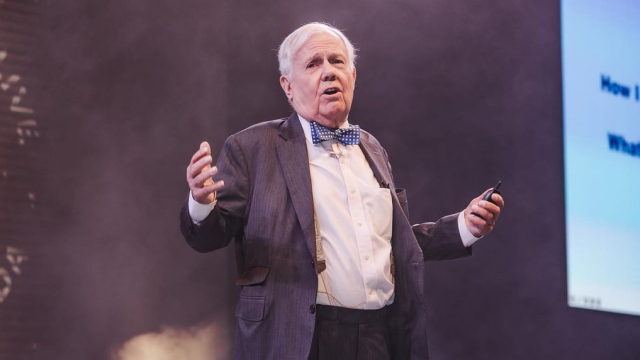

Famous investor Jim Rogers made a dire bear market prediction in a new interview. Rogers says the next bear market will be the worst he has ever seen.

Jim Rogers awaits the worst bear market of his life

Veteran investor Jim Rogers, who co-founded the Quantum Fund with George Soros, says he expects the next bear market to be the worst of his life. “You should be extremely worried,” he said in an interview with Real Vision last week. “If you’re not worried, you don’t know what’s going on,” he said. He also added that there will be trouble in all markets, including cryptocurrencies.

Rogers, 80, is George Soros’ former business partner who founded Quantum Fund and Soros Fund Management. The veteran investor, in his disastrous predictions, said, “The next bear market will be the worst of my life. Because debt has grown tremendously in the last 14 years.” says. He bases his concerns mainly on economic developments in the United States.

80-year-old investor worried about US situation

Rogers reiterated his previous statement that the US experienced a bear market in 2008 due to excessive debt. He pointed out that the level of debt worldwide has skyrocketed since 2009. In the interview, he said, “We should always be worried about Washington. They have no idea what they’re doing. And they prove it every day.”

The famous investor also believes that the US dollar will lose its status as the world’s reserve currency. Discussing the global de-dollarization trend, he highlights that many countries are actively seeking alternatives to the US dollar, in part because of concerns about the significant debt issue. He also mentioned that the weaponization of the US dollar creates incentives for nations to reduce trust in the US.

Rogers shared that he was “looking for an alternative to the USD every day,” knowing that “something bad will happen in the currency markets in the next two or three years.” He recently said that the time of the US dollar is coming to an end as countries seek alternatives to the US dollar.

The senior investor also expects interest rates to rise worldwide. While he admitted that he did not know how much the central banks would raise interest rates to reduce inflation this time, “The world has not seen debt, spending and money printing like in recent years. So this time, something will have to be very, very disruptive to fix this problem.”

Jim Rogers points out these assets for bear market

Rogers had previously highlighted 3 investment tools for crisis periods. The experienced investor draws attention to silver, copper and agricultural products. cryptocoin.comRobert Kiyosaki, another financial expert whose collapse is expected, is included in this list as gold and Bitcoin.