Foretelling the market crash in May of last year, a crypto analyst says that despite all the uncertainties, the Bitcoin price is “trading within the opportunity zone.

Current levels ‘opportunity’ according to analyst familiar with Bitcoin crashes

Dave the Wave is a popular cryptocurrency analyst with his most memorable prediction for May 2021. In his most recent tweets, the mysterious analyst told his 126,600 followers that Bitcoin is trading in an “area of opportunity.” The expert interprets this area as an extended horizontal area.

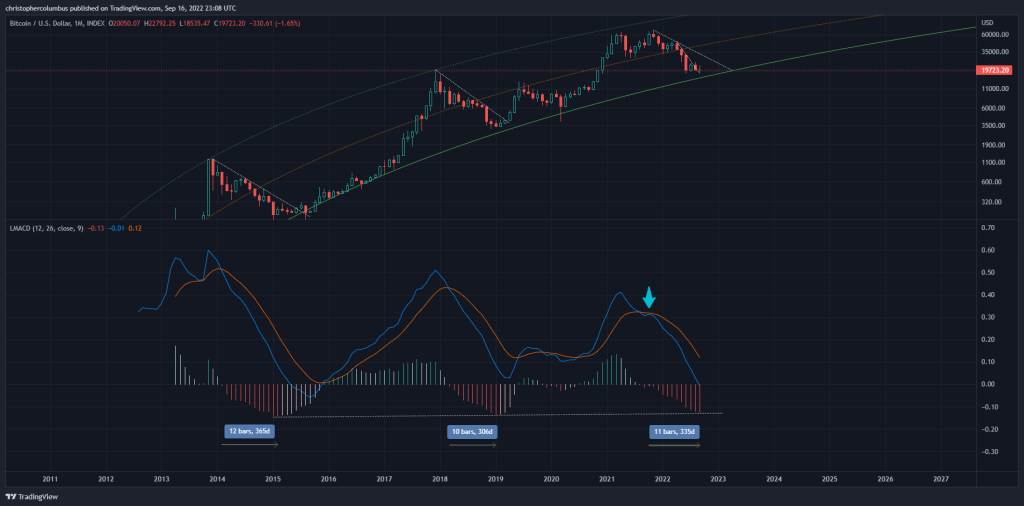

Dave also says that Bitcoin’s monthly moving average convergence divergence (MACD) is bullish. MACD is a trend-based momentum indicator. It tracks price fluctuations between two moving averages. The indicator is generally used to detect returns. Dave states that the MACD is now bullish:

The monthly MACD did wonders for predicting the top [momentum loss/blue arrow]. The histogram is now as stretched as before… and in a similar timeframe. Ascension [for the most affordable purchase instead of buying the top one].

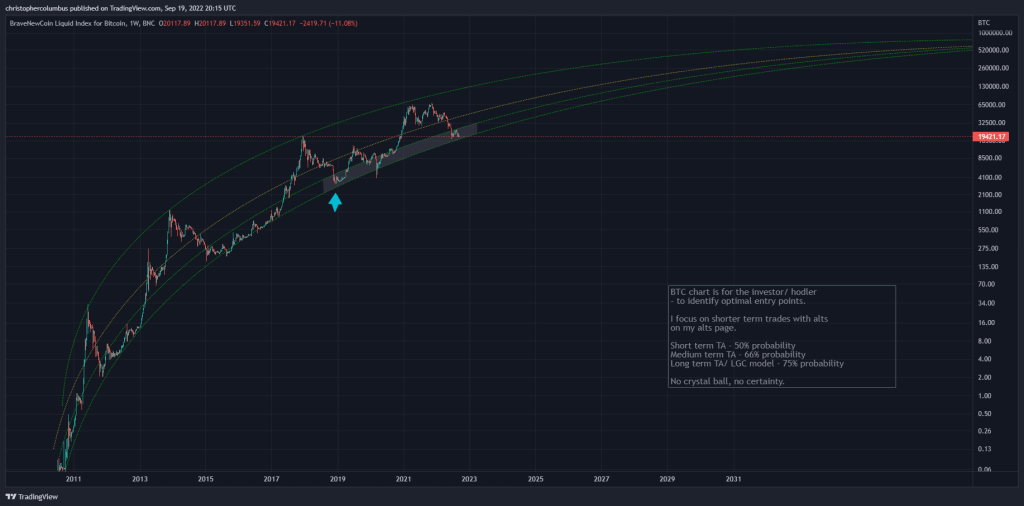

“LGC, the last surviving model of Bitcoin”

The logarithmic growth curve, also (LGC), is essentially a mirror image of the adoption curve, also known as the S-Curve. When adopting an emerging technology or asset, it usually follows the S-curve or Metcalfe’s law. Previous examples: television, fax, internet, email, Facebook, Tik Tok, Zoom etc.

Dave the Wave says LGC is the last surviving model of Bitcoin. The analyst says that the model has predicted the price range of BTC since 2018.

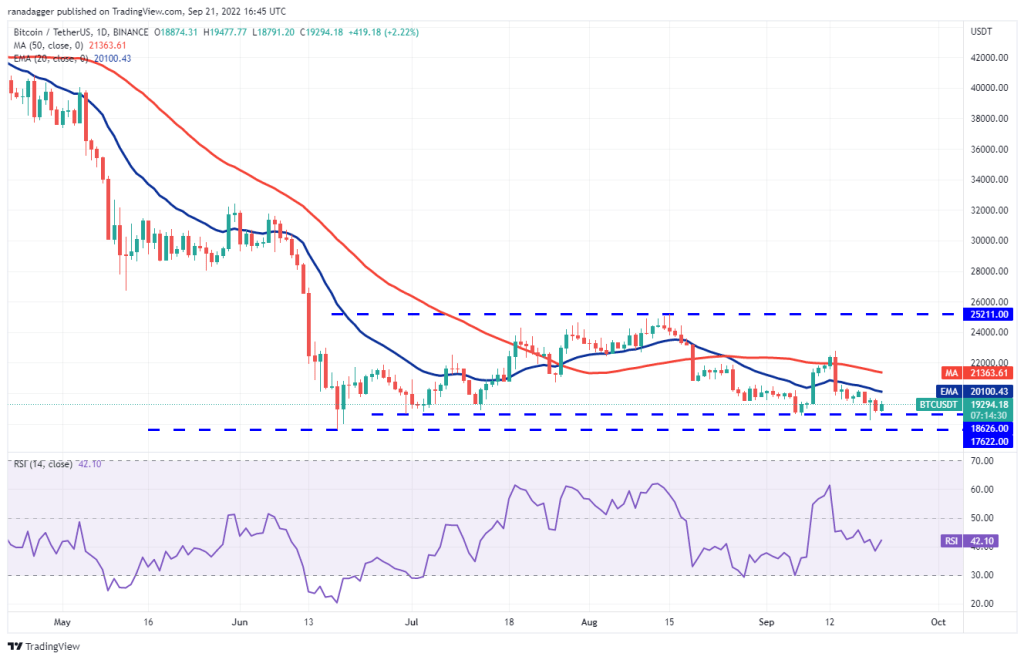

Technical analysis shows buyers are expecting more bearish levels

Bitcoin tested the $18,626 support on September 19, shortly after the Ethereum merge was completed. The worrying thing was that it violated this level for a short time. However, the long wick on the candlestick indicates strong buying at the lower levels. Later, the bulls managed to maintain this level again on September 21. The bears’ failed attempts were a positive sign for their buyers.

Analyst Rakesh Upadhyay says sellers will lose control above $20,100, the 20-week exponential moving average (EMA). The bulls will then push the price towards the 50-day simple moving average (SMA) at $21,363. This level will again act as a stiff resistance. However, if the bulls break this hurdle, their next target will be $25,211.

Conversely, if the price drops from the 20-day EMA, the bears will again target the strong support zone of $18,626 to $17,622. If they are successful, panic selling will end at $14,000, according to Upadhyay. cryptocoin.comAs you follow, Bitcoin is currently trading at $19,000.