New on-chain reports show that Bitcoin miners continue to send BTC to exchanges. The interesting thing is that these transfers are predominantly flowing into Binance derivatives to take leveraged positions…

Bitcoin miners have intensified selling pressure in recent weeks

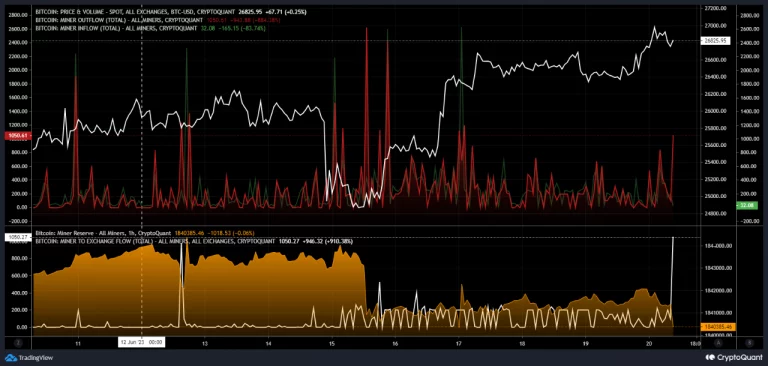

Recent data from CryptoQuant reveals a notable change in miner behavior. Starting June 15, miners have switched to a distribution mode that actively sends Bitcoin to exchanges on a regular basis. However, its recent activities indicate a departure from the accumulation trend seen in the past.

According to CryptoQuant’s report, BTC flow from miners to exchanges has increased significantly. This trend means that miners are emptying their wallets under current market conditions. By distributing Bitcoin reserves, miners contribute to the overall supply available on exchanges. Thus, they affect the delicate balance between supply and demand.

A clear indicator of selling pressure from miners

In a recent development, CryptoQuant reported a significant transfer of 1000 BTC to exchanges today alone. This significant move of Bitcoin by miners further reinforces the idea of increased selling pressure.

Such a large influx of Bitcoin into exchanges indicates that miners are willing to liquidate their reserves. This likely indicates a lack of confidence in the short-term price direction or a desire to profit. This behavior among miners can have a profound impact on overall market sentiment and Bitcoin price, given their influential role as key stakeholders.

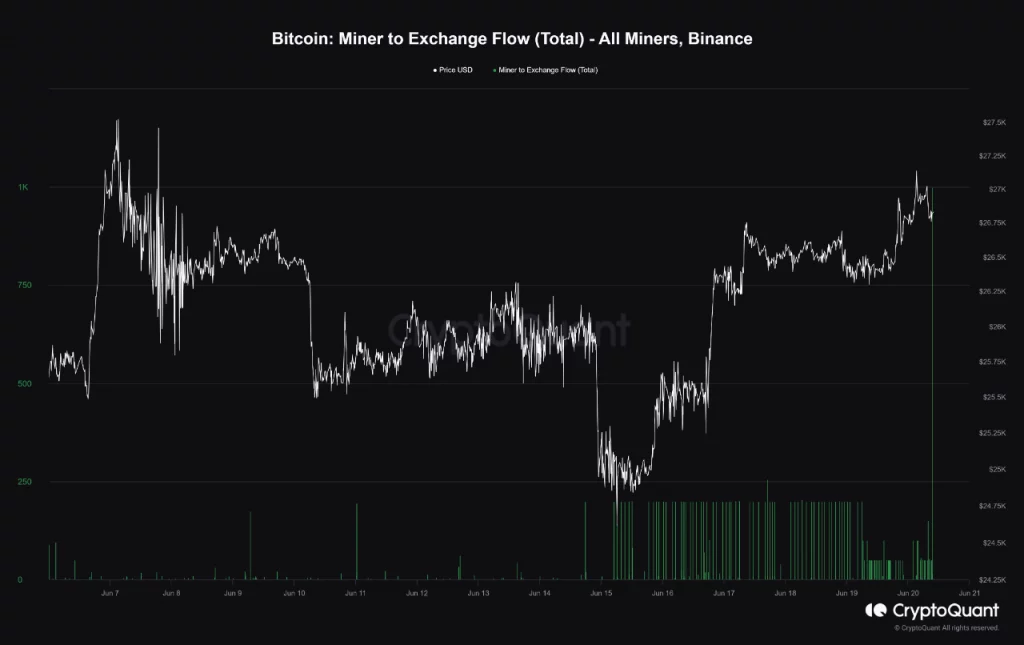

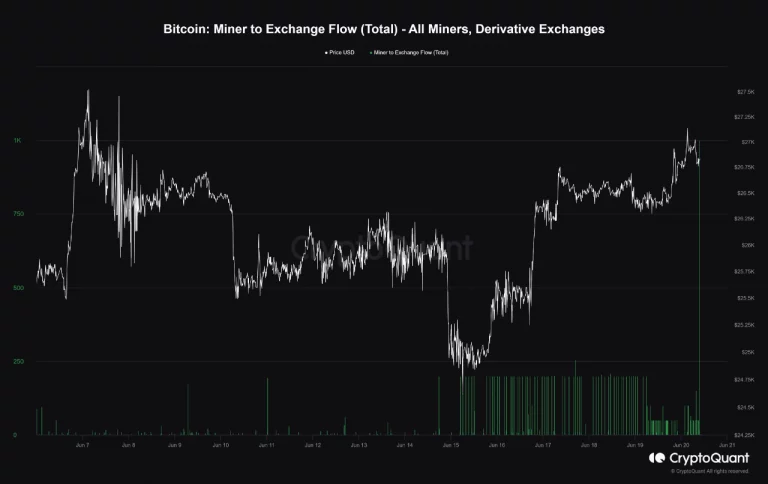

Leverage game: Bitcoins attracted attention to Binance derivatives

As CryptoQuant highlighted in its report, miners have focused their recent BTC transfers heavily on Binance derivatives. This detail increases the likelihood that miners can leverage their holdings and engage in derivatives trading.

Playing with leverage in the derivatives market allows miners to potentially increase their gains or losses based on Bitcoin’s price movements. This strategic move shows that miners are exploring alternative ways to maximize their returns, potentially adding additional volatility to the market.

What it means for Bitcoin investors

Such changes in the behavior of miners have serious effects on the market. The increase in the supply of Bitcoin on exchanges causes the selling pressure to increase. Additionally, the entry of miners into derivatives markets brings an element of speculation and increased volatility. Miners hold a significant portion of the total Bitcoin supply. This means that their actions have the power to affect market sentiment and the confidence of other investors. The next Bitcoin halving, when mining rewards will be halved, will occur in April 2024.

The next 8-12 month period is the ideal time for accumulation.

cryptocoin.com In the current analyzes we have quoted, we have stated that analysts declared the process up to the next Bitcoin halving cycle as the ‘accumulation phase’. While Bitcoin is currently retrieving $27,000 again for a short time, it is severely suppressing the altcoin market.