Gold prices fell below the psychological level of $1,700 last week. However, it managed to top it again, with US NFP data coming in line with expectations on Friday. A technical line in the sand at $1,680 in gold’s outlook? Technical analyst Gary Wagner seeks the answer to this question.

What does the historical performance of gold show?

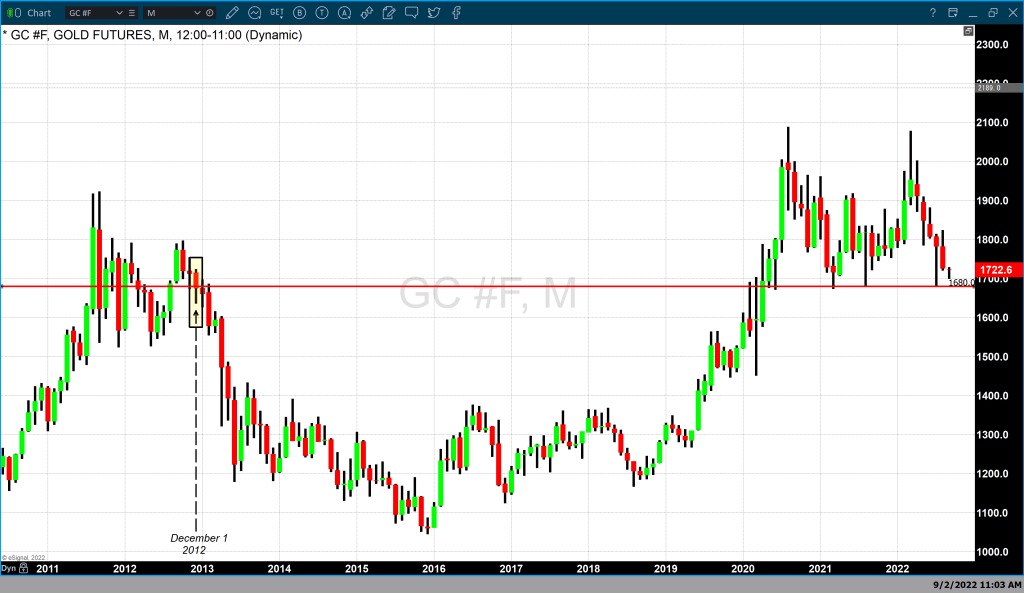

The chart below is a monthly chart of gold futures. The horizontal red line is stable at $1,680. In December 2012, gold futures opened at $1,770 and dropped to $1,635. Then, it settled at $1,671. This was the last time gold was valued above $1,700 until April 2020. Gold prices fell further until December 2015, when gold dropped to $1,046. This also marked the beginning of a multi-year rally in which gold rose from around $1,000 in early 2016 to its current record high of $2,088 in August 2020.

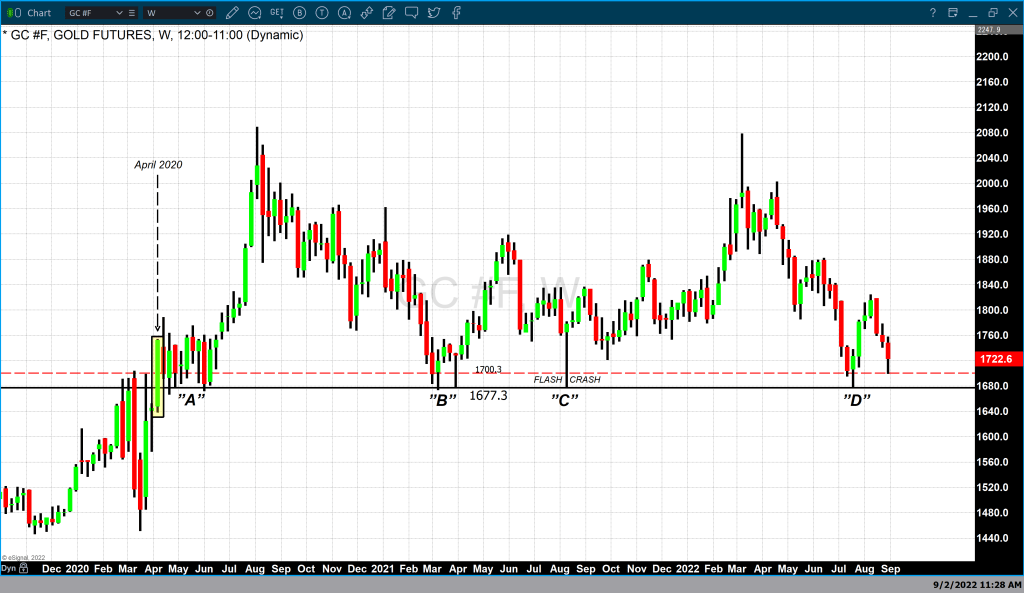

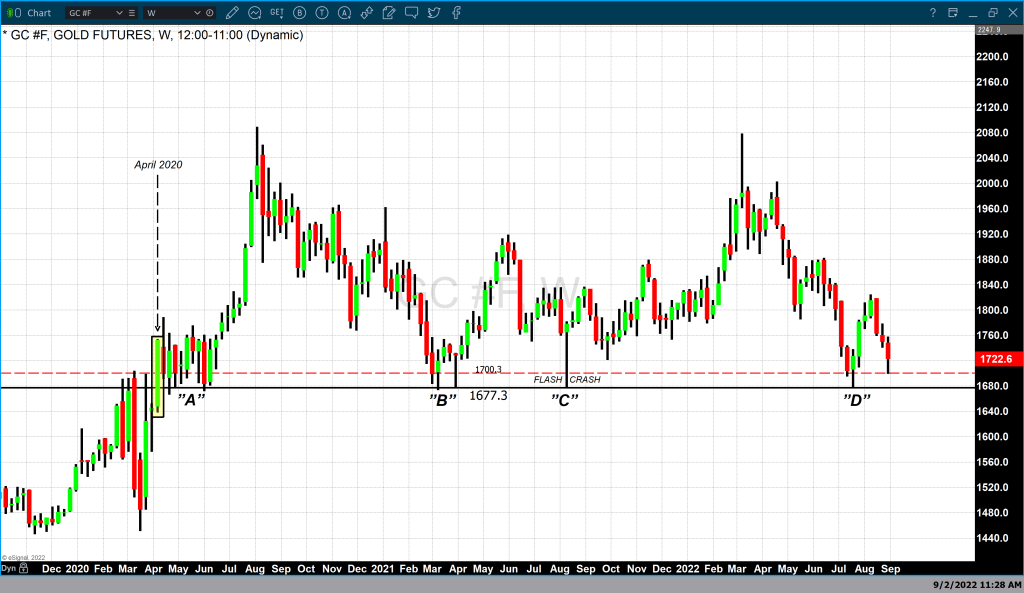

The chart below is the weekly gold futures chart. This chart includes a solid dashed red line at $1,700, a solid black line at $1,680, and letters A through D, which represent four time periods when gold fell as low as $1,680 and regained it.

Gold broke in April 2020. Later, it closed above $1,680. It then closed above $1,700 for the first time since December 2012. This week is marked with a rectangular box. A 10-week price consolidation (“A”) followed. During these 10 weeks, gold tested the lows of $1,680 twice. Plus, it’s risen above that price point every time. The low at $1,680 is an effective support. However, gold failed to rise above $1,800. This was the first instance after gold rallied above $1,700, where $1,680 became a key support level.

Marked ‘B’ on the weekly chart in March 2021, gold traded to a low of $1,680 on two occasions. Either way, bullion closed above $1,700 during that week after testing $1,680. This brings us to the flash crash that occurred in August 2021, marked “C” in the chart above. The last gold formation that tested $1,680 as a support took place in July 2022. Hence, gold traded at a low of $1,680 as in March and August of 2021. However, it closed above $1,700.

“Critical level for gold prices: $1,680”

Technically, every time gold prices tested $1,680 over the past three years and gold fell to these lows, it effectively closed above that price point. This clearly made $1,680 a strong technical support level.

cryptocoin.com As you follow, the shiny metal dropped to $1,699 last week. After Friday’s recovery, gold futures are now at $1,722.60. The yellow metal has tested and rebounded at $1,680 in the last four times. Based on that, it wouldn’t surprise me if gold tests $1,680 once again in the next few weeks. Historical performance by no means guarantees that $1,680 will be effectively held and sustained. However, being a strong support level will probably draw a line in the sand. We can accept that this is a critical level. So any break below this will likely lead to a strong price drop.