The phenomenon, dubbed “Kimchi Premium” among South Korean investors, refers to rising cryptocurrency prices as investors trade arbitrage. Doo Wan Nam, founder of hedge fund StableNode, says that Kimchi Premium now offers opportunity in the altcoin market.

Reports show that Korean Kimchi Premium is on sale for the altcoin market

Doo Wan Nam, co-founder and Chief Operating Officer (COO) of StableNode, stated that the discount on Kimchi Premium is a good time for investors to buy cryptocurrencies. “When Korean gamblers do FOMO later, you can win 20%,” says its senior analyst.

At midnight on February 20, Nam tweeted that Kimchi Premium has now turned into a Korean discount: “Kimchi in general means that interest in crypto has dropped after sales from Korean investors; Ironically, it’s usually a better time to buy because you know you can sell yours later, when FOMO starts, at a profit of 20%.”

Korean (Kimchi) Premium is now turned into Korean Discount 🤔

Generally it means fall in interest in crypto from Korean retail, which ironically is generally a better time to buy cause you know you can always sell yours to Korean gamblers for 20% premium later when they FOMO pic.twitter.com/FFcvdi93PE

— Doo | StableLab @Seoul (@DooWanNam) February 19, 2023

The term Kimchi, referring to a Korean dish, specifically denotes the difference between cryptocurrency prices on Korean exchanges and currency exchanges. It has been revealed by blockchain analytics platform CryptoQuant that Kimchi Premium has been flooded with discounts, making it an easier time for crypto users to buy cryptocurrencies, including Bitcoin, for less. According to the report, the Premium index has been fluctuating between -0.24 and 0.01 since February 17.

Bitcoin (BTC) fluctuates between exchanges

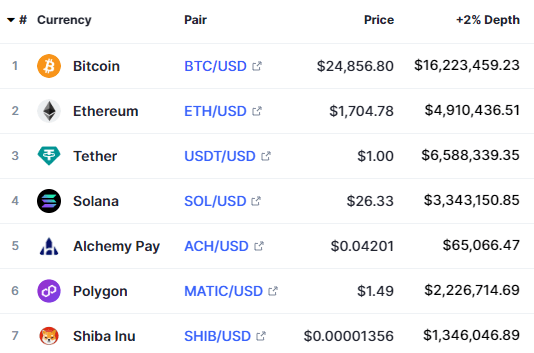

In the example of Bitcoin, it appears that BTC was trading at around $24,464 on Coinbase and $24,487 on Binance. At the same time, Korean crypto exchanges Bithumb and Upbit are trading BTC at $24,386 and $24,405, respectively.

Significantly, the second-largest cryptocurrency Ethereum (ETH) also showed a significant difference in price while being traded on Korean exchanges and other currency exchanges. According to reports, Coinbase sells ETH at roughly $1,687 and Binance at $1,691, while ETH is selling for $1,682 on Bithumb and $1,683 on Upbit.

Meanwhile, the time may be perfect for “arbitrage,” a practice where traders try to make a profit by buying and selling price differences between different exchanges. Amid rising trading volumes, the bulls are looking for opportunities to continue the current rally.

Bitcoin and altcoin market drop probability decreases

Over the past few days, Bitcoin has made headlines by breaking the $24,000 resistance, which remains an important psychological level. Alongside BTC prices, skepticism about the rise has also increased, with many calling the rise a bull trap. According to analyst Timothy Peterson, the probability of Bitcoin falling below $20,000 is less than 1%. Timothy believes most investors will immediately buy dips below $20,000.

One of the factors cited behind this rationale was that 50% of all risky asset holders expected to buy the dips. If the leading crypto returns to the $20,000 level, it will definitely impress its short-term investors. But this will be a good opportunity for long-term owners. According to data provided by Glassnode, the number of long-term HODLers of Bitcoin has grown considerably over the past few days.

📈 #Bitcoin $BTC Amount of HODLed or Lost Coins just reached a 5-year high of 7,617,132.238 BTC

View metric:https://t.co/dJK8rxCtsB pic.twitter.com/30Cxi6ULh1

— glassnode alerts (@glassnodealerts) February 18, 2023

While Bitcoin gives bullish signals as mentioned above, cryptocoin.comMany analysts you follow from , expect this week to pass with high volatility.