The DeFi altcoin giant Aave ecosystem will now have its own native decentralized, collateral-backed stablecoin GHO as the community approves the proposal. On the first day, the majority of the Aave community voted in favor. That’s why they showed their support for the promotion of the GHO stablecoin. With the effect of the news, the altcoin price took a long way in the green zone.

This DeFi altcoin community approves USD pegli stablecoin

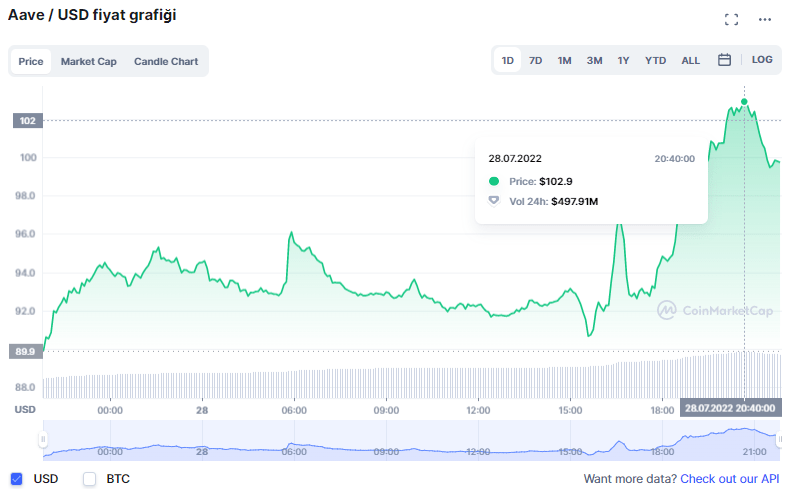

Aave Companies, the central authority behind the Aave protocol, has proposed the introduction of the GHO decentralized, collateral-backed stablecoin with the USD stablecoin. The “Green Light for the GHO” proposal was put to a vote between 28-31 July. If the DAO approves the proposal, the GHO will go live in the Aave Protocol. It will allow users to print the GHO in exchange for a set of provided collateral. With the effect of the news, the DeFi altcoin price started an upward movement. AAVE went from $90 to over $100 during the day.

It is possible for the GHO stablecoin to be minted by users against several crypto assets that have not yet been finalized. GHO’s borrowers will continue to earn interest on the collateral provided, similar to borrowing transactions in the Aave protocol. In addition, 100% of interest payments on GHO loans will benefit society through AaveDAO. In addition, offers on the initial interest rate and discount rate will come in the next few weeks.

However, if the community does not agree with the proposal, there is likely to be another proposal in the discussion. So far, the community seems to fully support the proposal as the majority voted in favor. The proposal received 99.96% of the votes in favor and 0.04% of the abstentions. Moreover, the community seems excited about the stablecoin, as no one has voted against the proposal yet.

Interestingly, the votes in favor of the proposal have almost 27,000 AAVEs and 25,000 AAVEs came from developer aavechain.eth. The community provided interesting feedback on the GHO proposal. Some include the interest rates set by the DAO, the cap on supply, and the value of the stability module.

IMF worries about another stablecoin-led selloff

Tobias Adrian, director of money and capital markets at the International Monetary Fund (IMF), expressed his concerns about the upcoming stablecoin-led crypto winter. Adrian says crypto sales aren’t over yet. He notes that stablecoins not backed by cash and treasuries will lead crypto to another decline.

Today, Solana-based stablecoin Nirvana (NIRV) has suffered a credit spurt. cryptocoin.com As you follow this attack then lost its steady and dropped 91%. NIRV is a stablecoin provided by DeFi altcoin income farming protocol Nirvana Finance. According to experts, the success of DeFi lending protocol Aave’s GHO stablecoin will depend on community support. Without any support, the stablecoin is destined to fail like NIRV.