The Federal Reserve has announced its highly anticipated interest rate decision. In line with the expectations, the Fed increased the policy rate by 75 basis points. The cryptocurrency market reacted positively as the decision came in line with the consensus. A prominent crypto analyst says traders are placing too much emphasis on the Fed. He also shares his altcoin picks he’s considering accumulating.

“Traders place too much emphasis on the Fed”

The highly anticipated Fed’s interest rate decision came in line with expectations. However, popular analyst Michaël Van de Poppe tells his 619,000 Twitter followers that traders are probably overestimating the potential impact of the Federal Open Market Committee (FOMC) on crypto markets. Based on the relatively calm movements in the markets, the analyst notes that those in the space are probably overthinking today’s Fed meeting. In this context, he shares the following thoughts:

Funny though, European stocks are doing relatively well. US stocks are consolidating, down a few percent since their recent high. Bitcoin and crypto are down 15%. People in the crypto space attach too much importance to the FOMC meeting.

Analyst’s Bitcoin and Ethereum expectations

The popular analyst says that Bitcoin (BTC) could rise if interest rates increase by less than 100 bps. cryptocoin.com As you follow, the Fed made an increase of 75 basis points. After the decision, Bitcoin rose above $ 22 thousand. So, he justified the analyst. The analyst says that if the leading coin surpasses $21,600, it could see new local highs. At the time of writing, BTC is trading at $22,427, up 3.4% in the last 1 hour. Van de Poppe makes the following statement:

Markets are improving and it was $21.6k for preferred Bitcoin. If this is broken to the upside, new highs will come. We’re looking at a $20.5k-$20.7k area for Bitcoin to enter the FOMC.

Source: Michaël van de Poppe / Twitter

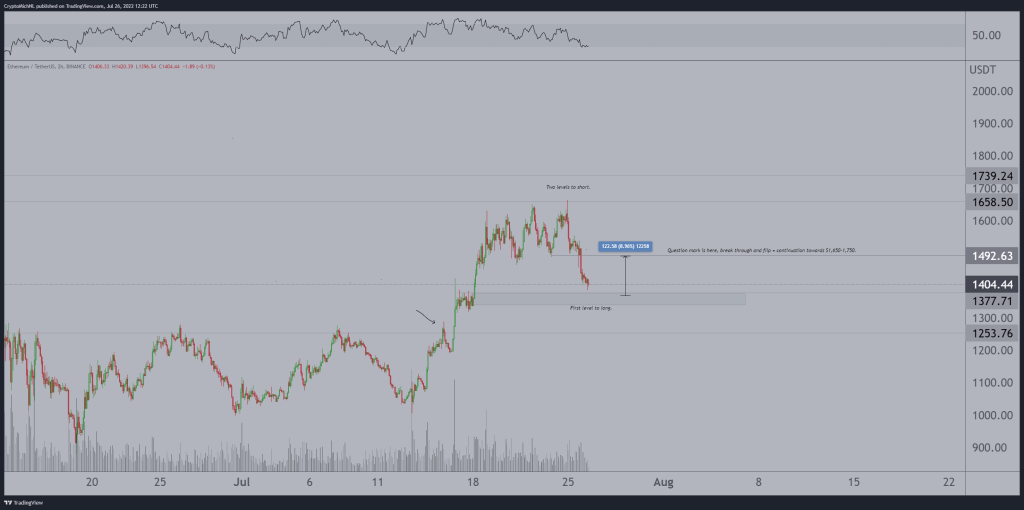

Source: Michaël van de Poppe / TwitterThe analyst is also looking at the leading altcoin Ethereum (ETH). Van de Poppe says the future of ETH depends on how it reacts at the $1,500 level. At the time of writing, ETH was trading at $1,575. The analyst makes the following assessment:

Obvious support level on Ethereum that can be played for a long time. The question mark starts at $1,500. This too must be broken and reversed to continue. Otherwise, there is a possibility of a retest near $1,250.

Source: Michaël van de Poppe / Twitter

Source: Michaël van de Poppe / Twitter“Altcoin projects that will do 20-60x in the next bull cycle”

However, Van de Poppe says traders are placing too much emphasis on the Fed. Meanwhile, the analyst says he will start accumulating altcoins for the next bull run. He says he puts his money on Cosmos (ATOM), Polygon (MATIC), Avalanche (AVAX), Concordium (CCD), and SKALE (SKL). The analyst uses the following statements:

Some projects that I will be slowly accumulating as I enter the next bull cycle: ATOM, MATIC, AVAX, CCD, SKL. I think this will be the package to get 20-60x returns in the next bull cycle.