Michael van de Poppe, one of the legendary analysts of the crypto money market, made recommendations to digital asset investors with a statement he made on May 23! The leading cryptocurrency analyst tells investors that these 5 assets should be in portfolios! Here are the details…

The closely followed cryptocurrency analyst explained: “These 5 assets should be in every investor’s portfolio!”

Legendary crypto analyst Michael van de Poppe, who is closely followed by the cryptocurrency market, tweeted a list of cryptocurrencies that every investor should have in his portfolio, pointing to the danger to market uncertainties. Pointing to the 5 assets that investors generally expect to withstand tough times in the rapidly growing digital asset market, the name suggests that investors diversify their investment portfolios.

These include real estate and equities, commodities such as gold, silver and uranium, cash, cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). The market expert also stresses the importance of investors rebalancing their portfolios on a consistent basis so they are prepared for any market situation.

Every portfolio should consist of;

– Real Estate / Stocks

– Commodities -> Gold / Uranium / Silver

– Cash

– #Crypto -> Bitcoin / EthereumAnd you should rebalance that on a solid period of time, to assure you're ready for any market circumstance.

Atleast, my take.

— Michaël van de Poppe (@CryptoMichNL) May 23, 2023

Real estate and stocks

Real estate assets such as REITs and stocks are considered essential assets in an investor’s portfolio because of their potential for long-term growth and wealth accumulation. Experts in this regard suggest that the real estate market is a reliable long-term investment during economic cycles, offering rental income and tax benefits. However, these assets can also act as a hedge against inflation. On the other hand, stocks allow investors to own companies and seize the opportunity to participate in their growth and profitability. However, according to experts, the stock market is arguably the most popular asset class because it is considered the best investment in terms of historical rate of return.

Commodity Market

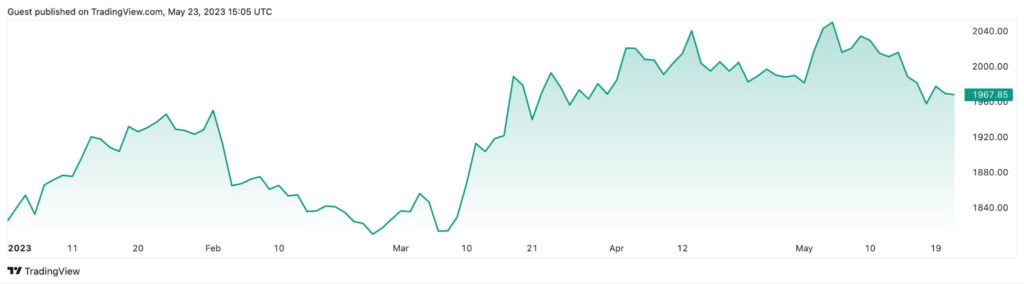

Commodities such as cryptocurrencies, such as gold and silver, are also seen as the most important safe-haven asset that investors should have in an inflationary environment, according to experts. This is because commodities often have an inverse relationship with inflation, meaning that when fiat currencies fall in value, commodities tend to retain their value or even appreciate, acting as a hedge against rising prices. Earlier this month, gold rose to an all-time high of $2,052 per ounce, partly due to the Federal Reserve’s recent rate hike. Meanwhile, uranium has also increased by more than 9.6% since the beginning of the year.

Cash Money

Cash is held by investors primarily to provide liquidity and is seen as a way to quickly convert assets into cash without significant loss of value. In addition, it offers investors significant flexibility to take advantage of unexpected investment opportunities that arise. For example, during market downturns when asset prices decline, having cash available allows investors to purchase assets at attractive prices.

Leading cryptocurrencies: Bitcoin (BTC) and Ethereum (ETH)

Finally, legendary cryptocurrency analyst van de Poppe mentioned BTC and ETH as assets that every investor should include in their portfolio. As you know, the two largest cryptocurrencies have witnessed significant price increases in the past, resulting in significant returns for early investors. Apart from that, Bitcoin and Ethereum are increasingly being accepted as assets that can help diversify portfolios due to their low correlation with traditional asset classes such as stocks and bonds.

However, the big crashes and turbulent period for cryptocurrencies in 2022 led to big drops for Bitcoin and Ethereum. But at the beginning of 2023, respectively, Bitcoin (BTC) gained 64 percent, while Ethereum (ETH) managed to gain more than 53 percent. That’s why veteran van de Poppe uses the words “safe haven” for BTC and ETH.