On Wednesday last week, the Federal Reserve (Fed) increased interest rates 10 times in a row since March 2022. With the 25 basis points increase in interest rates, which was in line with expectations, the federal funding rate came to a range of 5-5.25 percent.

Ok so far, but one of the most important issues we had to look at was the FOMC text. In my previous article, I drew attention to the following sentence in particular:

The sentence in the text of the March meeting, “The Committee may make some additional policy tightening to achieve a sufficiently restrictive monetary policy stance to return inflation to 2 percent over time” was removed from the text this time. We were now convinced that the Fed would stop raising interest rates.

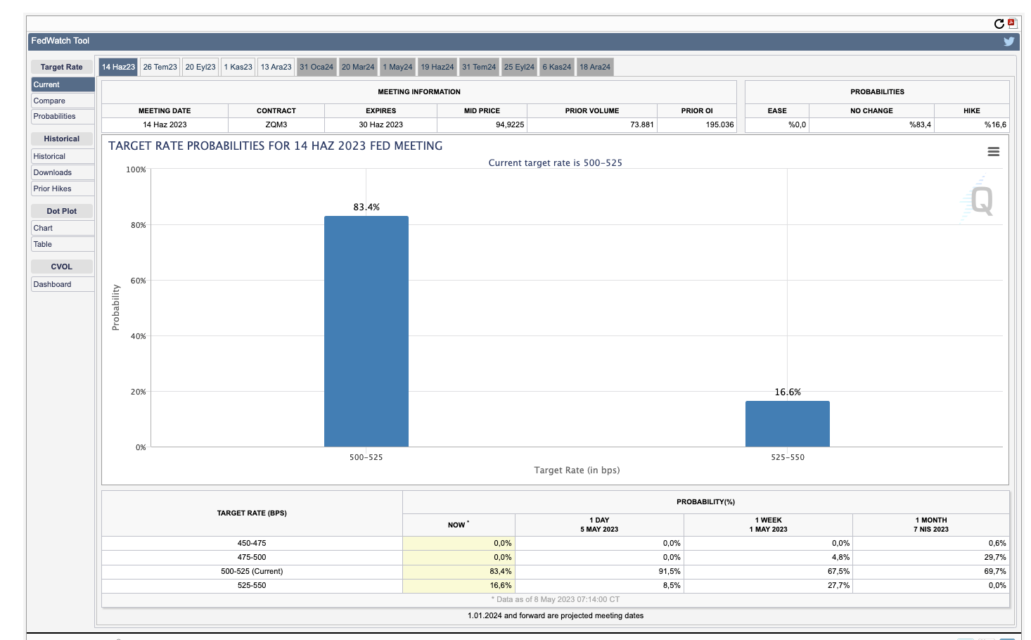

CME data currently does not expect a rate hike of 84% at the Fed’s June meeting.

After this point, at 21.30, Powell confronted the press and made confusing statements:

“The need for tightening in monetary policy will be evaluated with the data coming from the meeting to the meeting.

We will revisit our estimates of what the interest rate peak is in June.

It is not possible to say that we have come to the definitive end of the restrictive policy.”

Unemployment data and Non-Farm Employment data, on the other hand, are still not at the levels the Fed wants to see. That’s why the data coming this week is of extra importance.

In the economic calendar, we will follow the US CPI data on Wednesday, PPI data on Thursday and the first weekly jobless claims.

With the data from China, the world’s second largest economy, we will receive data from which we can get information about the recovery process after COVID-19. We will follow the April trade data, which will be released on Tuesday, and the inflation data for April, which will be announced on Thursday.

The Bank of England (BoE) is expected to raise interest rates another 25 basis points on Thursday. We will have first quarter GDP data to be released in the UK the day after the BoE decision. The expectation is that growth will remain weak in the first three months of the year.

In the cryptocurrency markets, this week Solana’s blockchain-based phone “Saga” will go on sale on Monday, May 8, and Chiliz new Sports Blockchain launch will take place on Wednesday, May 10.

Economic Calendar

Wednesday, May 10, 2023

- USA – Core Consumer Price Index (CPI) (MoM) Expected: 0.4% Previous: 0.4% – 15.30

- USA – Consumer Price Index (CPI) (Annual) Expectation: 5.0% Previous: 5.0% – 15.30%

Thursday, May 11, 2023

- USA – Producer Price Index (PPI) (Annual) Expectation: 0.3% Previous: -0.5% – 15.30

- USA – Applications for Unemployment Benefit Expectation: 245K Previous: 242K – 15.30

- UK – Interest Rate Decision Expectation: 25 bps Increase – 14.00

Friday, May 14, 2023

- Türkiye – President and 28th Term Parliamentary Election

- UK – Gross Domestic Product (GDP) (Quarterly) Expected: 0.1% Previous: 0.1%

Bitcoin Technical Analysis

We entered a week in which the price was suppressed downwards, with Binance temporarily stopping BTC withdrawals after the intensity experienced in the BRC-20 network. As of now, Bitcoin is trading at $27,800. It should be noted that this week, the US CPI data will be important.

On the daily chart, Bitcoin maintains the expensive zone in its movement. If the downside pullback continues, the price may want to buy open liquidity areas near the $25,600-$26,800 level. A candle closing by breaking this area will perform a “Market Structure Break” on the 4-hour chart and may carry the price to the $24,000-$25,200 levels, which I determined with the black box. We will continue to monitor the price for a new bullish wave.

High Volume Trading Pairsi/Pools

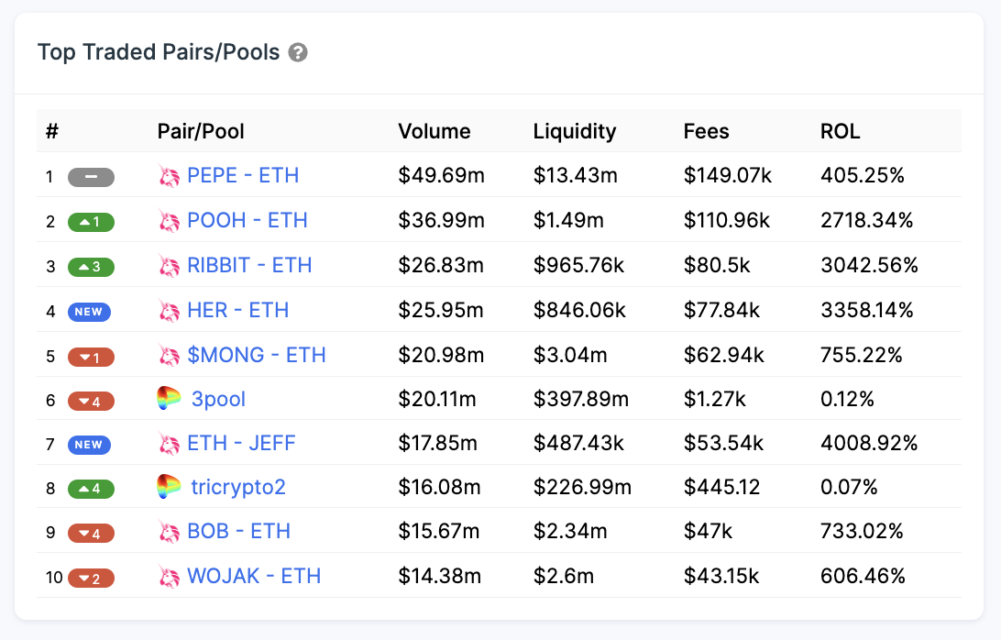

While ready-made MEME coins are trending, I wanted to bring this data for you. The table tracks key metrics for decentralized exchanges (DEXs) trading pairs, sorted by trading volume. The Volume column collects the 24-hour trading volume. Liquidity is the total amount provided from both coins in this trading pair. The fees are a function of the trading volume earned by the liquidity providers (0.3% in the case of Uniswap). Finally, the liquidity return (ROL) is the estimated return liquidity that the providers will derive from this pair based on 24-hour data.

Investors interested in providing liquidity can look at liquidity returns (ROL) to decide which pools to allocate their capital to. Traders, on the other hand, can see which tokens have the highest trading volume.

Last Week’s Top Rising Cryptocurrencies

- PEPE (PEPE) 487.7%

- Rocket Pool (RPL) 5.1%

- Tokenized Xchange (TKX) 2.3%

- Tron (TRX) 2.3%

- Stacks (STX) 1.7%

Last Week’s Featured Crypto News

Pepe’s (PEPE) Transaction Volume Overtakes Major Coins! Doubling its price in days PEPE ‘s data was remarkable. Strengthening its power with stock market listings PEPEhas surpassed almost all altcoins in terms of trading volume. XRP, DOGE, SOL, ADA, MATIC and LTC PEPE, which surpassed the trading volumes of , became the agenda in the crypto market. PEPE, which has increased by 762 percent in the last seven days, seems to have taken the flag of the market.

Argentina Central Bank Suspends Crypto Payments: In the decision from the country’s monetary authority, it was announced that payment systems should be freed from digital assets.

The Central Bank of Argentina stated that institutions providing payment services cannot transact with cryptocurrencies and other digital assets. This decision from the country’s central bank has drawn criticism from the local crypto ecosystem.

Will Ethereum Scalable? Expected Mayhem: the MergeEthereum ( ETH ), will try to reveal the low cost and fast network status in its next updates. In particular, Ethereum co-founder Vitalik Buterin stated that scalability is critical in future updates.

Buterin said that if they can’t fix the scaling issue, Ethereum’s transaction fees will be lowered in the next bull run. up to 500 dollarsHe said he could rise. Buterine, Cancunthat the so-called update will focus on this issue. underlined.

SUI Enters the Market Strongly: Investors are eagerly waiting for it sui( SUI ), began trading on cryptocurrency exchanges. Beginning to be listed on major exchanges SUI entered the market fast. SUI surpassed $2 in initial trades, with volume rising to over $160 million.

Chinese Giant Alibaba and Avalanche Form a Partnership: Alibaba Cloud, the cloud division of China-based technology giant Alibaba, has launched a platform for businesses to create metaverse worlds through the Avalanche Blochchain network.

Alibaba Cloud’s new launchpad, dubbed Cloudverse, aims to provide an end-to-end platform for companies to customize and maintain their metaverse space to experiment and find new ways to interact with their customers.