Gold closed at a three-month low on Tuesday as the rise in the US dollar continued to weigh on the yellow metal. However, the precious metal, which recovered slightly ahead of US inflation data, was trading at $1,852.80 at the time of writing, up 0.8%.

“Yellow metal will continue to face headwinds”

US Dollar Index (DXY) , started the week higher and traded near 20-year highs on Monday. A rising dollar can be negative for commodities priced in the unit, making them more expensive for users of other currencies. Lukman Otunuga, senior research analyst at FXTM, comments:

In the currency area, the king dollar has hit levels not seen in 20 years, driven by risk aversion and rising Treasury yields surpassing 3.2% for the first time since 2018. Commodity markets fell as investors searched for the sell button across all asset classes. Gold will likely continue to face headwinds in the form of a valuable dollar, rising Treasury yields and bets on Fed rate hikes.

Ricardo Evangelista: Downside risks for gold may persist

Indicator 10-year Treasury rate pulled back from multi-year peak on Tuesday and It traded close to 2.99%. This year, interest rate volatility has been a major source of pain for financial markets as the Federal Reserve prepares to aggressively raise interest rates in the coming months to cool high living costs. Analysts say the inflation data, which will be released on Wednesday, will be the main event on the economic calendar. Ricardo Evangelista, senior analyst at ActivTrades, highlights in a note:

So any staggering inflation figure above 8.1% could strengthen the situation for an increase in the Federal Reserve’s tightening rate, and Downside risks for gold may persist as it could fuel the dollar further.

TD Securities’ gold forecast came true on the same day

In a note released Tuesday, TD Securities strategists said they expect the yellow metal to drop below $1,850. Strategists’ predictions came true in the evening, and the gold price declined to $1,932. Strategists predicted:

Systematic trend followers are joining the liquidation gap below. Finally, the trend signals deteriorated enough to catalyze a significant selling program underneath. As gold prices push the psychologically important $1,850 range, the additional flow of CTAs could be enough to trigger a breakout at this technical level.

Key levels to watch for gold price

Gold price tests critical support and wounds near three-month lows below $1,850. licks. Resurgent US dollar demand amid rising global growth and inflation fears put negative pressure on the gold price as traders ignored the pullback of Treasury yields from their multi-year highs.

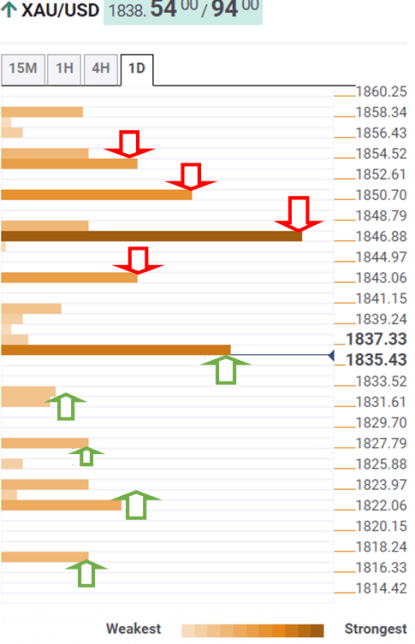

Additionally, hawkish Fed speakers exacerbated the pain in gold by boosting the US dollar. Attention turned to critical US inflation data for a new direction in the gold price. Technic Confluences Detector, used by market analyst Dhwani Mehta, shows that gold is testing bullish commitments at the critical support of $1,836. Dhwani Mehta continues his analysis in the following direction.

At this level, the one-day SMA200, the previous day’s low and the one-hour SMA5 coincide. The next relevant support awaits at $1,833, the previous four-hour low. Below this, a fresh drop at $1,827 towards the S1 one-day pivot point cannot be ruled out. Further below, sellers will target the one-week pivot point S2 at $1,822. The last line of defense for gold bulls is seen at $1,817, the one-day pivot point S2.

On the upside, any rebound can only gain momentum with a sustained break above the previous four-hours high at $1,841 and a 23.6% one-day Fibonacci test above it. The one-month S1 and Fibonacci 38.2% of the pivot point will converge one day at $1,847. The previous week’s low at $1,850 could be on the buyers’ radars and open the doors towards $1,853, the intersection of one-day Fibonacci 61.8% and one-week pivot point S1.

Technic Confluences Detector

Technic Confluences Detector Pablo Piovano: Current target for precious metal is $1,800

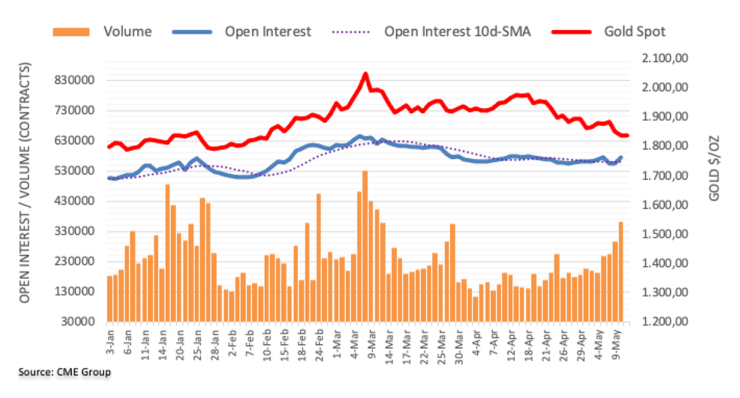

CME Group’s forward for gold futures markets Given the level data, the short position reversed the two-day slide in a row, gaining nearly 22,000 contracts on Tuesday. Volume followed suit and extended the uptrend for the fourth consecutive session, this time with around 66.6K contracts.

According to market analyst Pablo Piovano, the modest weekly decline in gold prices was driven by higher open interest and volume on Wednesday. However, the analyst states that extra pullbacks may be seen on the cards in the very near term and the current target will be the key level of $1,800.