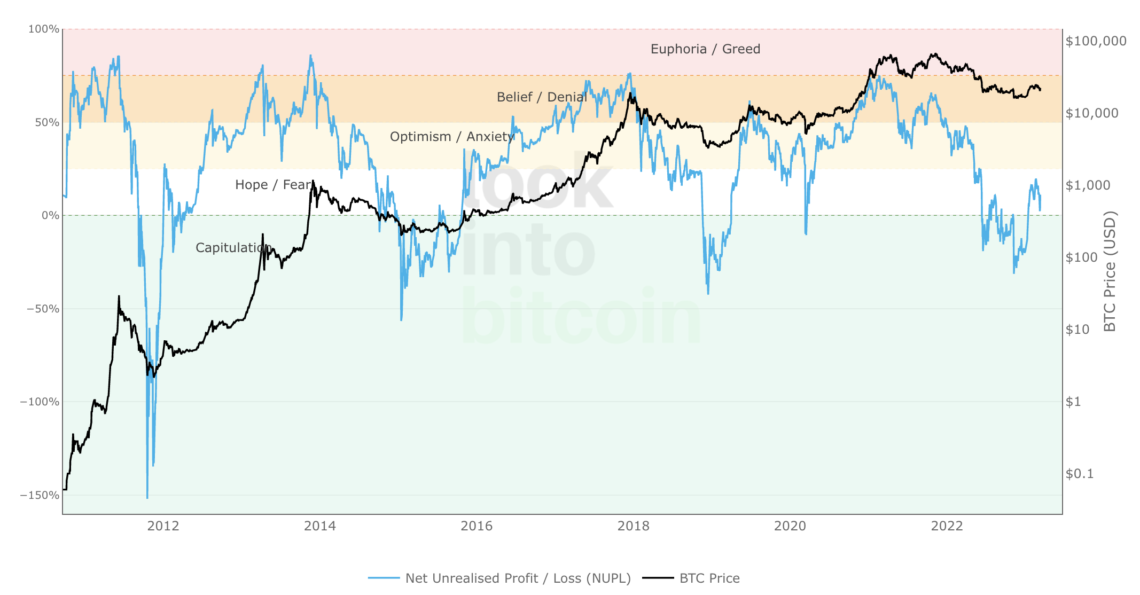

Net Unrealized Profit/Loss (NUPL)

Net Unrealized Profit/Loss (NUPL) serves to predict whether the Bitcoin price has reached large rises or falls and uses on-chain data to show market participant sentiment.

The basic principle is to measure the ratio between the market capitalization and the profit earned by the Bitcoin investor.

We see that the market is overheating when the market value rises much faster than the profit made, we can say that this is due to investor greed (red band) Such times for the strategic investor are the times to make profits in the historical process.

Top Cryptocurrencies of the Week According to CoinGecko Data

- KAVA (KAVA) 29%

- PAX Gold (PAXG) 3.8%

- APTOS (APT) 3.7%

- BNB (BNB) 2.9%

- Tether Gold (XAUT) 1.9%

Last Week’s Featured Crypto News

1- Crypto Bank Ends Silvergate Operations

The crypto banking institution that has recently stated that it has been experiencing financial difficulties silvergatehas terminated its SEN service to crypto exchanges.

After the painful processes, Silvergate’s parent company, silvergate from Capital A new announcement has arrived. Parent company, crypto banking service citing financial troubles Silvergate’sHe said he stopped his operations.

2- KuCoin has been sued!

New York’s senior official Letitia James , announced in a press release today that KuCoin has not registered with regulators in the US as a securities and commodities trading platform, which is a criminal offence. According to James, the company misled its own customers by promoting itself as a stock exchange.

3- Silicon Valley Bank Closed

Silicon Valley Bank was shut down by the California Department of Financial Protection and Innovation. The Federal Deposit Insurance Corporation (FDIC) was appointed as the buyer. The FDIC had created the National Bank for Deposit Insurance Santa Clara to protect insured depositors. Transactions at the bank halted earlier in the day.

4- Circle Lost Billions of Dollars

USDC issuer Circle admitted that it failed to recover $3.3 billion of the $40 billion it tried to withdraw from Silicon Valley Bank. Making statements on the social media platform Twitter, Circle has clarified the issue of stuck assets that have been discussed since the past day. Circle announced that it has confirmed that the withdrawals it initiated have not yet been completed, and that there is still $3.3 billion left.

5- The Coup Against Crypto Continues: Signature Bank Closed!

Negative news continues to come from giant banks known for their ties to crypto. based in New York Signature Benchof “ systemic Risk ” and it was decided to close it. With the following statements, the bank’s New York Financial Services ( NYDFS ) was declared to be taken over by. by state regulators shutdown decision received giant bankhas had a huge impact in the crypto industry.