Surge in Activity for Defiance’s Leveraged Strategy ETFs

On Monday, the Defiance leveraged Strategy (MSTR) exchange-traded funds (ETFs) experienced a remarkable uptick in trading activity, coinciding with a notable decline in the share price of the bitcoin-holding firm, MicroStrategy. The shares fell to their 200-day average, prompting traders to react.

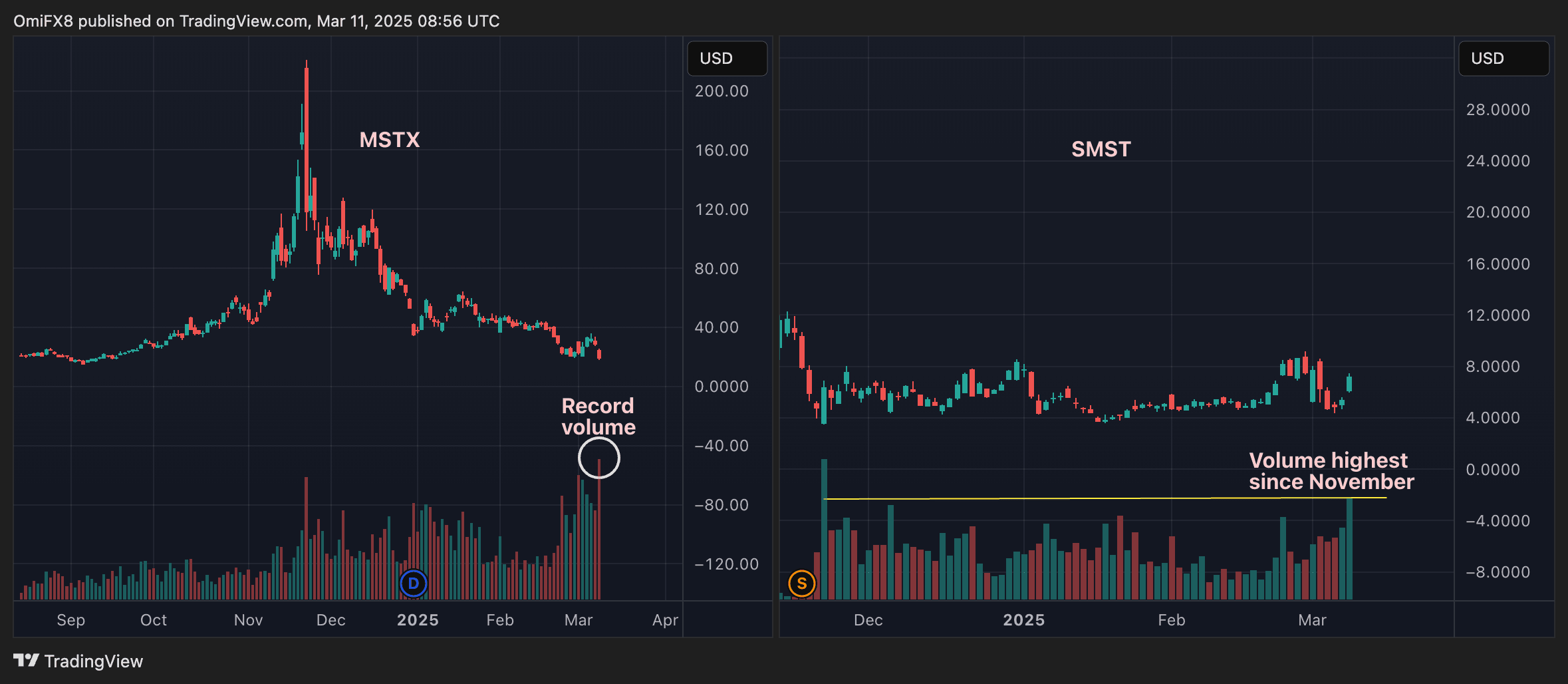

A staggering 24.33 million shares of the Defiance daily target 2x long MSTR ETF, which trades under the ticker MSTX, exchanged hands as the ETF’s price plummeted by 32% to $17.90, marking its lowest point since September, according to data from TradingView. This ETF aims to achieve 200% of the daily percentage change in the share price of MicroStrategy, a company that has become synonymous with bitcoin investments.

In contrast, trading volume for the Defiance daily target 2x short MSTR ETF, known as SMST, reached an impressive 51.21 million shares, the highest volume recorded since November 24. This ETF seeks to deliver results that correspond to twice the inverse of the daily performance of MicroStrategy’s shares. As of now, the net inflow figures for both funds from Monday remain unavailable.

The recent decline in MicroStrategy’s stock, which fell by 16.6% on Monday, brought the share price down to its 200-day simple moving average (SMA), revisiting a late February low of $231.62. This downturn comes amidst broader market concerns over a potential U.S. recession and a continued strengthening of the anti-risk Japanese yen. Since its peak of $543 on November 21, the stock has faced a staggering 55% decline.

MicroStrategy holds the title of the world’s largest publicly-listed bitcoin holder, with an impressive stash of 499,096 BTC, valued at approximately $40.4 billion. The company began its aggressive accumulation of bitcoin as a strategic balance sheet asset starting in November, financing these purchases largely through debt sales.

In a significant move on Monday, the company also announced a substantial $21 billion at-the-market (ATM) offering of its Series A preferred stock (STRK). The proceeds from this offering are expected to primarily fund further bitcoin acquisitions, reinforcing MicroStrategy’s commitment to its bitcoin-centric strategy.